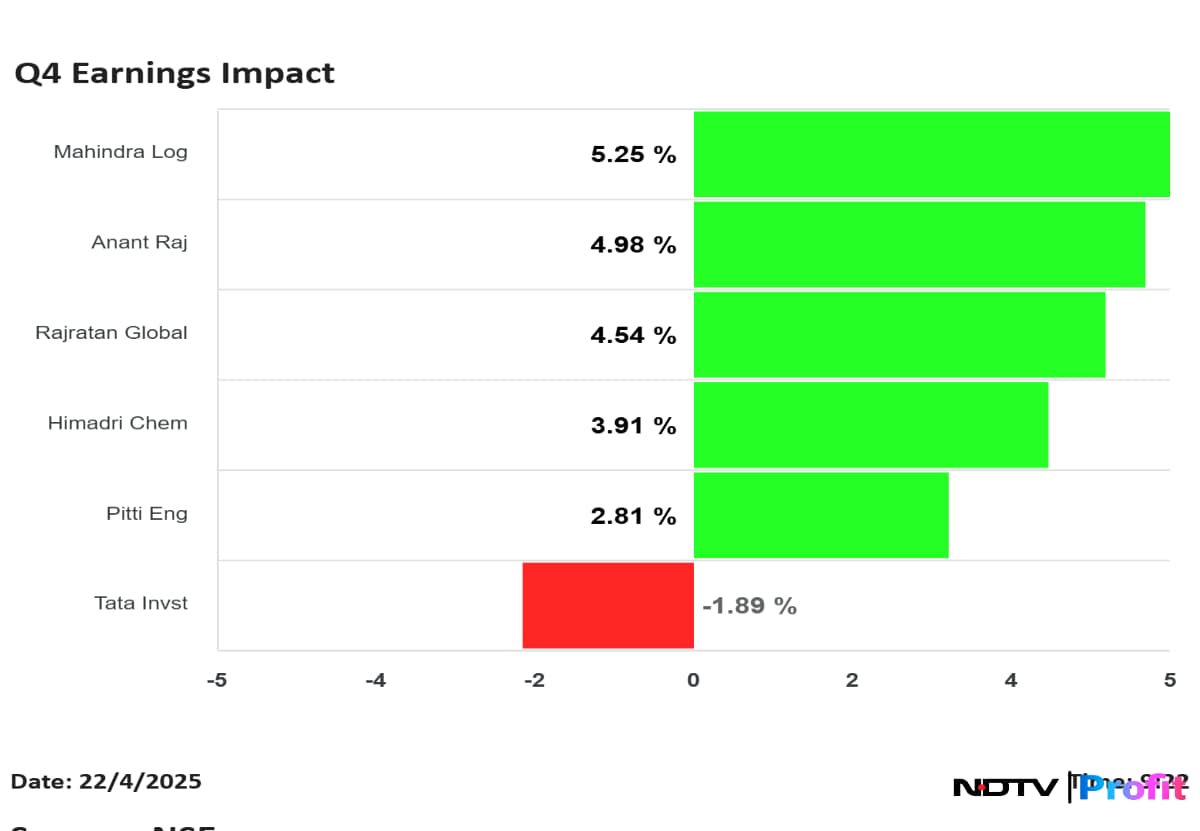

Shares of Mahindra Logistics Ltd., Pitti Engineering Ltd. and Tata Investment Corp. were in focus on Tuesday, after the companies announced their fourth quarter results.

Mahindra Logistics' shares rose the most, while Tata Investment Ltd. was the only one in red among the companies that announced their results for quarter ended March.

Mahindra Logistics Q4 FY25 (Consolidated, YoY)

Share price rose 6.83% to Rs 328.45.

Revenue up 8.2% at Rs 1,570 crore versus Rs 1,451 crore.

Ebitda up 37.3% at Rs 77.7 crore versus Rs 56.6 crore.

Margin at 5% versus 3.9%.

Net loss of Rs 6.7 crore versus loss of Rs 12.9 crore.

Revenue growth was driven by growth in 3PL contract logistics and Express.

The B2B express saw volume recovery in Q4, but cross-border continues to see volatility in pricing.

Appointed Hemant Sikka as MD and CEO.

Pitti Engineering Q4 FY25 (Consolidated, YoY)

Share price rose 5.16% to Rs 1,049.90.

Revenue up 39.6% at Rs 469 crore versus Rs 336 crore.

Ebitda up 54.2% at Rs 80 crore versus Rs 52 crore.

Margin at 17.1% versus 15.5%.

Net profit down 21.5% at Rs 36 crore versus Rs 46 crore.

Deferred tax credit of Rs 3.8 crore versus deferred tax charge of Rs 14.36 crore last year same quarter.

Current tax charge of Rs 9.85 crore versus current tax credit of Rs 6.62 crore last year in the same quarter.

The board approved dividend of Rs 1.5.

Tata Investment Q4 FY25 (Consolidated, YoY)

Share price fell 2.52% to Rs 6,239.50.

Net profit down 37.6% at Rs 37.7 crore versus Rs 60.5 crore.

Total income down 71% at Rs 16.6 crore versus Rs 57.5 crore.

Rajratan Global Q4 FY25 (Consolidated, YoY)

Share price rose 4.57% to Rs 340.

Revenue up 4.9% at Rs 251 crore versus Rs 240 crore.

Ebitda down 3.1% at Rs 33.3 crore versus Rs 34.4 crore.

Margin at 13.3% versus 14.4%.

Net profit down 24.9% at Rs 15.2 crore versus Rs 20.3 crore.

Himadri Speciality Q4 FY25 (Consolidated, YoY)

Share price up 5.18% to Rs 503.85.

Revenue down 3.6% at Rs 1,135 crore versus Rs 1,177 crore.

Ebitda up 30% at Rs 233 crore versus Rs 180 crore.

Margin at 20.6% versus 15.3%.

Net profit up 35% at Rs 156 crore versus Rs 115 crore.

Anant Raj Q4 FY25 (Consolidated, YoY)

Share price rose 6.36% to Rs 525.

Revenue up 22.2% at Rs 541 crore versus Rs 443 crore.

Ebitda up 36.4% at Rs 142 crore versus Rs 104 crore.

Margin at 26.3% versus 23.6%.

Net profit up 51.5% at Rs 119 core versus Rs 78 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.