FSN E-Commerce Ventures Ltd., the operator of beauty startup Nykaa, swung after the regulatory lock-in on anchor investors allotted shares in the initial public offering ended.

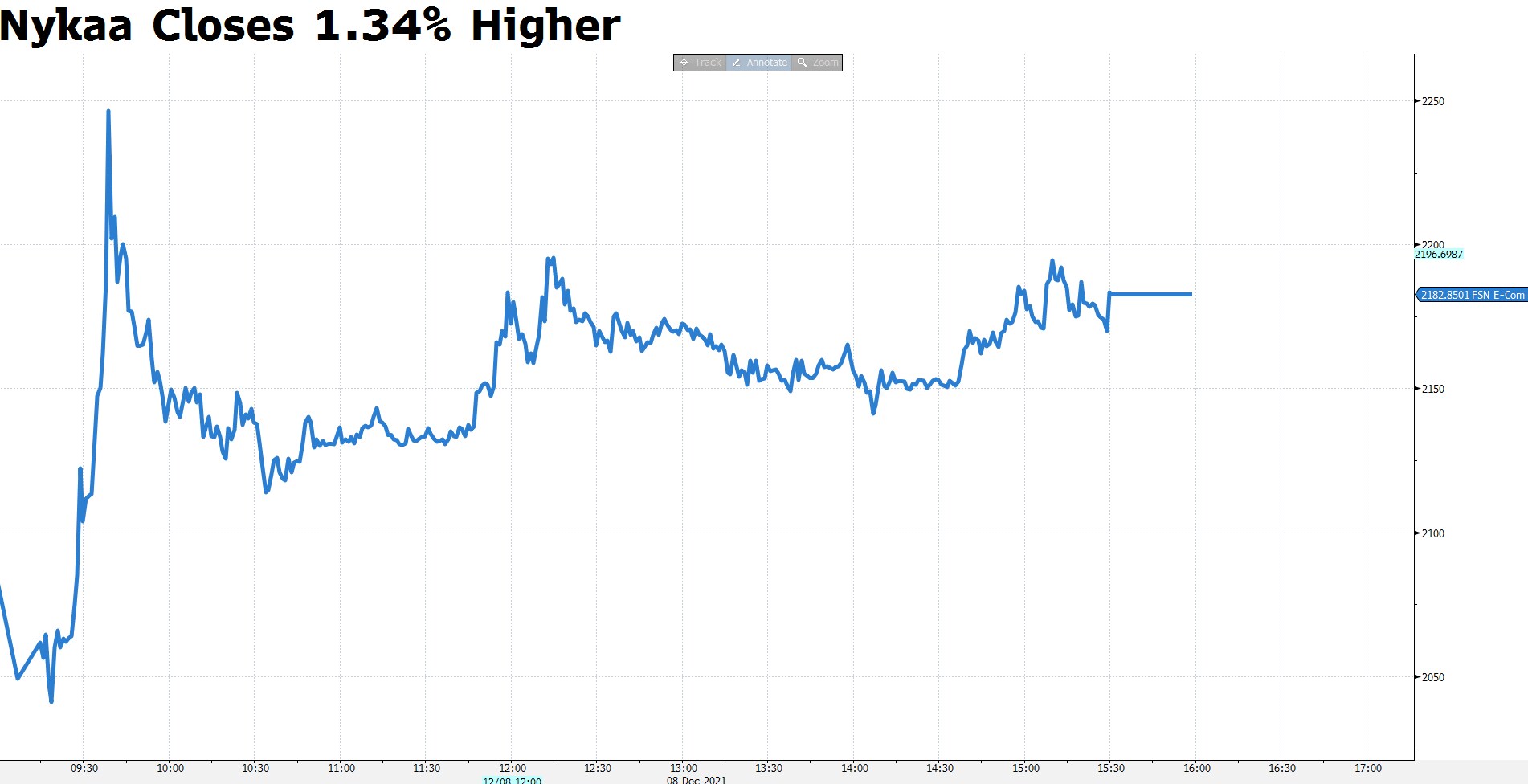

The stock closed 1.34% higher at Rs 2,182.85 on Wednesday after swinging between a gain of as much as 4.41% and a loss of 5.91% intraday. That compares with a 1.71% rise in the benchmark Nifty 50 to 17,469.15.

Nykaa had raised Rs 2,395.84 crore from 174 anchor investors ahead of its initial public offering. The company had allotted 2.13 crore shares to this category at Rs 1,125 apiece. The shares had surged 96.07% on debut.

Anchor investors are large institutions roped in to generate demand ahead of an IPO. The shares allotted to these investors are locked in for a month from the listing day. When the regulatory leash loosens, the stock usually faces volatility.

In December, lock-in period for 10 newly listed stocks ends. Others include One97 Communications Ltd., the parent of Paytm; Sapphire Foods India Ltd., the largest Indian franchisee of Yum Brands Inc. that owns KFC and Pizza Hut; and Fino Payments Bank Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.