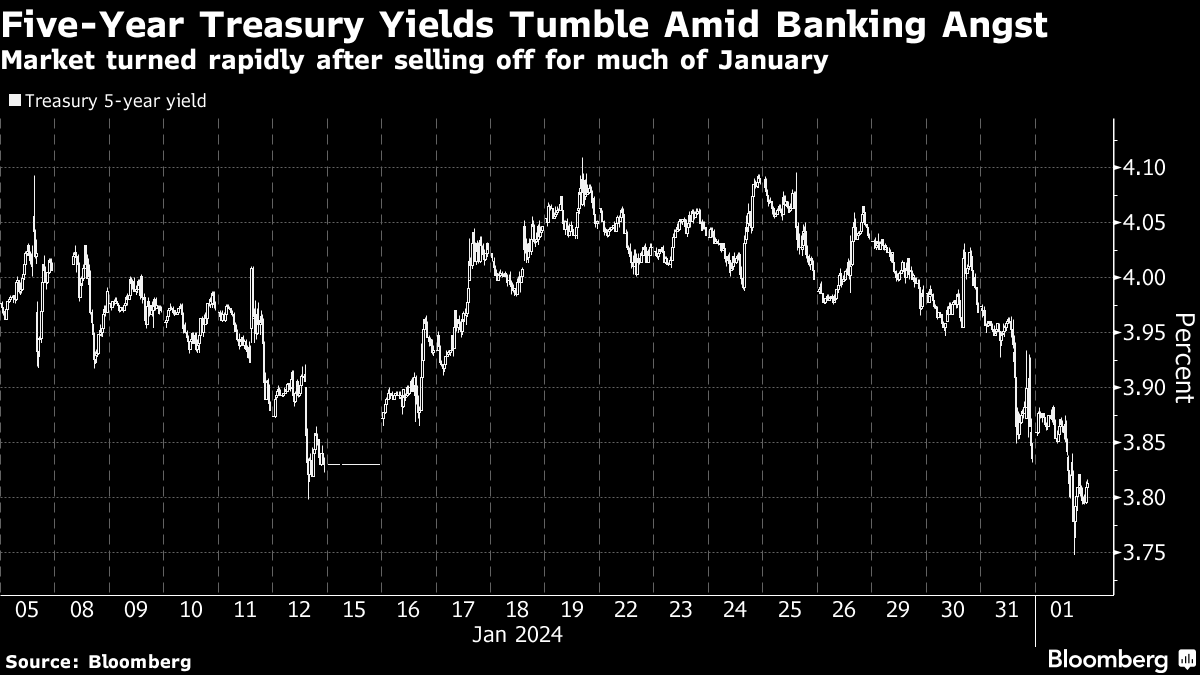

(Bloomberg) -- Investors should take profit on five-year Treasuries after the notes surged this week amid regional banking concern and data signaling the potential for a soft payrolls report on Friday, according to JPMorgan Chase & Co. analysts.

The bank recently recommended buying five-year Treasuries after yields jumped in January to a one-month high. With JPMorgan forecasting an upside surprise for January payrolls data on Friday, that makes it a good time for investors to sell the bonds now, analysts including Jay Barry, the firm's co-head of US rates strategy, wrote in a report Thursday.

“Combined with what we think is an overreaction to the regional bank developments as well as the risks around tomorrow's employment report, these factors present upside risks to yields,” they wrote.

While the Federal Reserve held interest rates on Wednesday and pushed back against bets on a March cut, declines in US financial stocks led traders to become more certain that the central bank will soon have to pivot toward rapid easing. That sent Treasury yields back down to where they started the year.

Treasuries Surge as Bank Stock Rout Rekindles Fed Rate-Cut Hopes

JPMorgan remains bullish on the longer-term outlook for medium-term Treasuries, and expects yields to go back up in the coming weeks, which will offer a more attractive time to go long again.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.