No Indian company is really into AI, warns Vijay Kedia

US tariffs a 'blessing in disguise', says Nilesh Shah

Distributor-backed SIPs sit tight through market volatility, says Sundeep Sikka

The best decade to invest in India is the next decade, says Ramesh Damani

Gold-based SIPs top focus of large distributors, says Nimesh Shah

The live blog session has concluded. Thank you for tuning into this coverage.

Actor-investor Vivek Oberoi says investing demands patience and staying put — he's not in it for a one-night stand but for the long haul.

"I do not think any Indian company is really into AI. Businesses that actually use AI in operations will benefit," said Vijay Kedia. However, he is bullish on the pocket.

Read the whole story here.

From blockbuster screens to boardroom bets, #VivekOberoi knows how to back a hit.

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

The actor‑entrepreneur brings a fresh lens on how to spot the hits in your investment playbook.@vivekoberoi @VikramOza #NDTVProfitIgnite #Samvat2082 https://t.co/cZwr8eoAfW

Veteran investor Vijay Kedia cautioned retail investors against buying stocks where he mops up shares via large trades.

"I am not a broker or a fund manager, and I don't recommend any stock," Kedia said at the NDTV Profit Ignite Conclave. His stock picks, which often make news and create market interest in the particular company, are made through his own investment vehicle, Kedia Securities.

Nilesh Shah said that silver is "the poor man's gold" while gold prices were becoming stretched, driven in part by industrial demand for solar energy.

On art, Shah suggested it could emerge as a hard asset and potentially become the next investment boom.

Nilesh Shah said that rebuilding companies like NVIDIA in India is achievable, but the key challenge lies in creating an ecosystem that nurtures AI talent.

#NDTVProfitIgnite | Let's conclude our conclave with this blockbuster session with market expert Nilesh Shah as we discuss the ultimate Diwali mantra for investing.@KotakMF @NileshShah68 @_nirajshah @TamannaInamdar #Samvat2082https://t.co/Jp4lUc2L8o

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Even 'panwaala' will come up with an #IPO tomorrow, boasting the paan will be made with AI: Vijay Kedia on 'pagalpan' in primary market.#NDTVProfitIgnite #Samvat2082 @VijayKedia1 @TamannaInamdar

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Watch LIVE: https://t.co/I0jGsGFarY pic.twitter.com/4Yi1eCEboO

NDTV Profit Ignite | Join this high‑energy session where market legend Vijay Kedia unpacks the rhythm, flow, and inner beat of India’s investing landscape.#NDTVProfitIgnite #Samvat2082 @VijayKedia1 @TamannaInamdarhttps://t.co/I0jGsGFIhw

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Rumit Dugar noted that modern day jewellery purchasing habits are seeing a steady shift from bigger pieces largely put away in lockers to pieces that can be worn everyday by customers.

"We are counting on Indian women and gold," says BlueStone's Rumit Dugar. @bluestone_com #NDTVProfitIgnite @Heeraal

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Watch LIVE: https://t.co/rwN2E3Dtc2 pic.twitter.com/nNMShEWKfD

India’s mutual fund industry is witnessing a landmark shift with goal-based SIPs on the rise and a growing base of 5.5 crore investors, yet industry leaders Nimesh Shah of ICICI Prudential AMC and Sundeep Sikka of Nippon Life India Asset Management note that some investors still chase returns.

Read the whole story here.

"What was the best decade to invest in India? Was it the Liberalisation decade? What is the decade after Modi became Prime Minister? Uniformly investors said that the best decade to invest in India is the next decade," Damani said.

Read the whole story here.

NDTV Profit Ignite | How will #GST 2.0 revitalise India’s consumption story?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Parle Products' Mayank Shah, Blue Star's Mohit Sud, BlueStone's Rumit Dugar in conversation with @Heeraal and @VikramOza@ParleFamily @mayank73 @BlueStarLtd @bluestone_com https://t.co/rwN2E3E11A

"It's not always about what the mutual fund industry needs, it's also about what the investor wants," says Nippon Life's Sundeep Sikka on SIFs.

Nimesh Shah said most of their investors have seen good returns from mutual fund investments, with large distributors primarily focusing on gold-based SIPs.

"Mutual fund industry is an infinite market, and the full credit goes to regulator," says ICICI Prudential AMC's Nimesh Shah.

