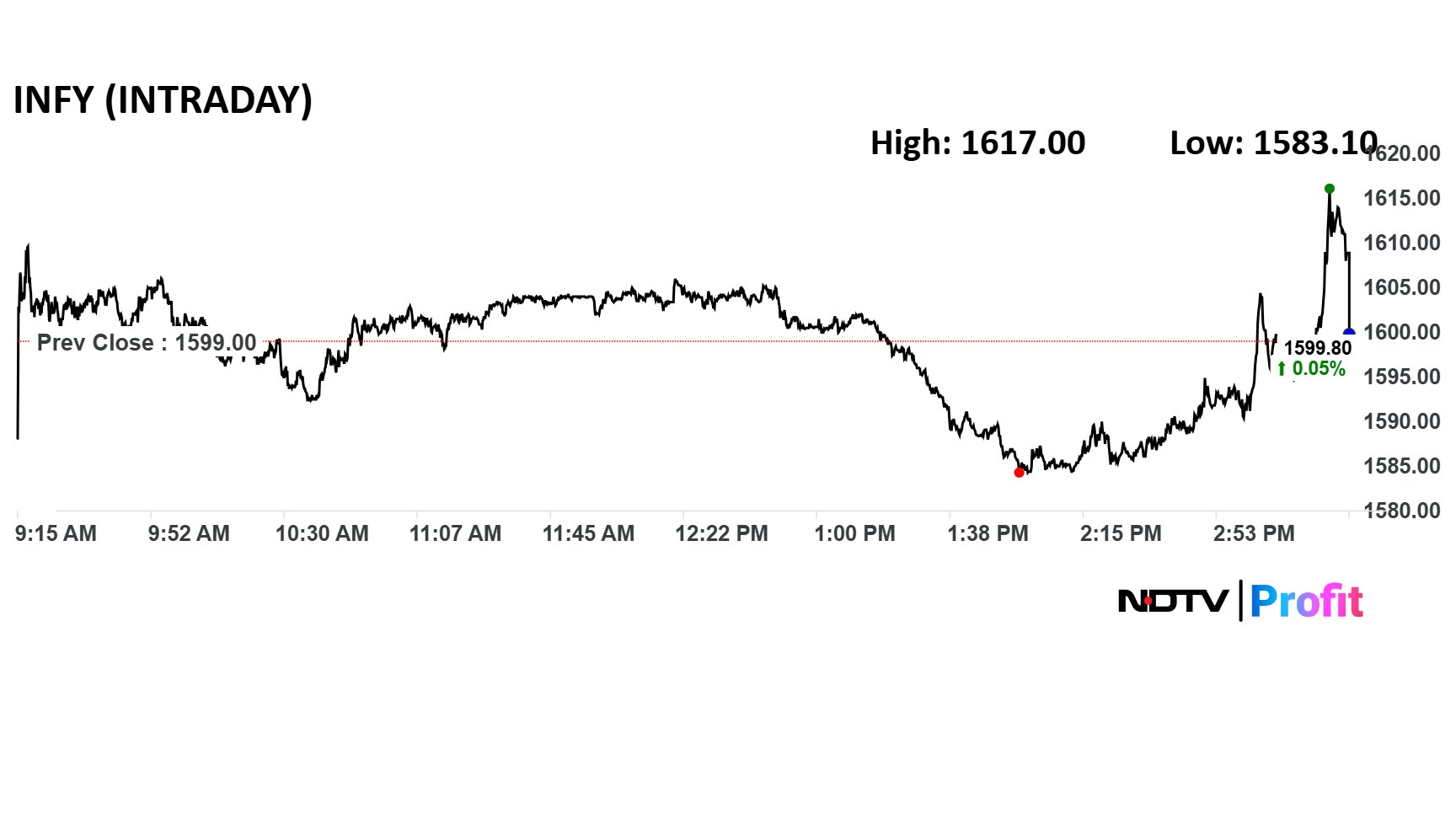

Infosys Ltd. has hired around 18,000 freshers so far in the current financial year and will meet its 20,000 target by March, Chief Financial Officer Jayesh Sanghrajka said on Wednesday.

The company had announced its goal to onboard 20,000 freshers back in April.

