Muthoot Finance Ltd. got a ratings upgrade to 'outperform' from CLSA. While, Manappuram Finance Ltd. also kept its 'outperform' rating as the brokerage sees the two firms benefiting from restrictions on peers.

Muthoot Finance and Manappuram Finance will report their December quarter numbers on Feb. 12 and 13, respectively.

CLSA also raised Manappuram Finance's target price to Rs 225 from Rs 200, which implied an upside of 15.21% from Monday's closing price. It raised Muthoot Finance's target price to Rs 2,400 from Rs 2,000. The current target price implied 9.2% upside from Monday's closing price.

Healthy rise in gold prices gives comfort to these companies on auction and recoveries. Bank loans dominated borrowing mix of these companies. As it's mostly linked to Marginal Cost of Fund-Based Lending, CLSA doesn't see any significant benefit in the current rate cut scenario.

Manappuram Finance reported a 17% year-on-year growth in loans, while Muthoot Finance reported 31% growth. The latter is the largest gold financier with Rs 90,200-crore loan book, according CLSA.

CLSA hiked Muthoot Finance's loan growth estimate to 25% for financial year 2025. Overall, net profit estimates for financial year 2025 and 2027 rose by 1–4%. The gold financer is well-placed to keep on benefitting from industry.

In the gold loan segment, State Bank of India and Muthoot Finance are the fastest growing, according to CLSA. Banks have witnessed 70% on the year growth as of December 2024, while personal loan segment's growth slowed down.

State Bank of India has the largest loan book of Rs 43,700 crore, which indicates 25% market share. The lender reported 42% year-on-year growth by last December.

Federal Bank is the second largest in gold financing, which reported 31% on the year growth by December 2024.

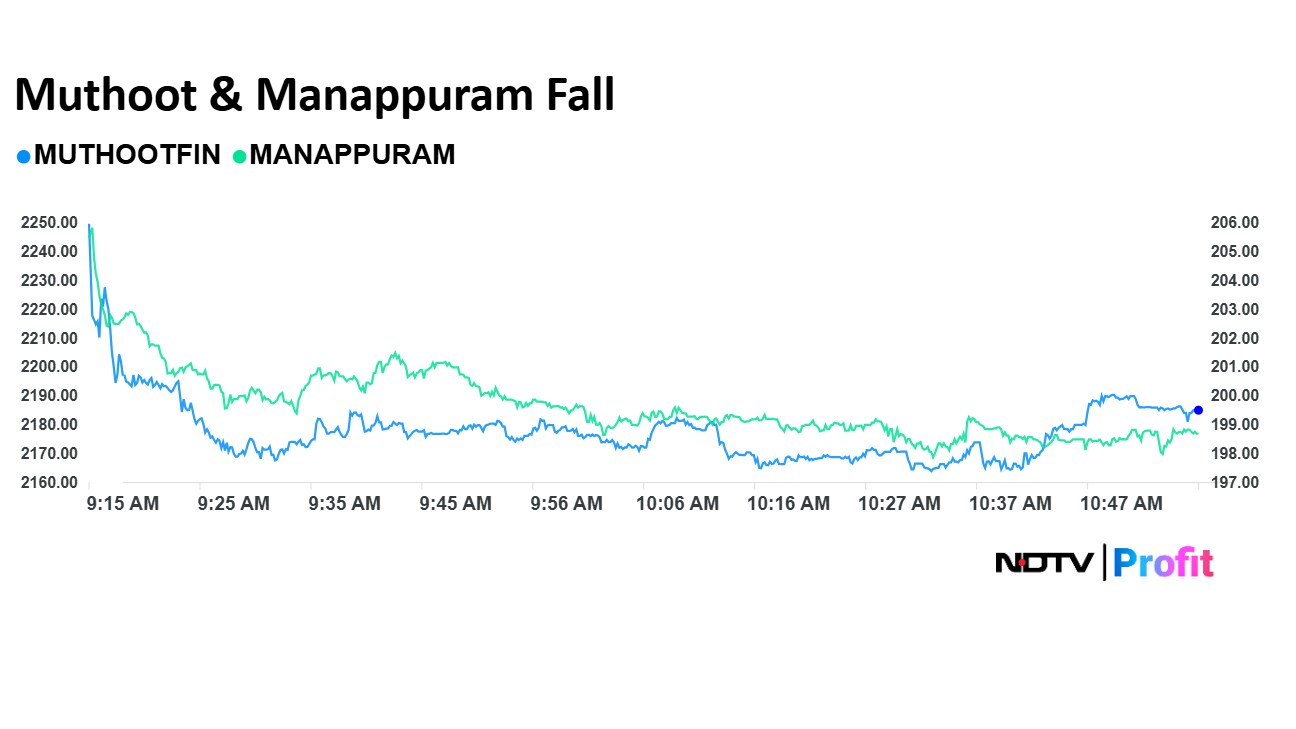

Muthoot, Manappuram Share Prices

Both Muthoot Finance and Manappuram Finance share prices declined 3.70% and 3.48% down, respectively. As of 11 a.m., both the shares were trading 0.62% and 2.96% down, respectively, compared to a 0.48% decline in the NSE Nifty 50.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.