NDTV Profit Insight | How are SIPs and mutual funds revolutionising wealth creation in India?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Industry stalwarts Nimesh Shah and @sundeepsikka in conversation with @alexandermats. #NDTVProfitInsight #Samvat2082https://t.co/c17QUJOUIT

India’s next multibagger companies will come from sectors that organise informal markets and take share from state-run enterprises, sees Manish Chokhani.

Read the whole story here.

Government-backed sectors that are set to see a massive infusion of capital and policy support in India will be rare earth minerals, shipbuilding and infrastructure, said Ramesh Damani.

Read the whole story here.

"I believe there's legs left in the PSU rally," said Damani. Chokhani added that he is also bullish on the financials space.

"Invest in a business where you think your money will double in three years," said Damani.

"Invest in a business where you think your money will double in 3 years": Ramesh Damani's mantra for young investors. #NDTVProfitIgnite #Samvat2082 @_nirajshah @tamannainamdar

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Watch LIVE: https://t.co/U9Ihil8viz pic.twitter.com/NBMobOzeor

Gold is a currency, and is not equivalent to a stock, said Chokhani at NDTV Profit IGNITE. The bigger central banks of the world are buying gold like there's no tomorrow, he added.

Read the whole story by clicking the link below.

The government positions India as a budding shipbuilding powerhouse, thanks to its extensive coastline and a younger workforce, said Ramesh Damani.

"If instead of being born in India, what if you just missed a little bit on the GPS, imagine where you would have been"

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Manish Chokhani shares his take on the 'Ovarian Lottery' and where Indians stand.#NDTVProfitIgnite @_nirajshah @chokhani_manish

Watch LIVE:… pic.twitter.com/MpLfequHMo

AI boom is hiding America's bad economics, says Ramesh Damani.

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Listen in. #NDTVProfitIgnite #Samvat2082 @_nirajshah @tamannainamdar

Watch LIVE: https://t.co/U9Ihil8viz pic.twitter.com/7DAgz23mEH

How should you prepare for the start of the new Samvat? Is it time for the Bulls to Roar?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Market experts Manish Chokhani and Ramesh Damani in conversation with @_nirajshah and @tamannainamdar.@chokhani_manish #NDTVProfitIgnite #Samvat2082https://t.co/U9Ihil9387

Dive deeper into the conversation on insurance and financial security in NDTV Profit IGNITE here.

Axis Max Life said discussions around insurance often miss a key point — its resilience. The company emphasised that insurance continues to be a push-based product, but as awareness grows and digital tools simplify access, the industry could see a shift from persuasion to proactive protection.

Roongta Securities highlighted that building an insurance portfolio is more complex than creating an investment portfolio, as it involves assessing multiple risks and family needs. They noted that a comprehensive protection plan for a family can be designed at around Rs 5,000–Rs 6,000 per month, urging people not to equate insurance benefits directly to the cost incurred.

