Zee Entertainment Enterprises Ltd.'s shares surged nearly 8% after shareholders decided to not re-appoint Punit Goenka as director of the company. The board also approved a Re 1 per equity share dividend for the financial year ending March 31, 2025, at the 42nd Annual General Meeting.

The board also approved a plan to pay out 25% of consolidated net profits as dividend to shareholders.

In the board meet Punit Goenka faced a setback as shareholders did not vote in favour of his reappointment as the company's director. This decision came just days after Goenka resigned from the position of managing director.

Goenka's bid for reappointment was narrowly rejected, with 50.45% of shareholders voting against the proposal. A significant portion of the opposition came from non-public institutions, with 88.4% voting against his reappointment. Despite the rejection of his reappointment as a director, Goenka will remain with the company as Chief Executive Officer, focusing entirely on his operational duties.

In an official statement, Zee Entertainment clarified that with Goenka's resignation from the position of managing director and his withdrawal of consent for reappointment, the proposal for his reappointment became “infructuous”. The company has indicated that Goenka will continue to oversee the company's day-to-day operations, but will no longer hold the director's position.

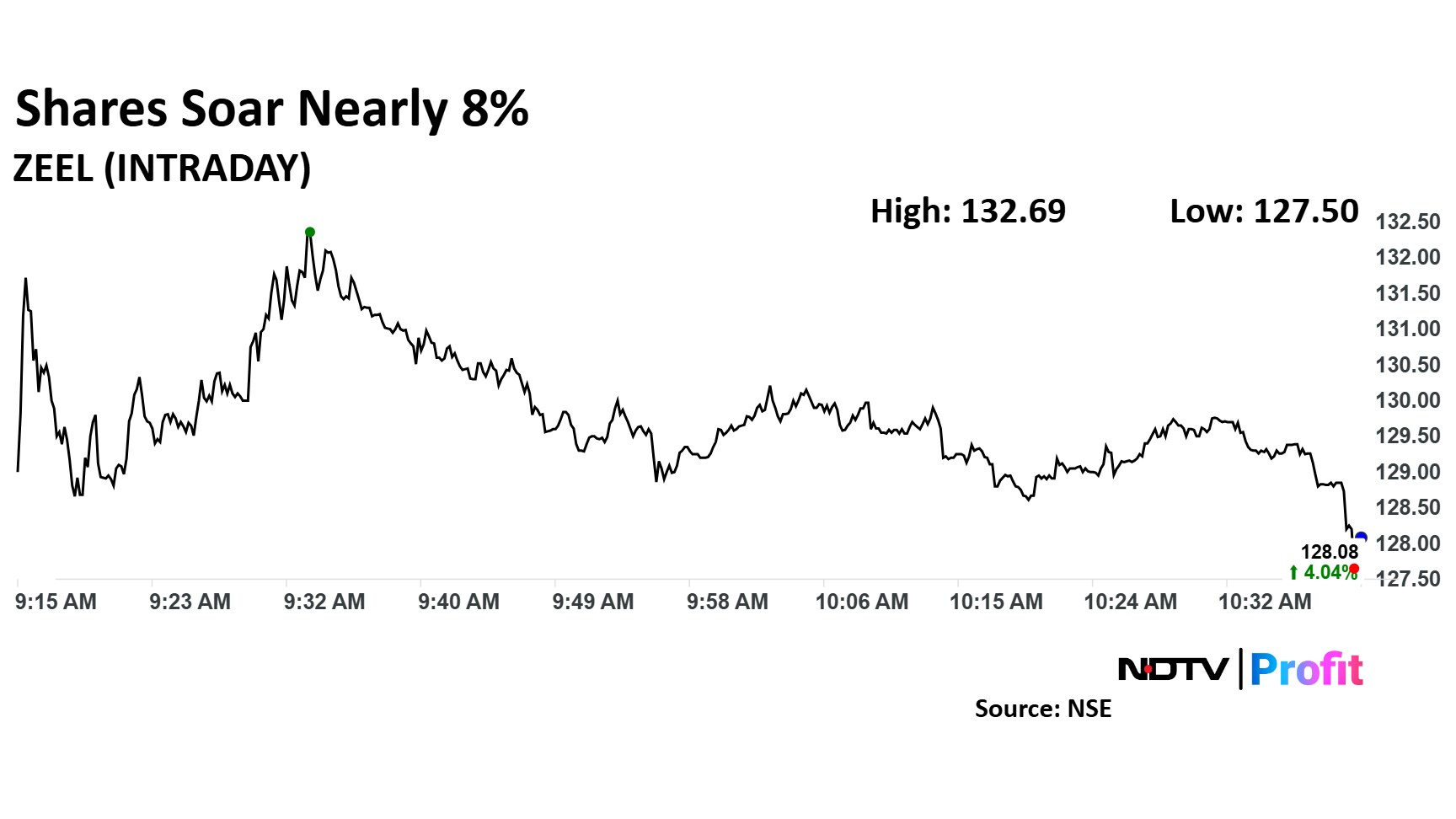

Zee Share Price

The scrip rose as much as 7.78% to Rs 132.69 apiece. It pared gains to trade 5.01% higher at Rs 129 apiece, as of 10:38 a.m. This compares to a 0.83% advance in the NSE Nifty 50.

It has fallen 48.23% in the last 12 months. Total traded volume so far in the day stood at 8.4 times its 30-day average. The relative strength index was at 60.

Out of 20 analysts tracking the company, nine maintain a 'buy' rating, four recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 25.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.