"We had said we will hire 20,000 freshers this year and we have onboarded 18,000 so far and on our way to finish our target. It reflects in our headcount also because many any of them are under training. Our utilisation, including training, has come down," Sanghrajka said. "It our investment in building future capacity," he added.

Infosys Took 18,000 Freshers So Far In FY26, CFO Says Amid Attrition DipNet Profit up 9.8% at Rs 917 crore versus Rs 835 crore

Total Income up 8.9% to Rs 1,624 crore versus Rs 1,491 crore

Profit up 36.3% at Rs 644 crore versus Rs 472 crore (YoY)

Calculated NII up 22% at Rs 2,285 crore versus Rs 1,872 crore (YoY)

"Infosys delivered a strong Q3 performance demonstrating how our differentiated value propositions in enterprise AI, through Infosys Topaz, are consistently driving higher market share," CEO Salil Parekh said.

Infosys' voluntary attrition rate fell to 12.3% from 14.3% in the previous quarter and 13.7% in the same period last year.

The total employee count rose by 5,043 sequentially to 3,37,034 in the December quarter.

Revenue from communications and manufacturing rose over 10% on a year-on-year basis. Financial services jumped nearly 5% and energy, utilities, resources and services by 1%.

Infosys onboarded 18,000 freshers so far in FY26.

In December 2025, the company had revised annual wages for freshers. Under this it hiked annual salaries for certain roles up to Rs 21 lakh per annum. The company's decision came amid efforts to expand its AI capabilities, attract young digital talent for specialised roles.

Infosys aims to hire 20,000 new recruits to push its AI-first strategy.

Check below for more details:

Infosys Revises Wages: Freshers Can Get Rs 21-Lakh Salary; Internet Gives 'Reality' CheckInfosys Ltd.'s headcount increased by 5,043 in the third quarter of FY26 on the back of demand.

The company had to provision Rs 1,289 crore as a one-time cost to comply with new labour codes notified by the government late last year.

Infosys joined other India IT companies to report a fall in net profit in the third quarter of the current financial year due to higher costs on labour.

Check more details below:

Infosys Q3 Results: Net Profit Hit With One-Time Higher Labour Cost, Guidance RevisedFY26 Revenue growth guidance revised to 3.0%-3.5% in constant currency from 2%–3%

Profit at Rs 6,654 crore versus estimate of Rs 7,377 crore

Revenue at Rs 45,479 crore versus estimate of Rs 45,098 crore

EBIT At Rs 9,479 crore versus estimate of Rs 9,538 crore

EBIT Margin At 20.8% Vs Estimate Of 21.2%

Infosys Q3 Highlights (Consolidated, QoQ)

Revenue up 2.2% to Rs 45,479 crore versus Rs 44,490 crore

Net Profit down 9.6% at Rs 6,654 crore versus Rs 7,364 crore

EBIT up 1.3% at Rs 9,479 crore versus Rs 9,353 crore

EBIT margin at 20.8% versus 21%

Infosys Ltd.'s net profit for the third quarter of FY26 stood at Rs 6,654 crore missing analysts' estimates of Rs 7,377 crore.

MRPL Q3 Highlights (Consolidated, QoQ)

Revenue up 9% at Rs 24,711 crore versus Rs 22,649 crore.

Ebitda up 87% at Rs 2,785 crore versus Rs 1,489 crore.

Ebitda margin at 11.3% versus 6.6%.

Net profit at Rs 1,445 crore versus Rs 639 crore.

The stockbroking firm announced a stake sale in Groww AMC, shedding a stake of around 4.99% for Rs 580 crore. Groww AMC is a wholly-owned non-material subsidiary of Billionbrains Garage Ventures.

State Street Global Advisors is set to acquire the selling stake in Groww AMC.

HDFC AMC Q3 Highlights (YoY)

Profit rises 7% to Rs 769 crore versus Rs 718 crore.

Total Income up 9.9% at Rs 1,234 crore versus Rs 1,124 crore.

Reliance Jio (Ex-Jio Platforms) Q2FY26 (QoQ)

Revenue seen up 2.7% to Rs 32733 crore vs Rs 31,857 crore.

Ebitda seen up 3.4% to Rs 17867 crore vs Rs 17,275 crore.

Ebitda Margin seen at 54.6% vs 54.2%.

Net profit seen up 1.8% to Rs 7095 crore versus Rs 6972 crore.

