- Nifty 50 slipped below 25,000, marking a nearly four-week low for the index

- Sensex dropped over 500 points, trading at 81,735 amid broad market weakness

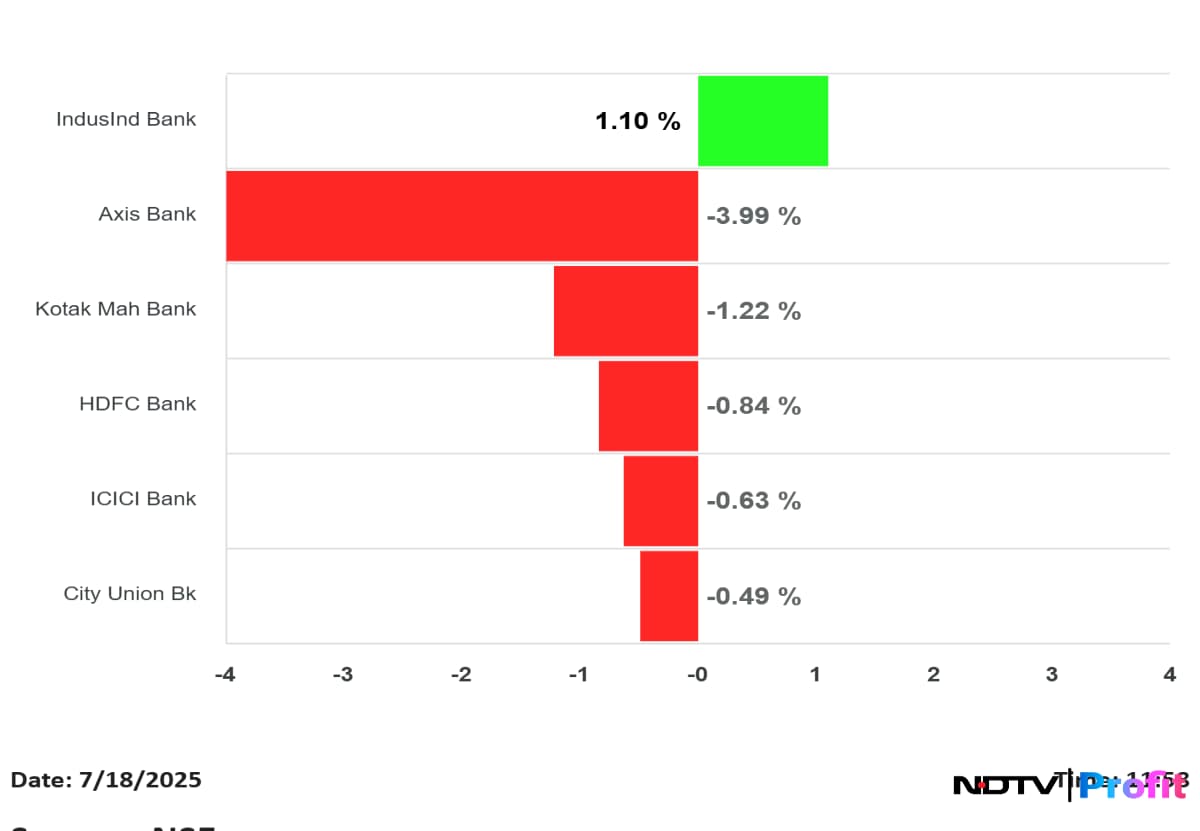

- Private sector banks, including Axis Bank and Kotak Mahindra, led the decline

The Indian equity markets witnessed a significant slip in levels on Friday, with the Nifty 50 slipping below the 25,000 mark and the Sensex shedding over 500 points. The Nifty 50 was trading down 0.63% at 24,956, while the Sensex stood lower at 81,735 at the time of publishing this story.

The Nifty 50's dip below 25,000 marked a nearly four-week low for the index, reflecting broad-based weakness across the market. The Indian equity markets are trading in a bearish tone as the Nifty has slipped below key support levels of 25,000.

Out of the 50 stocks comprising the Nifty 50, about 37 players were in the negative territory, with Axis Bank and SBI Life emerging as the top laggards. The financial sector, in particular, exerted significant downward pressure, dragging the Nifty 50 by nearly 100 points.

Why Did Stock Market Crash Today?

Private Sector Banks Decline

The downward momentum accelerated by the banking sector, with the Bank Nifty opening lower due to weak numbers from Axis Bank, eyeing upcoming results from HDFC Bank and ICICI Bank.

This market decline was predominantly led by private bank players, with major names like Axis Bank, Shriram Finance, and Kotak Mahindra Bank trading in the red. Insurance heavyweights such as SBI Life and HDFC Life also contributed to the drag on the Nifty 50. A key factor in the market's slide was the disappointing results from Axis Bank, which led private banks to led the overall decline.

The Nifty Private Bank index declined as much as 1.5% intraday. Eight of the nine constituent stocks were in red.

