"The commitment to large-scale OMO purchases is particularly significant. It provides banks with greater liquidity assurance, supports smoother transmission of the rate cut and is aimed at lowering funding costs across the financial system," said Bharat Dhawan, Managing Partner, Forvis Mazars in India.

For businesses and consumers, this combination of rate action and liquidity injection should meaningfully improve access to credit and revive momentum in segments where lending had slowed, he added.

Explaining this question the governor said, if the proportion of higher interest loans like retail and gold loans goes up then the average interest rate goes up but it doesn't mean that transmission has gone up.

While the average interest rate has gone up the interest rate for each segment does not go up as each segment has different interest rates.

According to him one should be looking at interest rate effect to see whether interest rate have come down or not for different segments of growth.

When asked about the steps by the RBI to reduce fraud and help victims recover their lost money the governor said that the central bank along with the other banks has taken various steps to stop the financial crimes from happening.

However, in terms of how to help recover the money he said there are cases ongoing in the courts and he hopes to find a solution along with the courts, the governments and the banks.

"I would not say that I am targeting a particular level of 1% etc. just giving the confident to the system and banking community that there would be ample liquidity especially as long as we are in the space where interest rates have to go down," said Governor Sanjay Malhotra.

Answering on SEBI chief's comment that Banks should be a part of non-agri commodity derivatives, the Governor said that SEBI's proposal has reached the RBI. However, as per regulations, banks can't be a part of non-agri commodity derivatives.

If this needs to be implemented, then the law will need to be changed for banks.

He also noted that such a proposal was brought for banks in other countries too, but that was not found to be feasible.

Answering question on moving gold holdings back to India, the governor on Friday said, "We are diversifying, it's not good to have all your gold in one place."

He further added that he expects deposit rates to moderate to some extent after the rate cut on Friday.

Further scope of policy rate cut will be data-driven, said Governor Sanjay Malhotra.

Answering NDTV Profit's question he said effects of low inflation are being felt on ground. He further said that there can be differential realisation of inflation across India.

According to Malhotra managing volatility in exchange rate is more of an art than a science. RBI's tolerance for volatility has remained the same, he added.

He also said that there is no conscious attempt to change volatility tolerance.

"See GDP growth slowing in quarters going ahead as base effects normalise," said Deputy Governor, Poonam Gupta

She also expects low policy repo rates rather than high rates going forward.

When talking about forex swap Governor Sanjay Malhotra said that the measures announced are for liquidity and not to support rupee.

MPC is mostly driven by growth-inflation dynamics and the dependence on external sector is a small percentage of GDP, said Governor Sanjay Malhotra during the press conference.

"Do not expect CAD to be as high as 2%," he said.

Malhotra further added that having delivered 8% growth on average over last 3-4 years, an 8% growth is within reach.

Rupee-to-dollar had climbed up to 88 in February, but these fluctuations can happen said Governor Malhotra. He further added that RBI's efforts have been to reduce any abnormal or excessive liquidity.

Stated policy of the RBI is to allow market to determine Rupee level and should get good capital flows going forward, given the fundamentals.

According to the RBI Governor, "We are in a comfortable position as far as external sector is concerned."

Inflation has been benign, expect it to remain benign, said Governor Sanjay Malhotra.

"Expectation is it is going to be very benign, whether that opens up policy for further rate cut, that would be getting into speculation and I dont want to get into it," said Malhotra.

He further said that RBI will have to let inflation transmit into the real economy before seeing how it behaves.

The RBI MPC policy press conference begins on Friday.

The RBI MPC policy press conference begins on Friday.

(Source: NDTV Profit)

"This easing cycle has already started influencing investor behaviour, particularly in interest-sensitive segments of the market. For investors, the move calls for a rethink of yield expectations and portfolio balance as lower rates may compress returns on fixed-income instruments and create shifts towards market-linked investments," said Swapnil Aggarwal, Director, VSRK Capital.

"The liquidity boost through OMOs and the USD/INR swap will help lower funding costs and improve credit transmission," said Dr. Ravi Singh, Chief Research Officer from Master Capital Services Ltd.

According to Anuj Puri, Chairman, ANAROCK Group if banks swiftly pass on this rate cut to borrowers, then there will be a renewed surge in sales velocity carrying firmly into first quarter of 2026. The current trends indicate that luxury homes will continue to drive residential real estate in 2026, as well he added.

