(Bloomberg) -- India's bond market will likely see an additional inflow of as much as $30 billion after the nation's inclusion in a major global index starts in June, according to Standard Chartered Plc.

“There will be a large chunk of investors who are new to India that will come in as the index weights start increasing from June,” said Parul Mittal Sinha, the bank's head of India financial markets, in an interview with Bloomberg TV Thursday. “We expect 25-30 billion dollars of additional inflows to come in and Indian markets are very excited for that.”

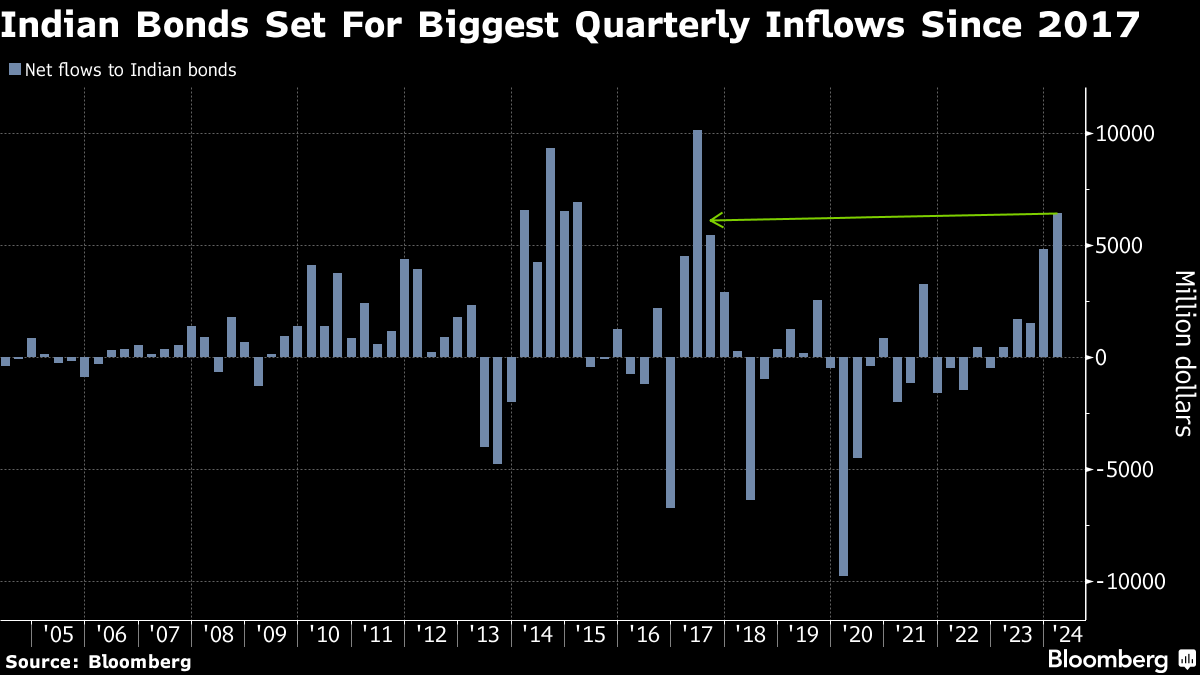

Global funds have already added about $10 billion into Indian bonds since JPMorgan Chase & Co.'s September announcement of the nation's inclusion in its closely followed emerging-market debt index. Sinha's comments also came as the country's sovereign notes staged a rally after the government unveiled a smaller-than-expected debt issuance plan for the first half of the fiscal year starting April.

Benchmark 10-year Indian bond yields have fallen 13 basis points to 7.04% so far this year.

Foreign investors are exploring multiple routes for investing in India, said Sinha, with about $4 billion also flowing into rupee-denominated but dollar-settled bonds issued by the sovereign, supranational and agency borrowers.

“We have seen interest in total return swaps, non-deliverable overnight indexed swaps, the derivative instruments giving clients access to India and currency forwards for hedging their exposure,” Sinha added.

Here are more of Sinha's views:

- Will look out for Reserve Bank of India's commentary on how liquidity evolves in next week's policy announcement. A change to a neutral stance would be a big market mover

- The rupee's decline last week shows RBI tolerance for a bit more currency volatility. We think this will continue, and will watch out for whether this tolerance is more for allowing rupee to weaken than appreciate

--With assistance from Paul Allen.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.