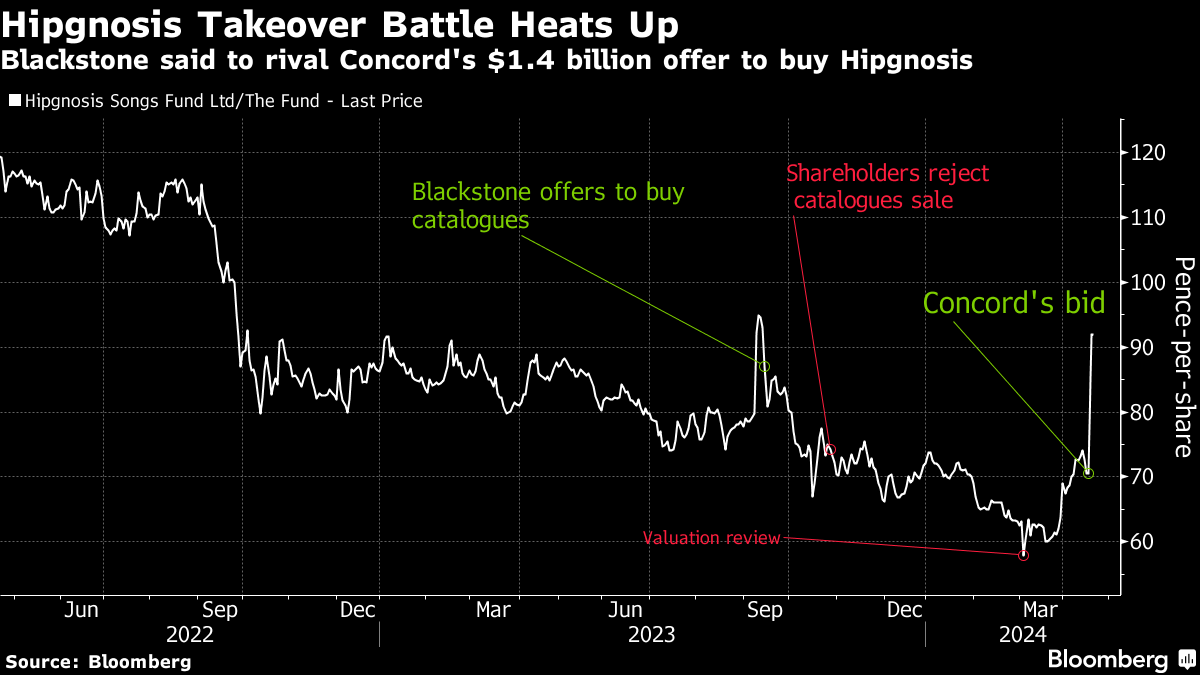

(Bloomberg) -- Private equity firm Blackstone Inc. is planning to offer nearly $1.5 billion to purchase Hipgnosis Songs Fund Ltd., competing with a bid made earlier this week by Concord, Sky News reported, citing people it didn't identify.

According to Sky, Blackstone has made prior offers for Hipgnosis, a London-listed music rights investment company which owns song catalogs from Blondie, the Kaiser Chiefs and the Red Hot Chili Peppers.

Previous offers from Blackstone ranged from 82 to 88 pence per share, according to insiders, worth marginally less than the 93.2 pence-per-share bid unveiled on Thursday from Concord Chorus, a music rights investment company backed by rival Apollo Global Management. Blackstone, which is being advised by investment bank Jefferies, is now considering the higher offer, Sky said.

Hipgnosis' board on Thursday unanimously agreed to a deal with Concord, stating it's unlikely that the share price will increase to reflect the company's performance because of “numerous company-specific and certain market issues.”

Read more: Hipgnosis Songs Fund Cuts Asset Value on Accounting Error

The deal caps a period of turmoil for the troubled fund, after a strategic review concluded in March that its assets were worth significantly less than Hipgnosis Song Management, its investment adviser, had reported last September.

While there's no guarantee a new offer will be made, Blackstone is already involved with the company's future, as it owns a stake in HSM, which has a contract to manage the fund's assets.

Read more: Concord to Buy Hipgnosis in $1.4 Billion Song Catalog Deal

Shares of Hipgnosis have surged about 30% since the Concord offer and closed at 91.9 pence on Friday, slightly below its offer price.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.