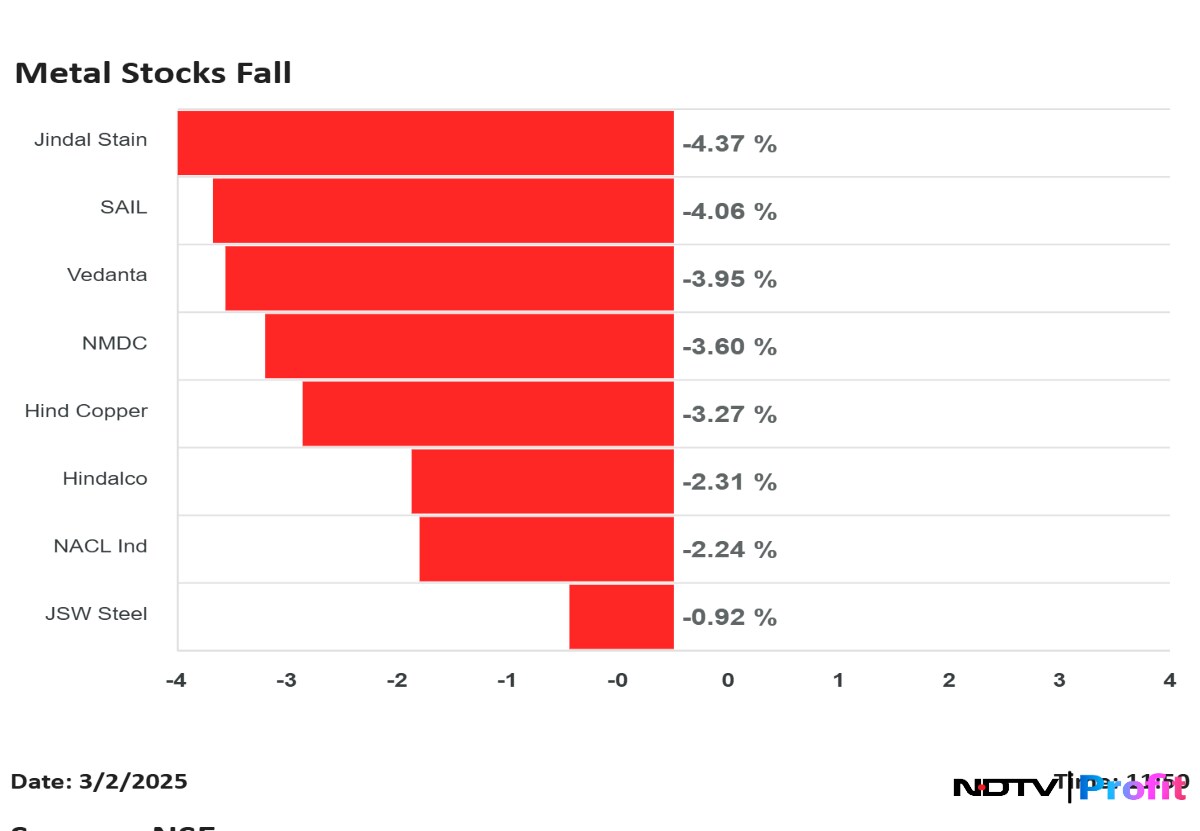

Nifty Metal was the top sectoral loser on Monday, with a intraday fall of 3.84%, the lowest since Jan. 14. Vedanta Ltd. weighed the Metal index the most, after the stock fell nearly 7% touching a five-month-low. This was followed by National Mineral Development Corp. that fell 5.84%, while Jindal Stainless Steel Ltd. also fell 5.84% to nearly a year low.

Steel Authority of India stock also fell 5.64% on Monday, while Hindalco Industries Ltd. fell to a 10-month low after a near 5% decline. Hindustan Copper Ltd. was also trading 4.68% lower. Other metal companies like NMDC, JSW Steel and National Aluminium Co. were also trading in the red.

This decline in metal stocks comes after US President Donald Trump imposed tariffs on China, Canada and Mexico, triggering a trade war that could have a severe impact on global economic growth. The move pushed commodities like copper to trade 1.60% lower at $421.05.

Trump has announced 10% tariff on imports from China and 25% tariff on imports from Canada and Mexico. The tariffs are to take effect from Tuesday.

US consumption of steel totalled about 93 million tonnes in 2023, with net imports accounting for 13% of that demand, according to data from the US Geological Survey. Last year, Canada, Brazil and Mexico were America's top three sources of imported steel, according to US Commerce Department data.

When it comes to aluminum, a higher-value metal than steel, the US consumed about 4 million tonnes in 2023, with net imports accounting for 44% of that total. Canada was the source of 56% aluminum imports, according to Morgan Stanley.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.