- Lenskart reported a 38.3% revenue growth to Rs 2,308 crore in Q3 FY26

- Net profit surged to Rs 131 crore from Rs 1.9 crore year-on-year

- Morgan Stanley upgraded Lenskart to Overweight, raising target price to Rs 561

Shares of Lenskart Ltd are in focus today on the back of stronger-than-expected growth and margins in the December quarter. The eyewear retailer also saw a string of target price hikes from major brokerages. Morgan Stanley upgraded the stock to ‘Overweight' from ‘Equal-weight' and sharply raised its target price to Rs 561 from Rs 445, called the performance a “massive beat.”

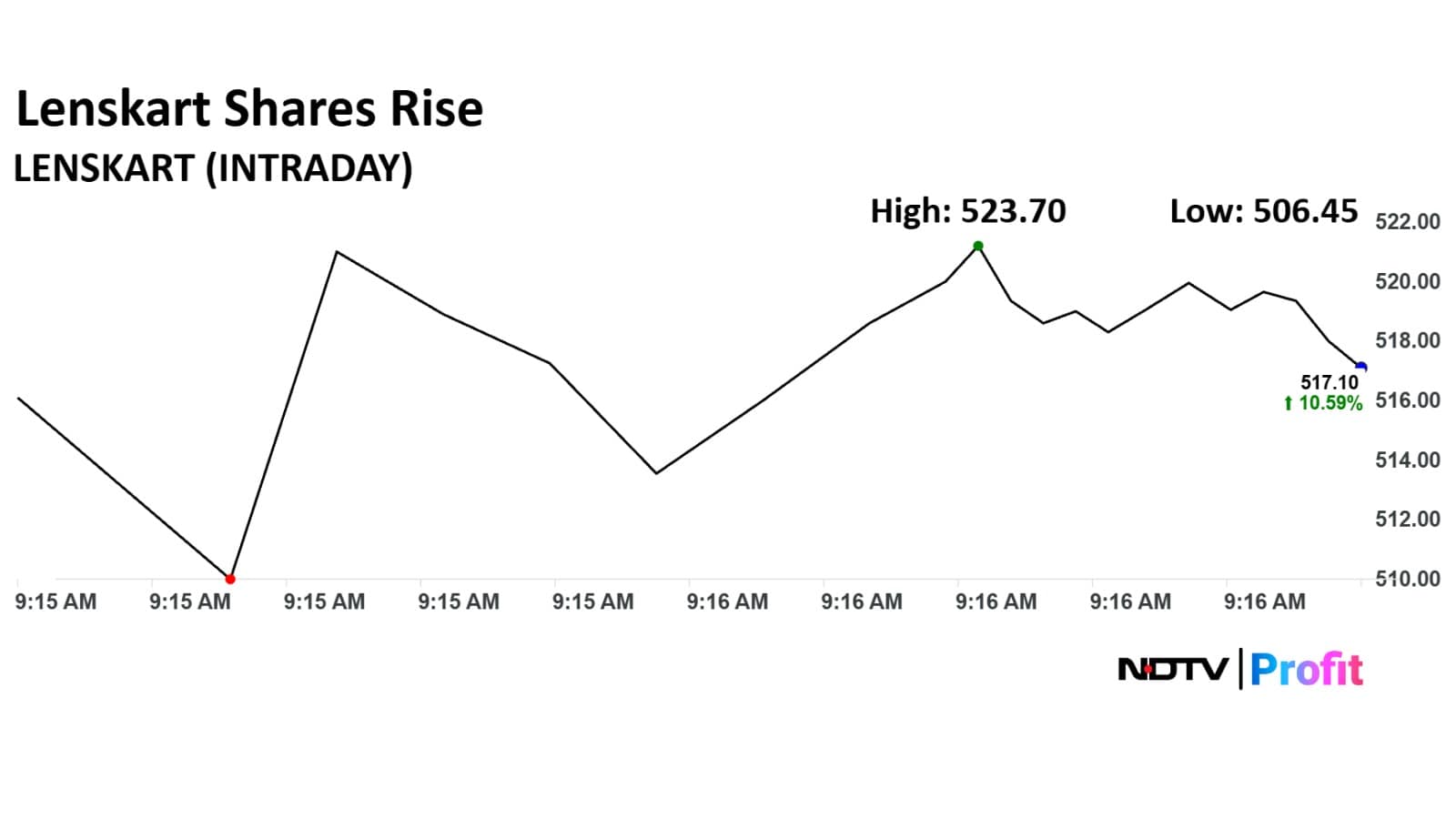

The shares of Lenskart rose over 10% and are trading around Rs 517 apiece. Lenskart's relative strength index (RSI) currently stands at 45.22.

Photo Credit: NDTV Profit

Of the 12 analysts tracking this stock, nine have a 'buy' rating, two have a 'hold' view, and only one has a 'sell' rating. The 12-month target price is Rs 529.83, with an upside potential of 13.3%, as per Bloomberg data.

Lenskart Q3 FY26 Results (Cons, YoY)

- Net profit at Rs 131 crore vs Rs 1.9 crore

- Revenue up 38.3% at Rs. 2,308 crore vs Rs 1,669 crore

- Ebitda at Rs 464 crore vs Rs 212 crore

- Ebitda margin at 20.1% vs 12.7%

Lenskart delivered a strong set of numbers for the quarter, with profit after tax jumping to Rs 132.7 crore, a sharp rise from Rs 1.85 crore a year earlier. The company's revenue grew 38.3% year‑on‑year, reaching Rs 2,307.7 crore compared with Rs 1,668.8 crore in the same quarter last year. EBITDA rose 118.9% to Rs 464.1 crore, up from Rs 212 crore a year ago, while operating margins improved significantly to 20.1%, versus 12.7% in the previous year.

In India, revenue increased 36.8% to Rs 1,385.2 crore, compared with Rs 1,012.9 crore in the prior year. EBIT came in at Rs 160.8 crore, a 234.3% surge from Rs 48.1 crore last year, leading to an expansion in India-level margins to 11.6%, up from 4.7%.

International operations also posted solid growth, with revenue rising 39.9% to Rs 935.9 crore, from Rs 668.9 crore a year earlier. EBIT improved to Rs 32.5 crore, recovering from a Rs 42.4 crore loss in the same quarter last year, translating to a margin of 3.5%.

ALSO READ: Lenskart Q3 Review: Most Brokerages Hike Target Price — Here's Why

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.