- Lenskart reported a 40% revenue growth and a sharp rise in consolidated net profit in Q3 FY26

- Net profit rose to Rs 131 crore from Rs 1.9 crore, with revenue up 38.3% to Rs 2,308 crore

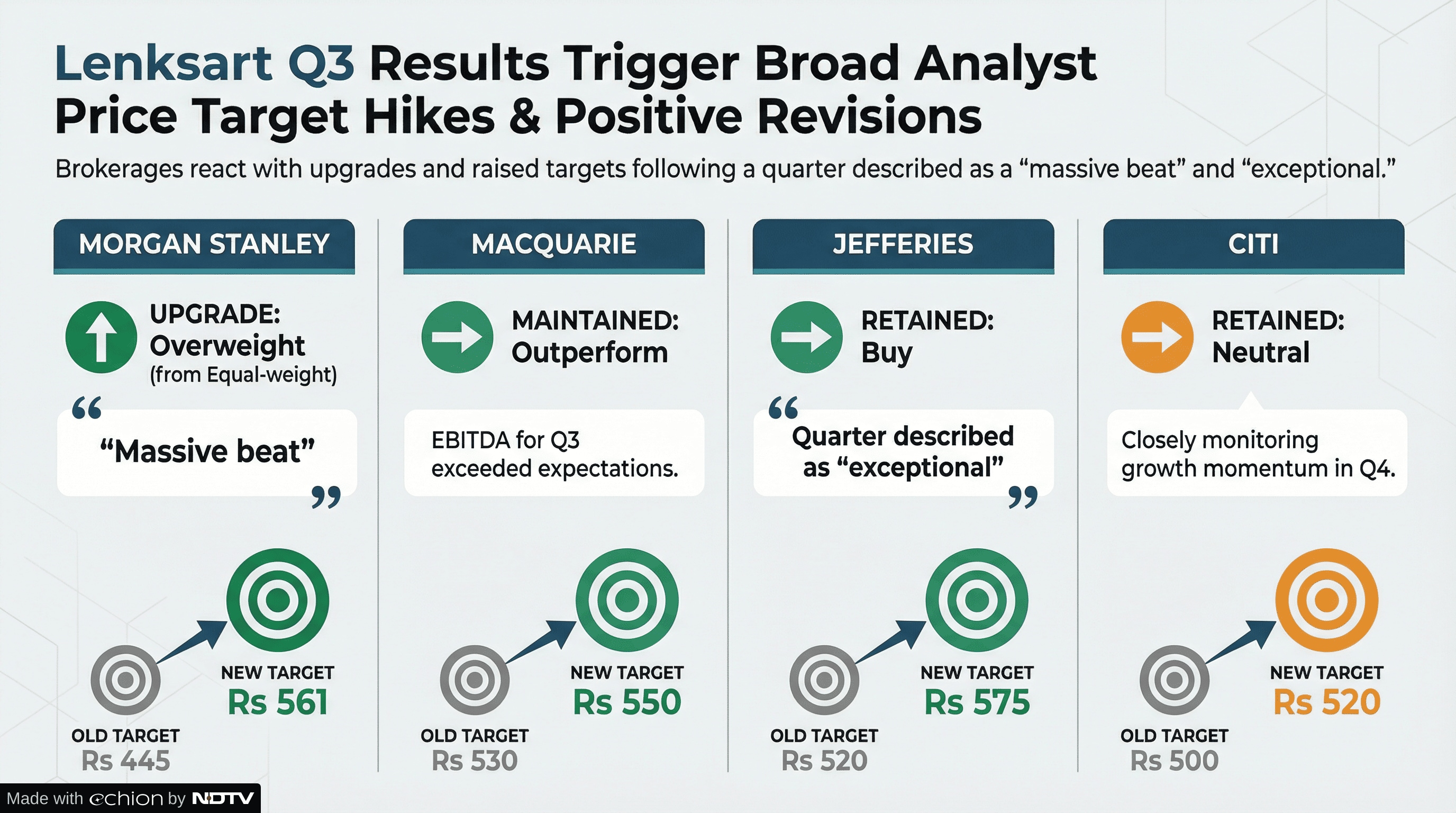

- Morgan Stanley upgraded Lenskart to ‘Overweight’ and raised target price to Rs 561 from Rs 445

Lenskart's December quarter has prompted a decisive shift in tone on the Street. After delivering stronger-than-expected growth and margins — particularly in its India business — the eyewear retailer saw a string of target price hikes, and even an upgrade, from major brokerages.

At the heart of the optimism is the company's 40% growth in revenue in Q3, and a multifold uptick in consolidated net profit.

Lenskart Q3 FY26 Results (Cons,YoY)

- Net profit at Rs 131 crore vs Rs 1.9 crore

- Revenue up 38.3% at Rs. 2,308 crore vs Rs 1,669 crore

- Ebitda at Rs 464 crore vs Rs 212 crore

- Ebitda margin at 20.1% vs 12.7%

Morgan Stanley, which upgraded the stock to ‘Overweight' from ‘Equal-weight' and sharply raised its target price to Rs 561 from Rs 445, called the performance a “massive beat.” The brokerage said the quarter effectively raises the bar on growth expectations, arguing that multiple levers — store additions, category expansion and deeper market penetration — remain firmly in place.

Execution was a common theme across analyst notes. Macquarie, which maintained its ‘Outperform' rating and lifted its target to Rs 550 from Rs 530, said EBITDA for the quarter exceeded expectations, supported by strong store additions and a favourable mix-led realisation pickup. The firm also raised its EPS estimates by 2–4%, reflecting confidence in operating leverage as domestic momentum sustains. Beyond India, it sees scope for faster margin expansion in international markets as consumer adoption improves and supply chain integration tightens.

Jefferies, retaining its ‘Buy' rating and increasing its target price to Rs 575 from Rs 520, described the quarter as “exceptional.” It pointed to what it termed smart margin expansion alongside strong growth, but said what stood out even more was management commentary. According to Jefferies, the company's emphasis on long-term growth over short-term margin maximisation — treating margins as an outcome rather than the core objective — reinforces confidence in execution and governance. The brokerage also highlighted the clarity and transparency of the shareholder communication.

Not everyone is fully convinced that upside remains unlimited. Citi retained its ‘Neutral' rating, though it raised its target price to Rs 520 from Rs 500. While acknowledging that execution remains strong across store expansion, same-store growth and profitability metrics, the brokerage cautioned that current valuations already factor in much of the anticipated growth and margin improvement. Citi said it would closely monitor growth momentum in Q4 before turning more constructive.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.