Indoco Remedies Ltd.'s share price surged 10% to over one–month high as the company announced it's collaboration with a UK–based pharmaceutical distributor. Indoco Remedies entered into a strategic distribution with Clarity Pharma UK, it said in an exchange filing on Monday.

The partnership with Clarity Pharma is significant for Indoco Remedies as it will launch 20 products over the next 18 months through the British pharmaceutical company in the UK market, the filing said.

Indoco Remedies will continue supplying all products under existing business–to–business partnership to its client, it said.

Clarity Pharma has over 25 years of experience in introducing products to market and now services over 4,000 primary healthcare customers, Indoco Remedies said.

In a separate exchange filing, the research–based Indian pharmaceutical company said it has received a GST show–cause notice from Hyderabad Commercial Tax Department. A potential demand of Rs 15.51 crore has been made for the GST liabilities, basis the details provided for the period from 2020-2021.

Indoco Remedies does not see the claim materialising, however. "In the opinion of the company and based on the legal advice, these claims are nontenable in law as per other judicial pronouncements."

Indoco Remedies Share Price Today

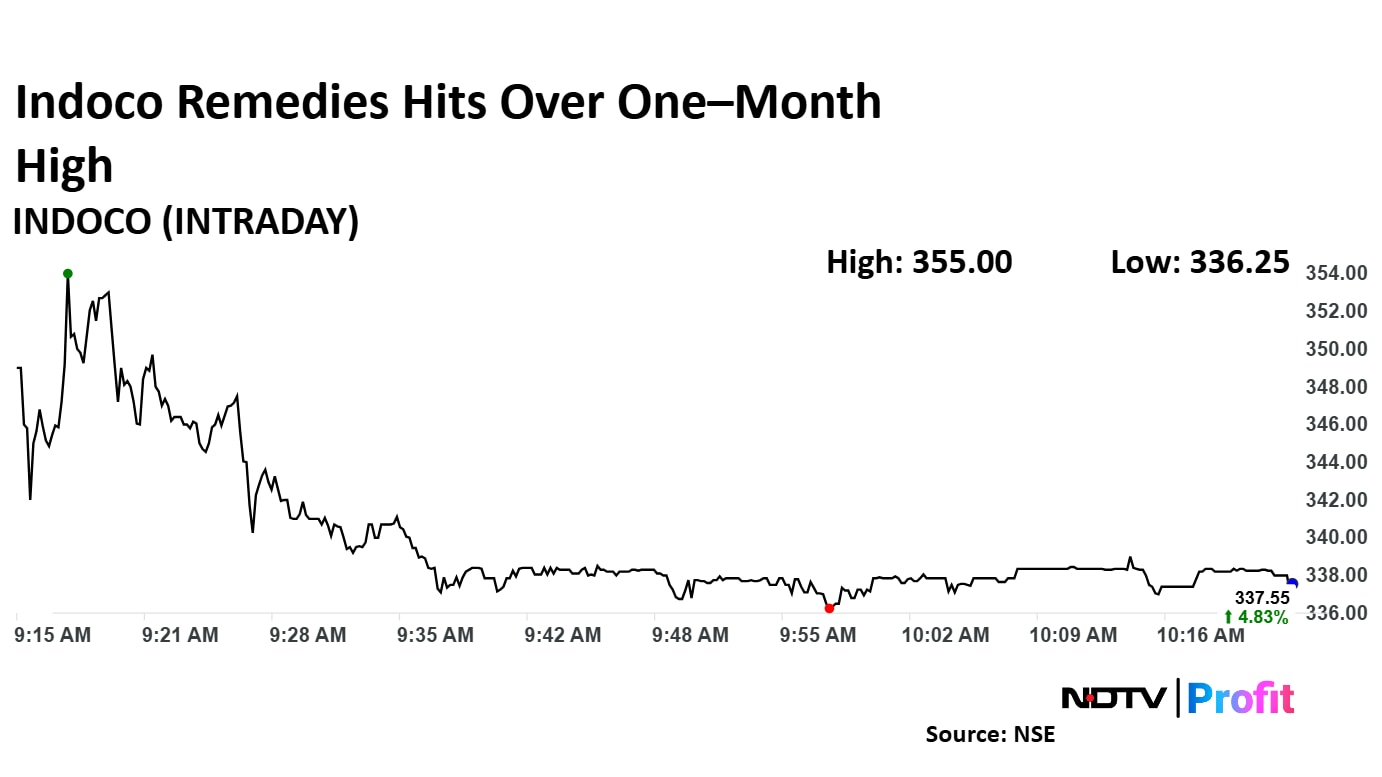

Indoco Remedies' share price rose 10.25% to Rs 355.00, the highest level since Oct. 1. It pared gains to trade 5.03% higher at Rs 338.20 apiece, as compared to 0.35% advance in the NSE Nifty 50.

The stock gained 11.15% in 12 months, and declined 14.39% on year-to-date basis. Total traded volume so far in the day stood at 26 times its 30-day average. The relative strength index was at 61.98.

Out of seven analysts tracking the company, two maintain a 'buy' rating, two recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.2%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.