ARPU seen up 0.8% at Rs 213 vs Rs 211 – growth slowest in last six quarters.

Subscribers seen at 51.4 crore versus 50.64 crore.

HSBC Global Investment Research expects Larsen & Toubro Ltd. to post a decent third quarter performance, supported by a stronger order prospect pipeline and a robust order backlog, even as macro concerns weigh on capex outlooks domestically and internationally.

The brokerage retains a 'hold' rating but cuts the target price to Rs 3,900 from Rs 4,000, implying a 3% downside.

Revenue seen up 1% at Rs 257038 crore vs Rs 254623 crore.

Ebitda seen up 4.6% to Rs 47997 crore vs Rs 45885 crore.

Ebitda Margin seen at 18.7% vs 18%.

Net profit seen up 6% at Rs 19271 crore vs Rs 18165 crore.

The oil-to-telecom conglomerate's October-December quarter revenue is expected to rise 1% on a sequential basis. Ebitda is expected to increase 4.6% to Rs 47,997 crore compared with Rs 45,885 crore in the previous quarter, supported by better operating performance in key businesses. Operating margin is projected to improve to 18.7% from 18%. While net profit is projected to grow 6% sequentially to Rs 19,271 crore from Rs 18,165 crore.

HDB Financial Services reported a 1.6% YoY drop in profit after tax to Rs 581 crore in Q2FY26 from Rs 591 crore in Q2FY25. Net interest income grew 19.6% YoY to Rs 2,192 crore in Q2FY26 from Rs 1,833 crore in Q2FY25.

Shares of Groww have erased their day's losses to overperform the Nifty as of 1:10 p.m.

Indian Overseas Bank Q3 Highlights (YoY)

NII up 18% at Rs 3,299 crore versus Rs 2,789 crore

Net profit up 56% at Rs 1,365 crore versus Rs 874 crore

Gross NPA at 1.54% versus 1.83%

Net Gross NPA at 0.24% versus 0.28%

Union Bank of India Q3 Highlights (YoY)

NII up 1% at Rs 9,328 crore versus Rs 9,240 crore

Net profit up 9% at Rs 5,017 crore versus Rs 4,604 crore

Gross NPA at 3.06% versus 3.29%

Net Gross NPA at 0.51% versus 0.55%

Billionbrains Garage Ventures Q3 Highlights (Consolidated, YoY)

Profit down 28% at Rs 547 crore versus Rs 757 crore

Total income up 26% at Rs 1,252 crore versus Rs 996 crore

Billionbrains Garage Ventures Q3 Highlights (Consolidated, QoQ)

Revenue up 19.44% at Rs 1216 crore versus Rs 1018 crore.

Ebitda up 19.37% at Rs 720.8 crore versus Rs 603.8 crore.

Ebitda margin down 3 bps at 59.27% versus 59.31%.

Net profit up 16.13% at Rs 547 crore versus Rs 471 crore.