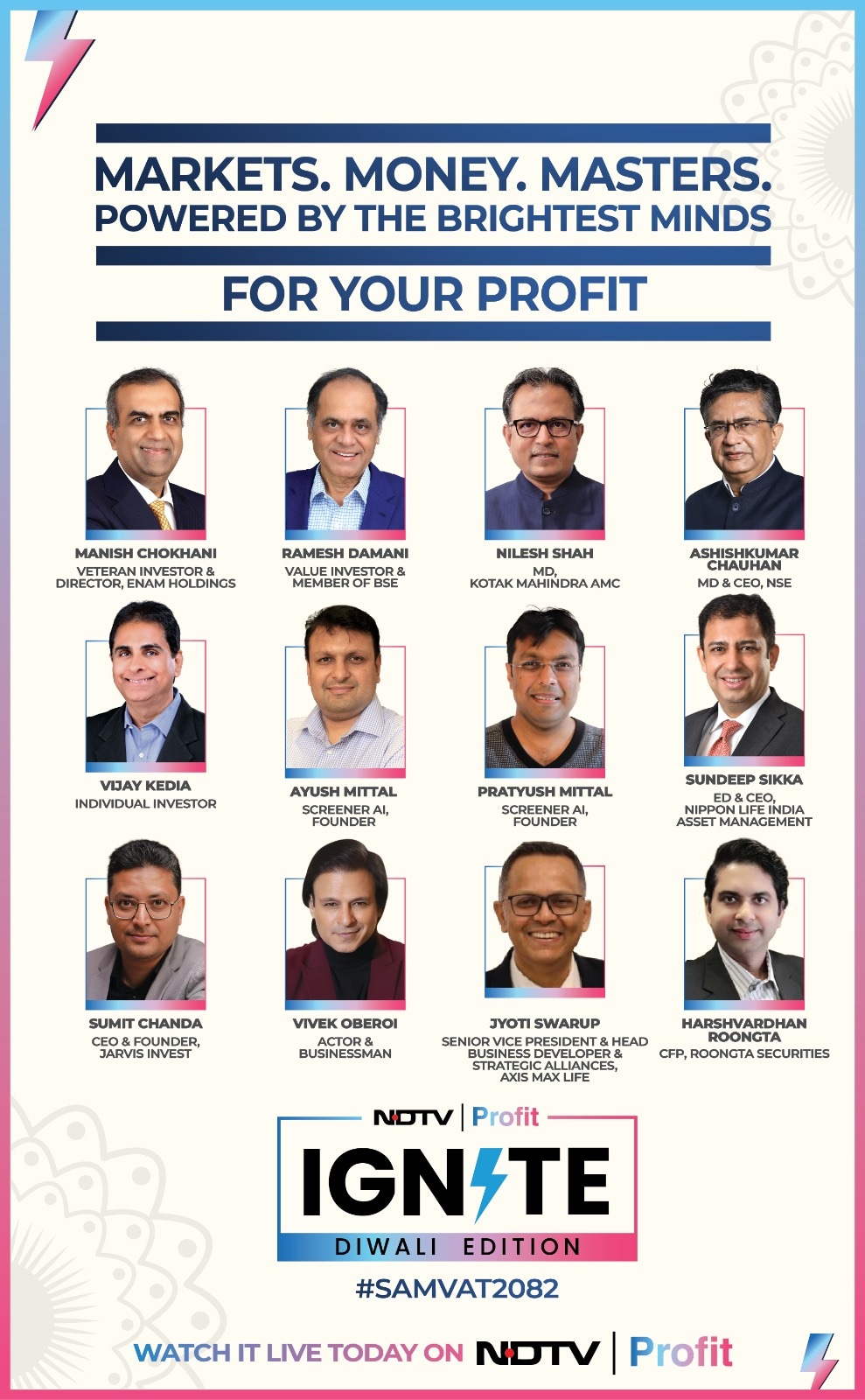

Take a look at all the experts taking part in NDTV Profit IGNITE Diwali edition today.

Take a look at all the experts taking part in NDTV Profit IGNITE Diwali edition today.

Every Indian Insured: Can We Achieve The Dream?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

At #NDTVProfitIgnite, we discuss success stories and practical strategies that bring insurance within reach for millions.@Harsh_Roongta @RoongtaGroup @AxisMaxLifeIns @VikramOzahttps://t.co/oPkqmrAl97

Jarvis Invest’s Sumit Chanda said media houses need to adopt AI faster than their audiences, as media plays a crucial role in bridging the gap between humans and artificial intelligence.

The founders of Screener AI said artificial intelligence should be used as a research tool in investing rather than for making direct stock picks. They added that it continually evaluates the latest AI models to enhance its capabilities and ensure more informed analysis.

How much does @JarvisInvest Founder Sumit Chanda trust the AI tools in which he has invested millions?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Listen in. @_nirajshah #NDTVProfitIgnite @JarvisInvest

Watch live: https://t.co/yYFrTZ0sUs pic.twitter.com/IaTwozq2Xo

Sumit Chanda of Jarvis Invest says relying on a single AI model can lead to replication of human patterns. Unlike traditional platforms, Jarvis Invest said it doesn't provide users with research but delivers the final investment outcome directly.

The founders of Screener AI said it has witnessed how information and data have evolved over time, adding that the vast amount of data available today highlighted the immense potential of artificial intelligence.

The company emphasised the importance of optimising data to deliver a seamless user experience.