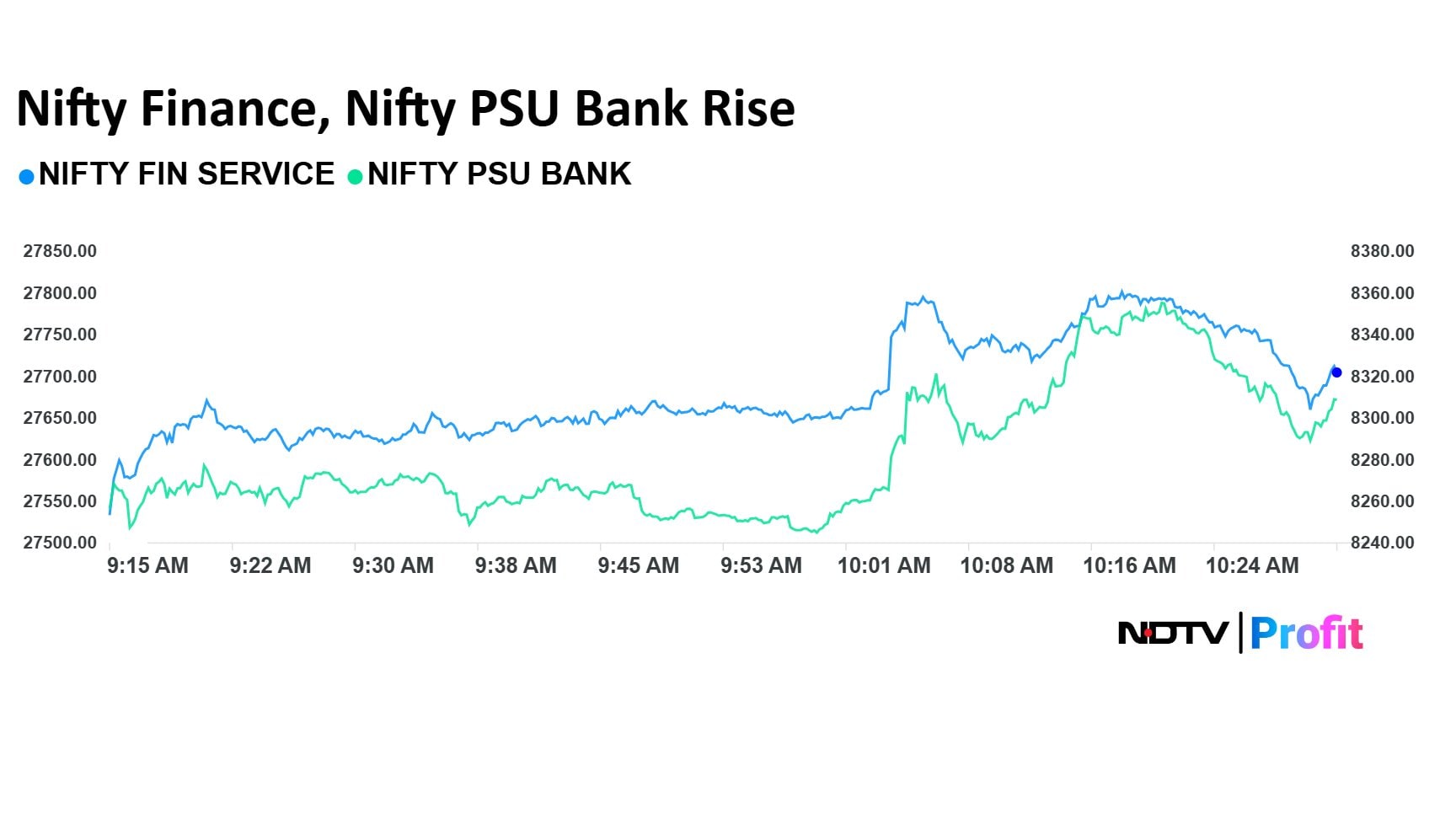

The NSE Nifty PSU Bank and the NSE Nifty Financial Services index rose post rate cut. The NSE Nifty PSU Bank was the top leading sector.

The NSE Nifty PSU Bank and the NSE Nifty Financial Services index rose post rate cut. The NSE Nifty PSU Bank was the top leading sector.

The repo rate reduced by 25 basis points to 5.25%. "The rate cut will improve the situation of homebuyers as there will be a moderation in interest rates on home loans, making housing an accessible option. Refinancing the existing home loans will be easier as the EMIs on loans will also reduce," said Rajat Bokolia, CEO, Newstone.

"The policy prioritises domestic expansion over external currency defense, signaling a continued favorable environment for borrowers and equity investors alike," said Santosh Meena, Head of Research at Swastika Investmart.

