KFin Technologies Ltd. got a target price cut from Jefferies which sees weaker equity market revenues for fiscal 2026 that could also play through the following year as well.

The brokerage estimates that 40% of KFin Tech's revenue is linked to equity, the majority from mutual fund business besides AIF.

It has factored in weakness in equity markets post third-quarter results, so incremental changes and impact are lower. "We now factor in negative mark-to-market of 10% in fourth quarter compared to 7% earlier and lowered market return in FY26 from 12% to 8%," the note said.

Further, analysts have reduced the fiscal 2027 revenue estimate by 2% and overall earnings by 4% without factoring in any cost cuts, as the management will likely prioritise investments over short-term earnings defense.

Yet, Jefferies projects a healthy 17% compounded annual growth in profit over FY25-27 and an upside from merger and acquisitions.

The brokerage has maintained a 'buy' rating on the KFin Tech stock with a target price of Rs 1,310, down from Rs 1,460 earlier. The target is based on 50 times its FY27 price-to-earnings.

KFin Tech Share Price Movement

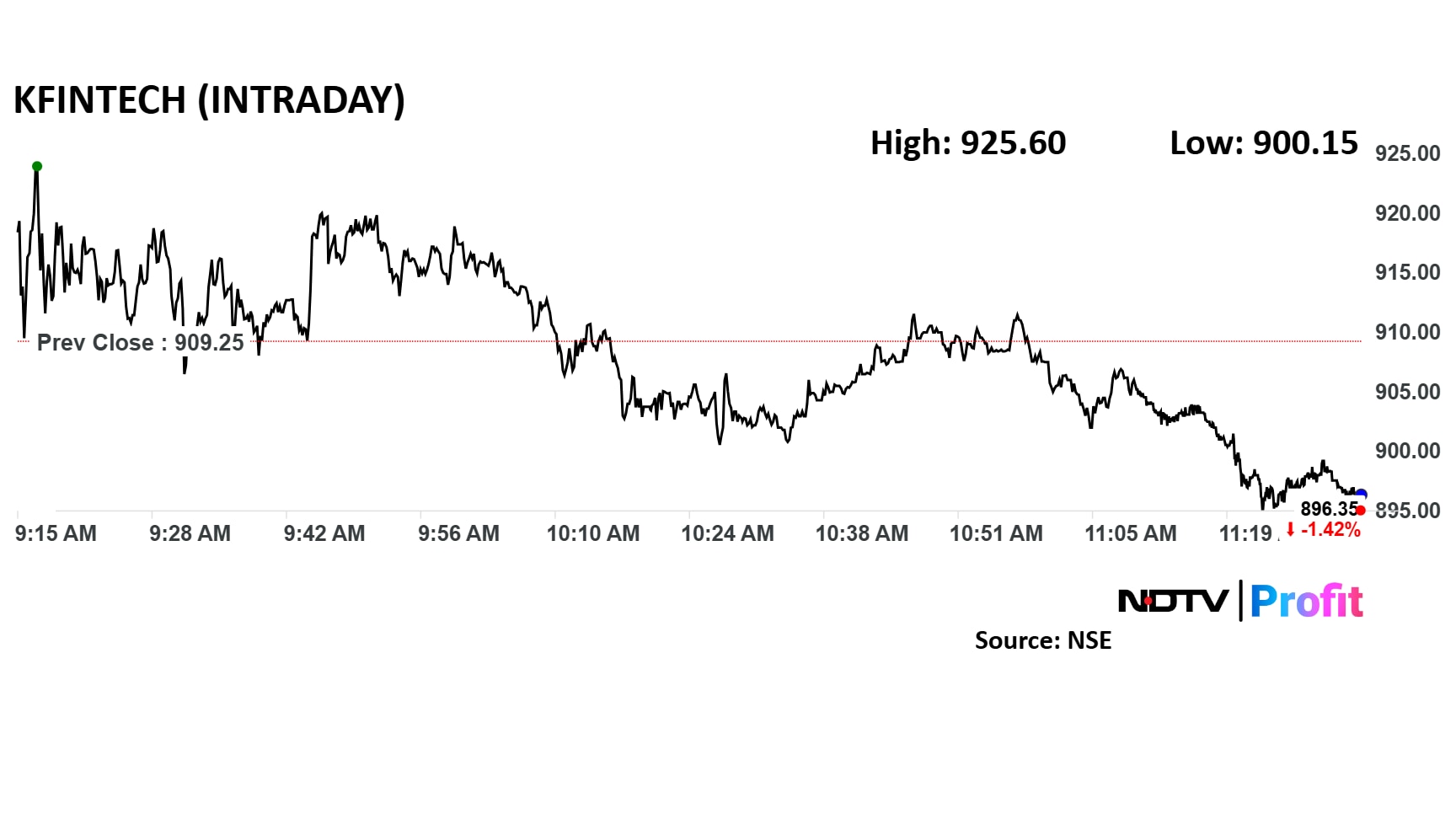

KFin Tech share price had a volatile session on Tuesday, swinging between gains and losses.

KFin Tech share price had a volatile session on Tuesday, swinging between gains and losses. The scrip was trading 1.4% lower by 11:30 a.m. The benchmark NSE Nifty 50 was flat.

The stock has fallen 27% in the last 12 months and 41% on a year-to-date basis. The relative strength index was at 35.

Nine out of the 16 analysts tracking KFin Tech have a 'buy' rating on the stock, four recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target of Rs 1,216 implies a potential upside of 35%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.