Join the Mittal brothers of Screener AI & Sumit Chanda of Jarvis Invest as they unveil how AI is not just reshaping markets but reinventing the essence of smart trade. @_nirajshah #NDTVProfitIgnite @JarvisInvest @ayushmitt @faltoo @screener_in https://t.co/yYFrTZ0sUs

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

NSE CEO Chauhan recalls the days of Harshad Mehta reign over the stock markets, stating that he lost Rs 50,000 as compared to the Rs 3,000 his salary was when Mehta's scam got exposed. Read the whole story by clicking the link below.

NDTV Profit Ignite | Ringing in the new Samvat with NSE MD & CEO Ashishkumar Chauhan. @TamannaInamdar #NDTVProfitIgnite #Samvat2082 @NSEIndia @ashishchauhan https://t.co/QzmXfasFik

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

NSE MD & CEO Chauhan said the number of people trading in derivatives has declined following the new regulations, which the exchange had earlier warned could impact revenues. He cautioned investors, saying, "Don't enter the derivatives market if you don’t understand it."

"In a socialist country, stock markets are seen as a nuisance. Thankfully, they didn’t close the market down at independence," said NSE CEO Chauhan at the event.

Tune into the whole discussion:

NDTV Profit Ignite | Ringing in the new Samvat with NSE MD & CEO Ashishkumar Chauhan. @TamannaInamdar #NDTVProfitIgnite #Samvat2082 @NSEIndia @ashishchauhan https://t.co/QzmXfasFik

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

NDTV Profit's Managing Editor Tamanna Inamdar shares her idea. Take a look:

NDTV Profit Ignite | What does IGNITE mean for you? Setting something ablaze? Revving up your engines?

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Here's what it means for our Managing Editor @TamannaInamdar. Watch her keynote address at #NDTVProfitIgnite. #Samvat2082

Watch live: https://t.co/IQgGnFZXEm pic.twitter.com/eVjx0sLMTZ

The Diwali edition of NDTV Profit IGNITE has officially commenced. Watch here:

The CEO of the National Stock Exchange, Ashish Chauhan, marks his presence at the Conclave.

#NDTVProfitIgnite | @NSEIndia CEO @ashishchauhan has arrived.

— NDTV Profit (@NDTVProfitIndia) October 10, 2025

Stay tuned for more! pic.twitter.com/AjsVAtoS1B

The Diwali Edition of IGNITE is an aggregation of ideas and opportunity, a space where leaders can reflect, debate, and co-create the future of India's markets and economy. The conclave will begin shortly at 3 p.m.

Across fireside chats, panel discussions, and one-on-one conversations, the event will explore critical themes shaping India's financial and corporate future: the evolution of market strategies, the transformative role of AI in trading, retirement planning, wealth creation through SIPs, GST-driven consumption growth, and the interplay of money and the markets.

The IGNITE conclave will gather visionaries and pioneers who are redefining India's economic and corporate landscape, including Manish Chokhani, Veteran Investor & Director, Enam Holdings, Ramesh Damani, Value Investor & Member, BSE, Nilesh Shah, MD, Kotak Mahindra , Ashishkumar Chauhan, MD & CEO, NSE, Nimesh Shah, MD & CEO, ICICI Prudential AMC, Sundeep Sikka, ED & CEO, Nippon Life India Asset Management.

The event will also include, Vijay Kedia, Individual Investor, Vivek Oberoi, Actor & Businessman, Ayush Mittal, Screener AI, Founder, Pratyush Mittal, Screener AI, Founder, Sumit Chanda, CEO & Founder, Jarvis Invest, Jyoti Swarup, Senior Vice President & Head - Business Developer & Strategic Alliances, Axis Max Life, Yashovardhan Sinha, Chairman & Managing Director, Aditya Vision Ltd, Rumit Duggar, CFO Bluestone, and Mayank Shah, Vice President Parle Products Pvt Ltd

The Diwali Edition of IGNITE is an aggregation of ideas and opportunity, a space where leaders can reflect, debate, and co-create the future of India's markets and economy. By blending celebration with strategy, IGNITE will capture the essence of Diwali - a time to kindle possibilities, embrace knowledge, and step confidently into a year of growth, innovation, and prosperity.

NDTV Profit is all set to host a conclave themed NDTV Profit Ignite on Friday in Mumbai. The event, scheduled from 3 p.m. onwards at Mumbai's Sofitel , will focus on discussions around NDTV Profit IGNITE - Diwali Edition.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.