The share price of small-cap company CIAN Agro Industries & Infrastructure Ltd. has run up multifold, becoming a multibagger. The market's interest in the stock is so notable that BSE has placed it under the long-term Additional Surveillance Measure — a framework by SEBI and stock exchanges to monitor and manage stocks showing abnormal, continuous trading patterns.

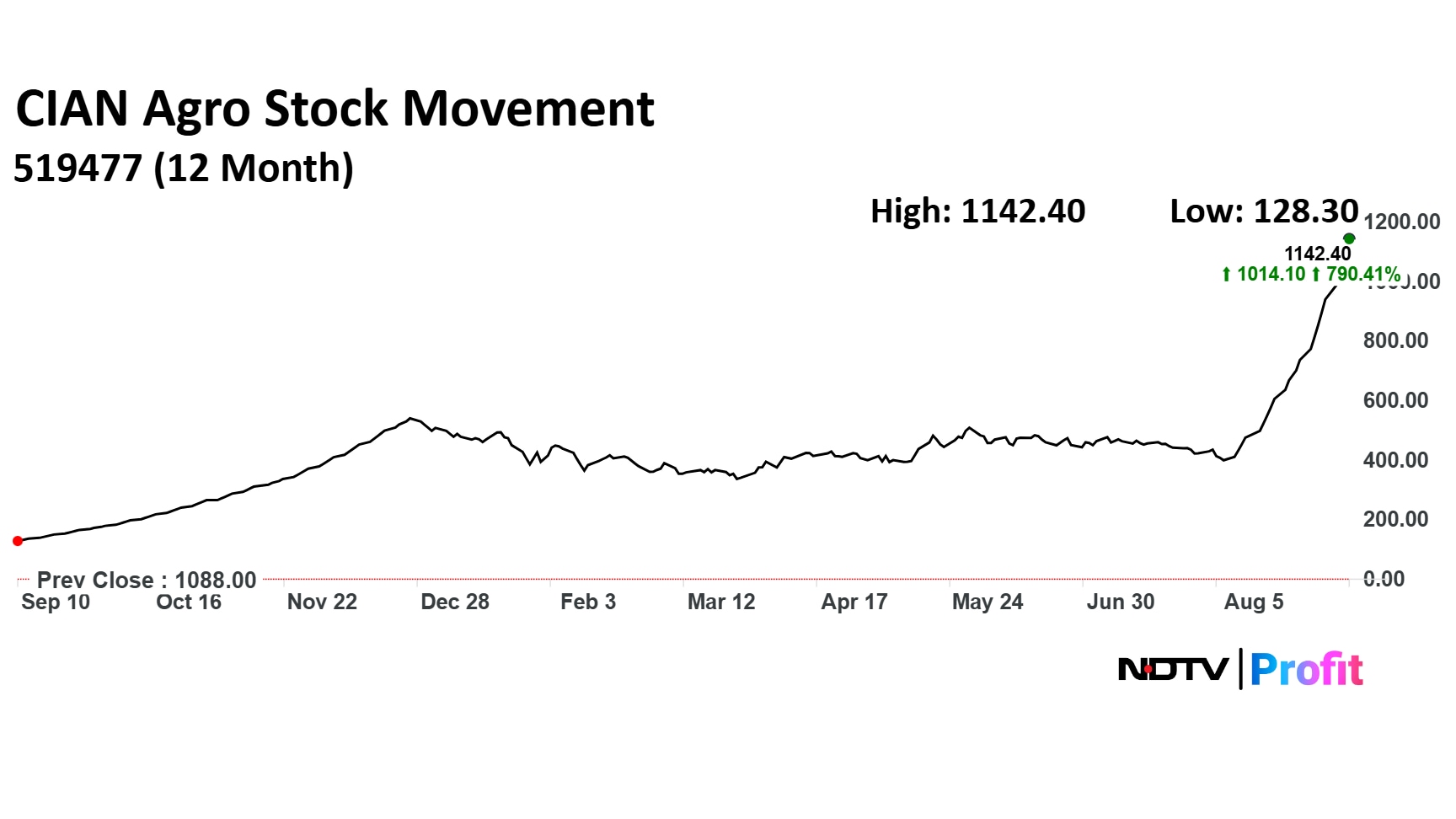

The share price has surged 790% in the last 12 months, 120% so far this year, and 185% in the last month. The stock is listed exclusively on the BSE.

Business Operations

The CIAN Group is an integrated group with presence diverse sectors — spices, edible oil, personal care, home care, sanitation and agro. But its primary income comes from ethanol. It markets home care products under 'Oir' and 'Neu' brand and agro products under 'Amrutdhara'.

The company has manufacturing facilities in Maharashtra's Nagpur and Chandrapur districts. It has a sales network across Maharashtra, Goa, Kerala, Chhattisgarh, and Madhya Pradesh.

Manas Agro Industries & Infrastructure Ltd., a step-down subsidiary, manufactures sugar, generates power, and is involved in distillery operations, ethanol production, and the trading of E-10 and LPG. The arm's revenue for the financial year 2025 was Rs 913 crore and a profit of Rs 5.27 crore.

Notably, the central government has been promoting the blending of ethanol in petrol to up to 20% and successfully defended its policy in the Supreme Court.

Shareholding PatternThe

The promoters own 67.67% of CIAN Agro Industries as of June 2025. Nagpur-based Avinash Fuels Pvt. Ltd. is the single-largest shareholder with 26.13%.

Retail investors hold just 6.5% of the stock, while resident individuals with nominal share capital exceeding Rs. 2 lakh hold a 21.23% stake.

Guttikonda Vara Lakshmi offloaded shares worth Rs 15 crore last week through a large trade. This individual held a 1.28% stake as of June. The buyers could not be ascertained.

CIAN Agro Industries' share price has surged 790% in the last 12 months.

Financial Performance

CIAN Agro Industries reported a 22% rise in both consolidated revenue from operations and net profit in the financial year ending March 2025. The topline rose to Rs 738.2 crore from Rs 607.57 crore in the previous fiscal, according to the company's annual report. Profit came in at Rs 73.95 crore versus Rs 60.86 crore.

The company improved its operational performance. Earnings before interest, tax, depreciation, and amortisation (Ebitda) rose 25% to Rs 137.08 crore. Margin improved to 18.6% versus 18.1%.

Management

Nikhil Gadkari, son of Union Minister Nitin Gadkari, is the managing director of CIAN Agro Industries. According to his profile on the company website, Nikhil oversees project planning, budgeting, funding, liaison activities and regulatory aspects.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.