So far this year the RBI MPC has delivered 125 basis points rate cut and the governor pointed that from this 69-basis points reduction in weighted average lending rate has already happened.

Now more rate cuts have to be passed but the RBI needs to ensure there is liquidity in the system, hence the liquidity push from forex swap and bonds purchase via OMO.

"To address recent liquidity tightness and currency volatility, the central bank also announced substantial support measures, including Rs 1 lakh crore in Open Market Operations (OMO) and a $5 billion forex swap," said Santosh Meena, Head of Research at Swastika Investmart.

According to DBS Bank's Radhika Rao, RBI has given weightage to inflation which led to the rate cut. She told NDTV Profit that this is likely the last rate cut for this cycle. In addition, she said that going forward in 2026 a pause is looking more likely.

The RBI's decision to cut the repo rate by 25 bps is a powerful, proactive signal that strategically leverages India's macroeconomic strength – a robust 8.2% Q2 GDP expansion alongside record-low headline inflation. This is not a reactive measure to a slowdown, but a confident and forward-looking deployment of monetary space to deliver a structural stimulus, ensuring the nation's growth engine becomes more inclusive.

Indian Rupee has slipped past 90 per dollar once more after policy announcements.

The RBI has revised the fiscal 2026 CPI inflation projection and lowered it to 2% versus 2.6% earlier.

Third quarter of fiscal 2026 CPI inflation projection at 0.6% versus 1.8% earlier.

Fourth quarter of fiscal 2026 CPI inflation projection at 2.9% versus 4% earlier.

First quarter of fiscal 2027 CPI inflation projection at 3.9% versus 4.5% earlier

Second quarter of fiscal 2027 CPI inflation projection at 4%.

The RBI has revised the fiscal 2026 GDP growth projection at 7.3% versus 6.8% earlier.

Third quarter fiscal 2026 GDP growth projection at 7% versus 6.4% earlier.

Fourth quarter fiscal 2026 at GDP growth projection at 6.5% versus 6.2% earlier.

First quarter fiscal 2027 GDP growth projection at 6.7% versus 6.4% earlier.

Second quarter 2027 GDP growth projection at 6.8%.

Reduce repo rate by 25 bps to 5.25% -- unanimous decision -- stance unchanged at neutral.

FY26 GDP growth forecast upped to 7.3% from 6.8% earlier.

FY26 CPI inflation projected downwards at 2% vs 2.6% earlier.

RBI to conduct 3-year $5 bn dollar-rupee buy/sell swap.

To buy Rs 1 lakh crore worth of bonds via OMO.

RBI to begin two-month campaign from Jan 1 to address grievance of customers.

Financial parameters of banks remain robust noted the governor. He also said that total flow of resources to commercial sector has strengthened.

"Bank credit has seen an uptick, growth supported by retail lending," he said on Friday.

Money market rates largely aligned to repo rate, said Governor Sanjay Malhotra. He further noted that transmission of rate cuts is broad-based and satisfactory.

The RBI is committed to provide sufficient durable liquidity, he added. The central bank continuously assesses durable liquidity needs of banking system.

RBI hopeful that OMO auctions and forex swap will facilitate monetary transmission. Also hopeful of OMO buys and forex swaps for providing sufficient liquidity.

Index forex reserves provide import cover of over 11 months added Malhotra. He also noted that CAD for financial year 20 26 are seen to be modest.

Financial year 2026 CPI inflation projected downwards at 2% versus 2.6% earlier, said Governor Sanjay Malhotra

Third quarter inflation projected downward to 0.6% from 1.8% earlier.

Inflation going to be softer than projected in October, he added.

He further said that the rise in precious metal prices has added 50 bps to headline CPI. Risks to inflation forecasts are evenly balanced he added.

Financial year 2026 GDP growth forecast was upped by the RBI to 7.3% from 6.8% earlier.

Third quarter GDP growth projection at 6.7% versus 6.4% earlier.

The RBI will conduct forex buy/sell swaps of 3-year $5 bn dollar-rupee. in December

Governor Sanjay Malhotra said that RBI will buy Rs 1 lakh crore worth of bonds via OMO auctions in December.

While the RBI has cut the repo rate, the stance continues to remain 'Neutral'.

The governor also added that the SDF rate has been adjusted to 5%. In addition, MSF and Bank rate were adjusted to 5.50%.

MPC cuts repo rate by 25 basis points to 5.25%, said Governor Sanjay Malhotra.

The repo rate has been cut to 5.25% from 5.5%.