Source: Exchange Filing

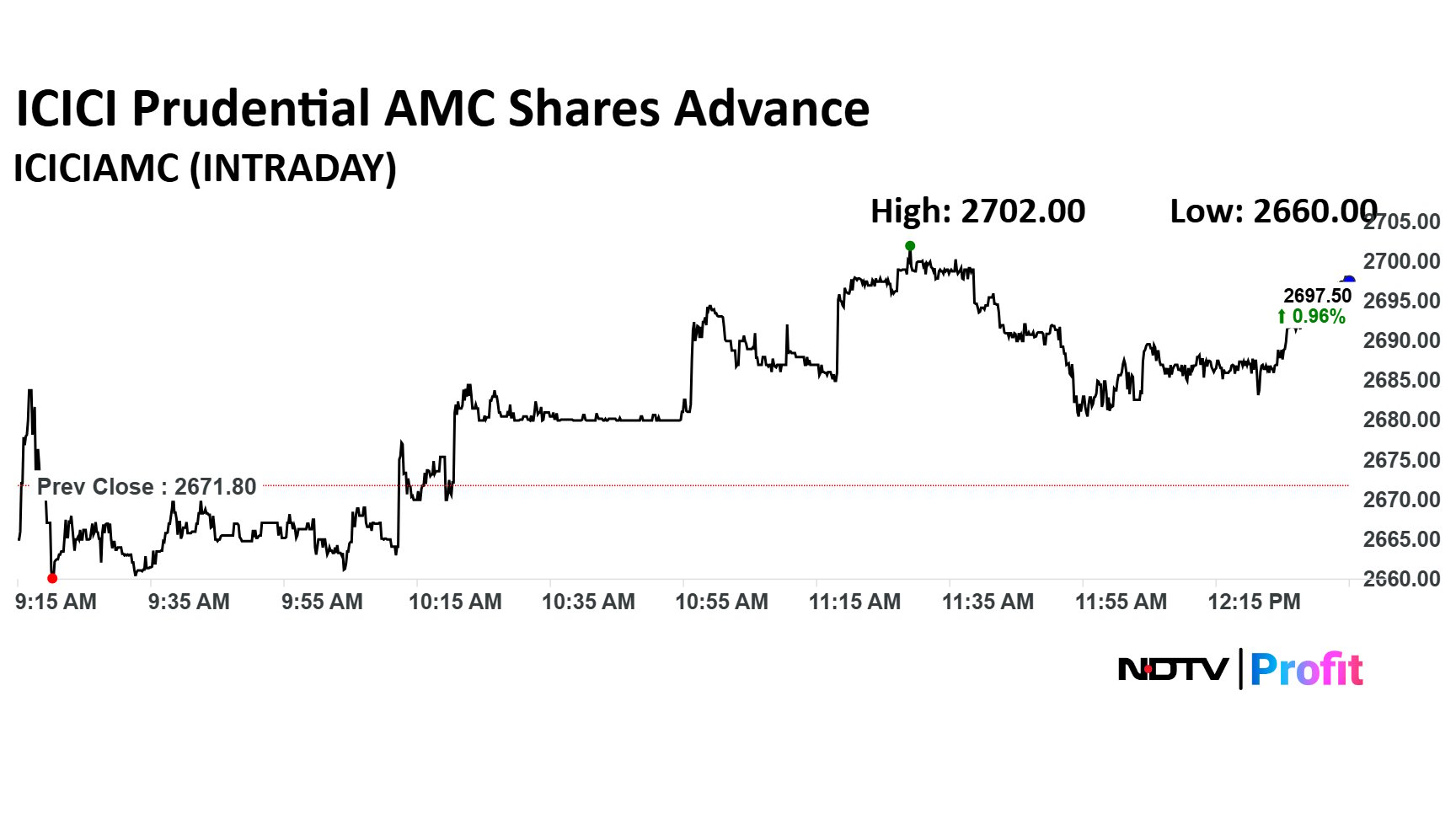

ICICI Prudential AMC's share price is up nearly 1% on Wednesday, ahead of its Q3 numbers.

Billionbrains Garage Ventures reported a 12.2% year-on-year (YoY) rise in consolidated net profit to Rs 471.34 crore in Q2FY26 from Rs 420.2 crore in Q2FY25. Total income declined 7.7% YoY to Rs 1,070.8 crore in Q2FY26 from Rs 1,160.05 crore in Q2FY25.

Revenue seen 2% higher at Rs 45,204 crore versus Rs 44,490 crore

EBIT seen 2% higher at Rs 9,558 crore versus Rs 9,353 crore

EBIT margin seen at 21.14% versus 21.02%

Profit seen little changed at Rs 7,397 crore versus 7,364 crore

Infosys is expected to report muted sequential growth in the December quarter, with margins seen holding firm even as seasonality and furloughs weigh on revenue momentum.

In Q2FY26, Infosys Ltd. revenue from operations rose 8.6% to Rs 44,490 crore compared with Rs 40,986 crore in the same period last year. Profit for the quarter increased to Rs 7,375 crore from Rs 6,516 crore a year earlier. Operating profit stood at Rs 9,353 crore, up from Rs 8,649 crore, marking an 8.1%. Operating margin came in at 21.0%, slightly lower than 21.1% in the year-ago quarter.

Hello, and welcome to NDTV Profit's coverage of the December quarterly reports released by India Inc.

Today, names like Infosys, Groww, HDB Financial Services and ICICI Prudential Asset Management are in focus as they share their financial performance for the quarter in question.

Stay tuned to NDTV Profit for all the live updates!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.