The week ahead promises intense action on D-Street packed with domestic events, primary market buzz, corporate action, and some major global cues, which will keep investors busy after the Reserve Bank of India's latest monetary policy verdict and quarter-point interest rate cut on Dec. 5.

D-Street will witness trading action this week as shares of e-commerce giant Meesho will debut on stock exchanges after its initial public offering. Alongside, markets will also witness corporate action as shares of other companies will trade ex-dividend, ex-split, and ex-bonus this week.

"Looking ahead, volatility may persist with a positive bias as investors digest RBI's dovish action and track global triggers. The US Fed meeting and clarity on India–US trade talks will be key, while Q3 earnings optimism faces risks from rupee swings, widening CAD, and global trade tensions," said Vinod Nair, Head of Research, Geojit Investments Ltd.

Markets on Home Turf

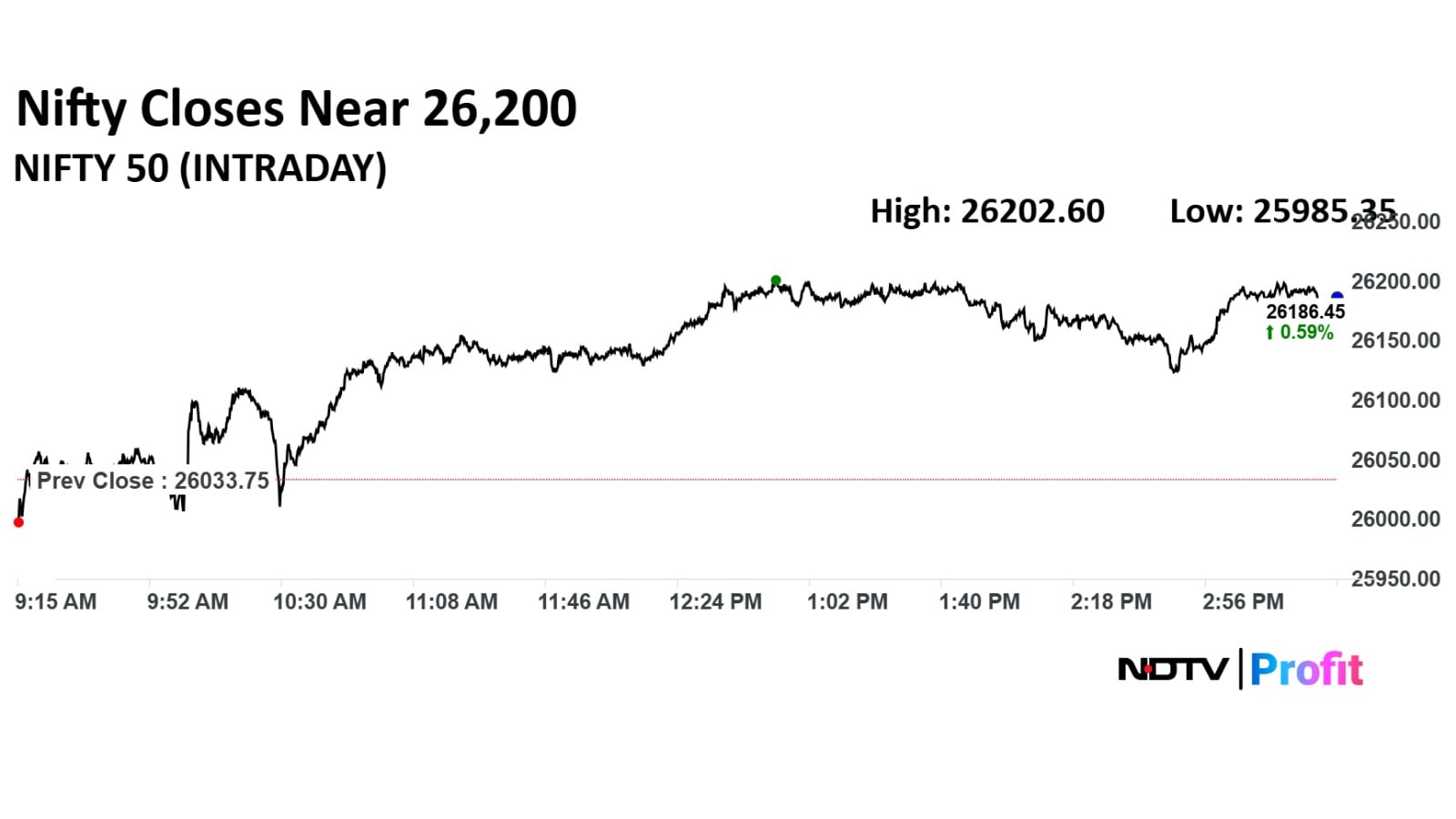

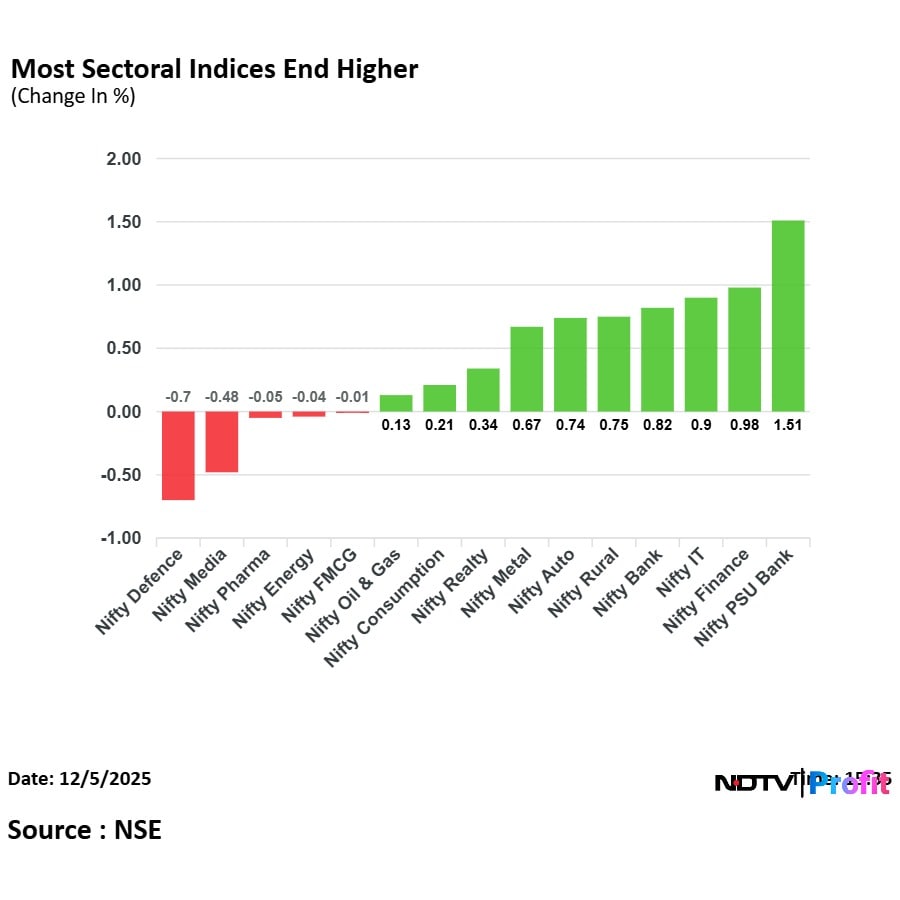

Domestic equity benchmarks Sensex and Nifty rallied on Dec. 5 after the RBI cut the key benchmark interest rate for the first time in six months and took steps to boost liquidity to support a 'goldilocks' economy in the face of high US tariffs.

Rising for the second day in a row, the 30-share BSE Sensex rose 447.05 points, or 0.52%, to settle at 85,712.37. The 50-share NSE Nifty rose 152.70 points, or 0.59%, to 26,186.45. In doing so, the RBI seems to have shrugged off concerns over fall in the rupee, which breached 90 to a dollar this week.

The RBI lowered its inflation forecast for the fiscal year through March to 2% from 2.6%, while raising its GDP growth projection to 7.3%, from the previous estimate of 6.8% over robust economic growth and constant disinflation.

US Fed Policy, US Jobs Data

The US Fed's interest rate decision will be the major factor dictating trends in the domestic equity market this week, with global movements and foreign investor activity also influencing sentiment, according to analysts.

Ajit Mishra- SVP, Research at Religare Broking Ltd said, "Globally, the spotlight will be on US Federal Reserve's interest rate decision, which could drive risk sentiment across emerging markets already navigating currency pressures."

The US Federal Open Market Committee (FOMC) will meet on Dec. 9 to deliberate on the next monetary policy decisions and US Fed Chairman Jerome Powell will unveil the interest rate decision on Dec. 10, 2025.