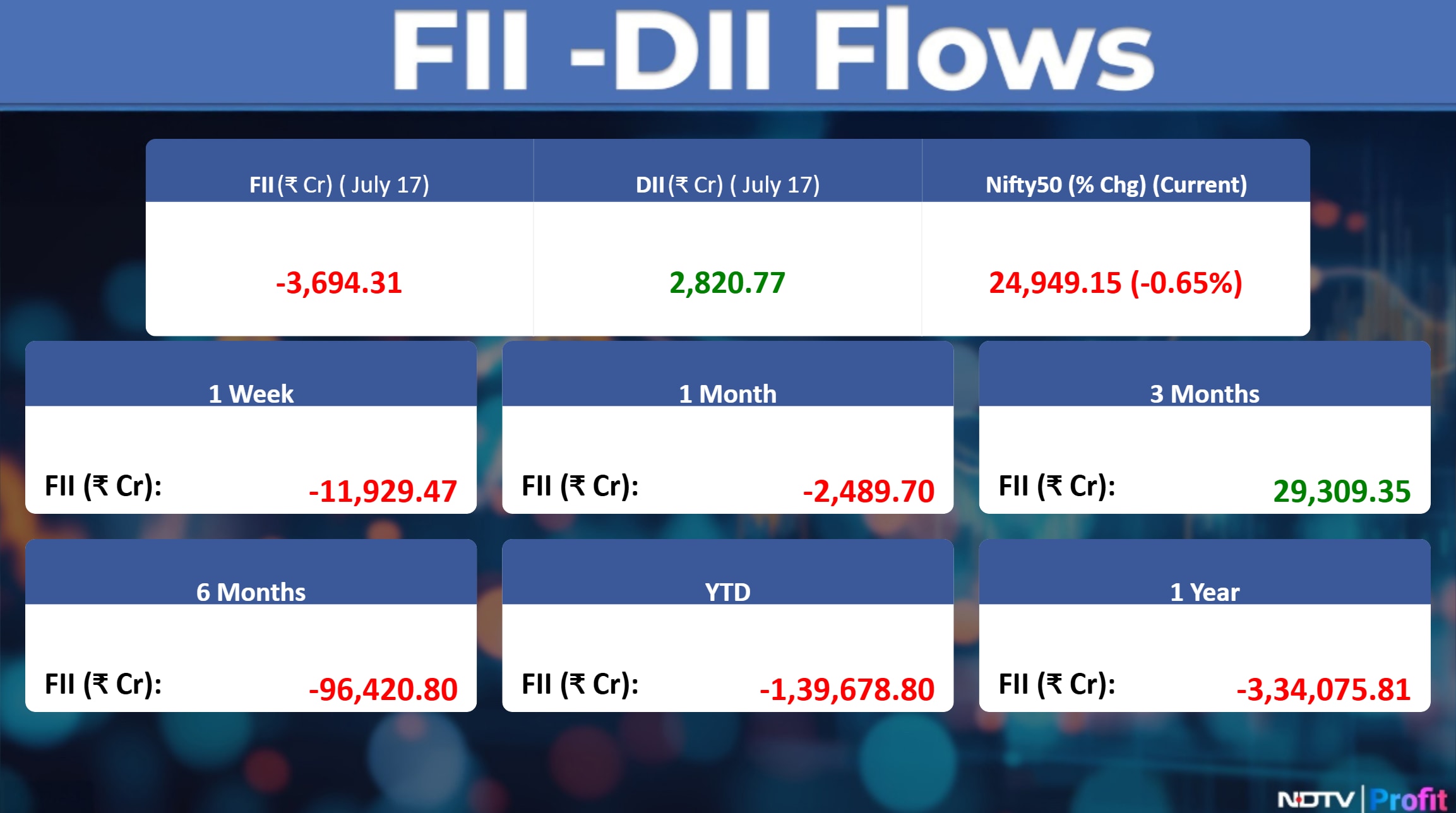

FII Sell-Off, Higher Pressure

Adding to woes, Foreign Institutional Investors are increasingly building short positions in the derivative market, a clear indicator of their bearish sentiment. The FII long-short ratio currently stands at a striking 83% shorts against only 17% longs, underscoring this negative outlook. This derivative market activity is complemented by consistent FII selling in the cash market, which has been adding considerable pressure to equities.

In fact, FIIs have offloaded equities worth nearly Rs 12,000 crore in just one week, contributing significantly to the prevailing market weakness.

FIIs have offloaded equities worth nearly Rs 12,000 crore in just one week.

FIIs are increasingly building short positions in the derivative market.

Stock Market Crash: Experts Weigh In

Weighing in on the market downturn, Kranthi Bathini from WealthMills Securities attributes some of the risk-off mood to the macro-economic uncertainty.

"There are a lot of uncertainties looming around the India US Trade policy. The conclusion is not coming though we are expecting something positive," he said.

Taking about the markets breaching the support levels, the experts zooms out to look at the global cues for the way ahead.

"Nifty 25,000 levels has been held for a few days, once the Nifty has violated this level, its creating extra pressure," he added. Once the European markets open, investors need to watch for any buying interest according to Bathini.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.