In addition, he said that MPC voted unanimously for the rate cut.

Current growth inflation dynamics show rare goldilocks period, the governor added.

Since October policy Indian economy has witnessed rapid disinflation, said Governor Sanjay Malhotra. The inflation dipped while GDP growth accelerated, he added.

Governor Sanjay Malhotra begins address after the December MPC meet.

The index of industrial production showed a 0.4% expansion in October, compared with an expectation of 4%. While one argument can be that there were fewer working days in October owing to the festive season, there is a clear slowdown in manufacturing and negative growth in consumer durables.

The other important data point to consider is goods and services tax collection for November, which rose just 0.7% year-on-year. At Rs 1.7 lakh crore, monthly GST collections were the lowest in a while. The next big data point to watch is credit growth. In the month of October, non-food bank credit growth was at 11%, largely led by lower credit growth in agriculture, despite a 100 bps rate cut this year. There is also a marked slowdown in UPI transactions in November, as the festive rush peters down.

So growth is looking a bit uncertain right now. Even if the headline GDP growth number was 8.2% in Jul-Sep, the potential GDP growth in the economy might be 7% or lower, according to Radhika Rao of DBS Bank. To that effect, a rate cut might be warranted.

Ahead of the RBI MPC meeting stock markets declined with Nifty near 26,000 and Sensex falling over 110 points.

Track live market updates here.

Ahead of the RBI MPC meeting stock markets declined with Nifty near 26,000 and Sensex falling over 110 points.

Track live market updates here.

The yield on the 10-year bond opens flat at 6.50% before RBI rate decision.

Source: Bloomberg

Rupee opened 13 paise stronger at 89.85 against US Dollar

It closed at 89.98 a dollar on Thursday

Source: Bloomberg

Should India's rate setting panel cut rates further, as retail inflation is widely expected to turn negative in the coming few readings? Or should it hold its fire and watch for further evolving data, even as GDP clocked in a surprising 8.2% growth rate for the July-September quarter?

There are too many expert voices advocating for both sides and they all seem very sure.

Click here to read what experts have to say

You can watch the RBI announcement live on the RBI’s social media handles. The RBI Governor’s press briefing can also be watched live on NDTV Profit.

Audiences can follow the updates in real time and track key highlights on YouTube and other social media channels of the NDTV Network.

Viewers can visit RBI’s YouTube channel to watch the press conference at 12:00 p.m. on Dec. 5.

“As the RBI’s MPC meets, the realised inflation and the trajectory provides space for RBI to ease interest rates to improve the transmission, however the weakening rupee and strong GDP might push the same for February meeting. The expert expectations are divided on the status quo or a cut," said Kunal Shah, Co-founder, SURE.

The last RBI Monetary Policy Committee meeting for financial year 2025-26 will be held on the following date:

Feb. 4-6, 2026

The central bank holds six bi-monthly meetings annually. Previous meeting in this financial year took place in October.

The Reserve Bank of India Monetary Policy Committee in its previous meeting in October kept the repo rate unchanged at 5.5% for the second consecutive time. The decision was made unanimously by the MPC committee, which has also unanimously decided to maintain a 'neutral' stance.

Five Key Highlights:

RBI retained 'neutral' stance, with most of the commentary from the governor Sanjay Malhotra alluding to lower inflation.

The Reserve Bank of India lowered its inflation project for FY26 at 2.6% vs 3.1% earlier, with Sanjay Malhotra stating, "There has been a singificant moderation in inflation."

The inflation project of Q2FY26 and Q3FY26 stands at 1.8% while Q4FY26 stands at 4%.

Real GDP growth for FY26 has been revised upward to 6.8% from the earlier estimate of 6.5%, which indicates stronger-than-expected economic performance.

RBI has proposed a series of measures to improve credit flow, ease costs and expanding lending flexibility.

The Reserve Bank of India’s last interest rate decision of the year is proving to be one of its trickiest, with policymakers having to weigh up record low inflation against a plunging currency and 8%-plus economic growth.

A majority of the 44 economists surveyed by Bloomberg expect the central bank to cut its benchmark repurchase rate by a quarter point to 5.25% on Friday given inflation is well below the 4% target.

Read full story here.

The Monetary Policy Committee or MPC of the Reserve Bank of India, chaired by Governor Sanjay Malhotra, began its three-day meeting on Wednesday, Dec. 3, to discuss the fifth monetary policy for financial year 2026. Key areas of the decision-making process included interest rates, inflation and growth outlook.

Malhotra will announce the decision of the six-member MPC at 10:00 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.