"Alongside the FOMC decision, key US economic data will remain on investors' radar. The US JOLTs Job Openings data due on Dec. 9 and the employment cost Index (q/q), scheduled for Dec. 10, will provide fresh insights into the health of the US labour market and wage pressures," said Pravesh Gour, Senior Technical Analyst at Swastika Investmart Ltd.

''Movements in the US dollar index and treasury bond yields will be critical indicators, as any sharp shift could impact risk appetite across global equity and debt markets," added Gour. Powell's guidance and dissent count being watched for clues about future US Fed policy.

CPI Inflation, Rupee Vs Dollar

This week, market participants will closely track India's consumer price index-based inflation print on December 12. However, the inflation data will be released post-market hours. The movement of the rupee, which breached 90 to a dollar last week, will also be tracked by investors.

"A Fed cut would boost global risk appetite, enhance flows into emerging markets, and provide tailwinds to Indian equities and the rupee," said Sudeep Shah, Head - Technical and Derivatives Research at SBI Securities.

According to Ponmudi R, CEO - Enrich Money, an online trading and wealth tech firm, with India's economic growth remaining resilient despite tariff pressures and global headwinds, the equity market is well-positioned to benefit if global fund flows begin to rotate back into emerging markets.

Primary Market Action, New Listings

India's primary market is gearing up for one of its busiest stretches of the year, with five mainboard IPOs set to steal the spotlight between Dec. 8 and 12. ICICI Prudential Asset Management Company, one of the most anticipated filings this year, will open for subscription on Dec. 12.

Among big listings, shares of online shopping major Meesho will debut on BSE and NSE on Dec. 10 after the conclusion of its public offer. Apart from Meesho, shares of Vidya Wires and Aequs will also debut on the bourses.

Corporate Action

Corporate action will also be in focus this week as shares of Modison will trade ex-dividend on Dec. 8. Apart from this, shares of Bharat Rasayan will trade ex-bonus, as the company will declare a bonus issue. Shares of Mrs. Bectors Food Specialities Ltd and Bharat Rasayan will trade ex-split this week. Nureca and VLS Finance will conduct a buyback of shares on Dec. 12.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.