(Bloomberg) -- There's no room for double-digit gains again. With less upside expected for global stocks this year than in 2023, Citigroup Inc. strategists say buy at times of weakness and don't chase rallies.

While the probability of broadening earnings growth and a soft landing for the global economy will support stocks in 2024, a rerating for valuations remain unlikely after last year's rally, strategists led by Beata Manthey wrote in a note on Friday.

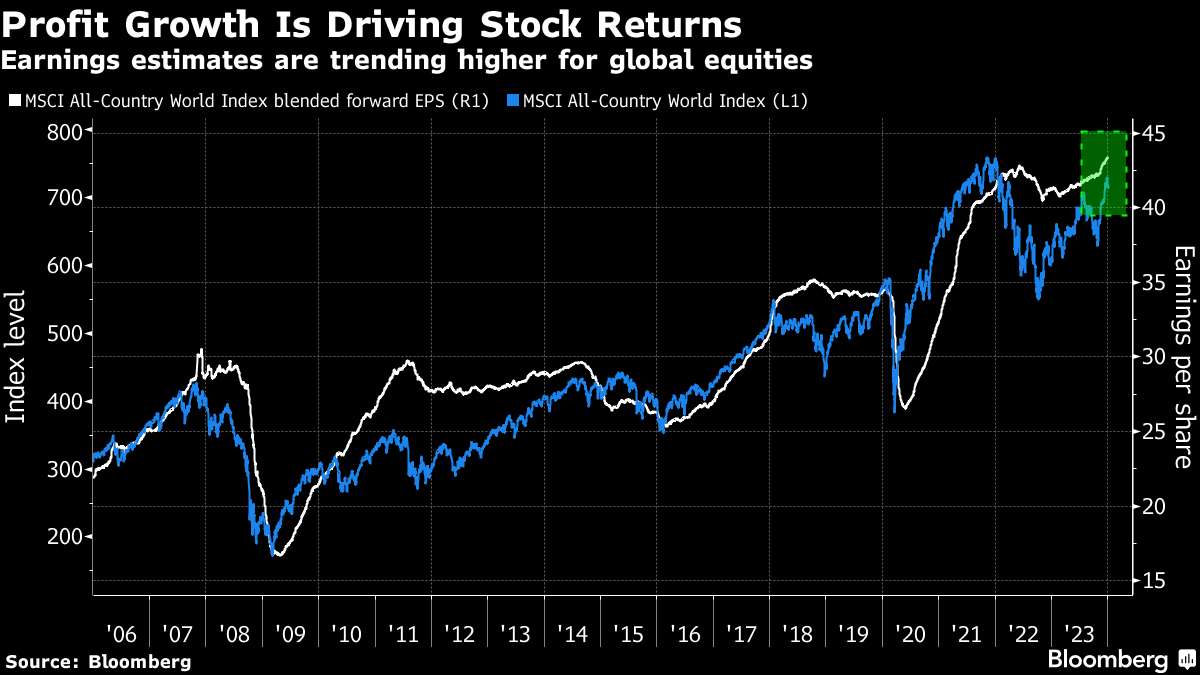

The view is supported by expectations of about 8% upside for the MSCI All-Country World Index and 9% in earnings growth for 2024, “a conservative assumption in a Fed easing cycle,” they said.

“We would buy dips” while not necessarily chasing rallies, the strategists said.

After about 20% gains in 2023, the global benchmark is having a rockier start to the year with about 2% in losses in the first week. Investors have been more cautious after the euphoria of the past two months, while bond yields are rising again with traders trimming their expectations for interest rate cuts.

Citi's strategists see the economic backdrop as supportive for cyclical sectors and markets, preferring financials and industrials, as well as regions outside the US such as Europe ex-UK and emerging markets. Manthey has a neutral view on the US, with the region being less cyclical and already pricing in a soft landing.

She has been optimistic on Europe for most of 2023 , but sees the region still pricing a relatively bearish earnings outlook, even after the strong run.

“Cheap cyclical exposure keeps Europe well positioned for further market broadening and potential stimulus out of China,” she said.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.