PCBL Ltd. share price fell 11% in early trade on Monday after its third quarter net profit declined 37% due to higher interest and depreciation expenses.

The company's consolidated December quarter revenue from operations increased 21.4% to Rs 2,010 crore compared to Rs 1,656 crore in the same period last year. Analysts' estimates compiled by Bloomberg projected Rs Rs 2,131.

Net profit fell 37% to Rs 93.1 crore, compared to Rs 148 crore in the year-ago period. The Bloomberg estimate was Rs 109 crore.

On the operating side, Ebitda saw a growth of 14.1%, amounting to Rs 317 crore, up from Rs 278 crore. However, margin contracted to 15.8% from 16.8% in the previous year.

Carbon black sales grew 2% year-on-year, driven by 5% volume growth, but offset by 3% drop in realisations due to weak crude prices.

Export volume growth slowed down due to excess inventory stocking in the third quarter. Domestic customers also deferred some purchases to the next quarter.

PCBL's long-term growth story backed by diversification of businesses holds merit, but elevated debt levels and a likely turnaround in Aquapharm are key monitorables, brokerage firm Nuvama said in a note. Aquapharm business came under pressure owing to competition from China and tepid demand in the US.

The brokerage revised its rating on PCBL stock to 'hold' from 'buy' and target price to Rs 397.

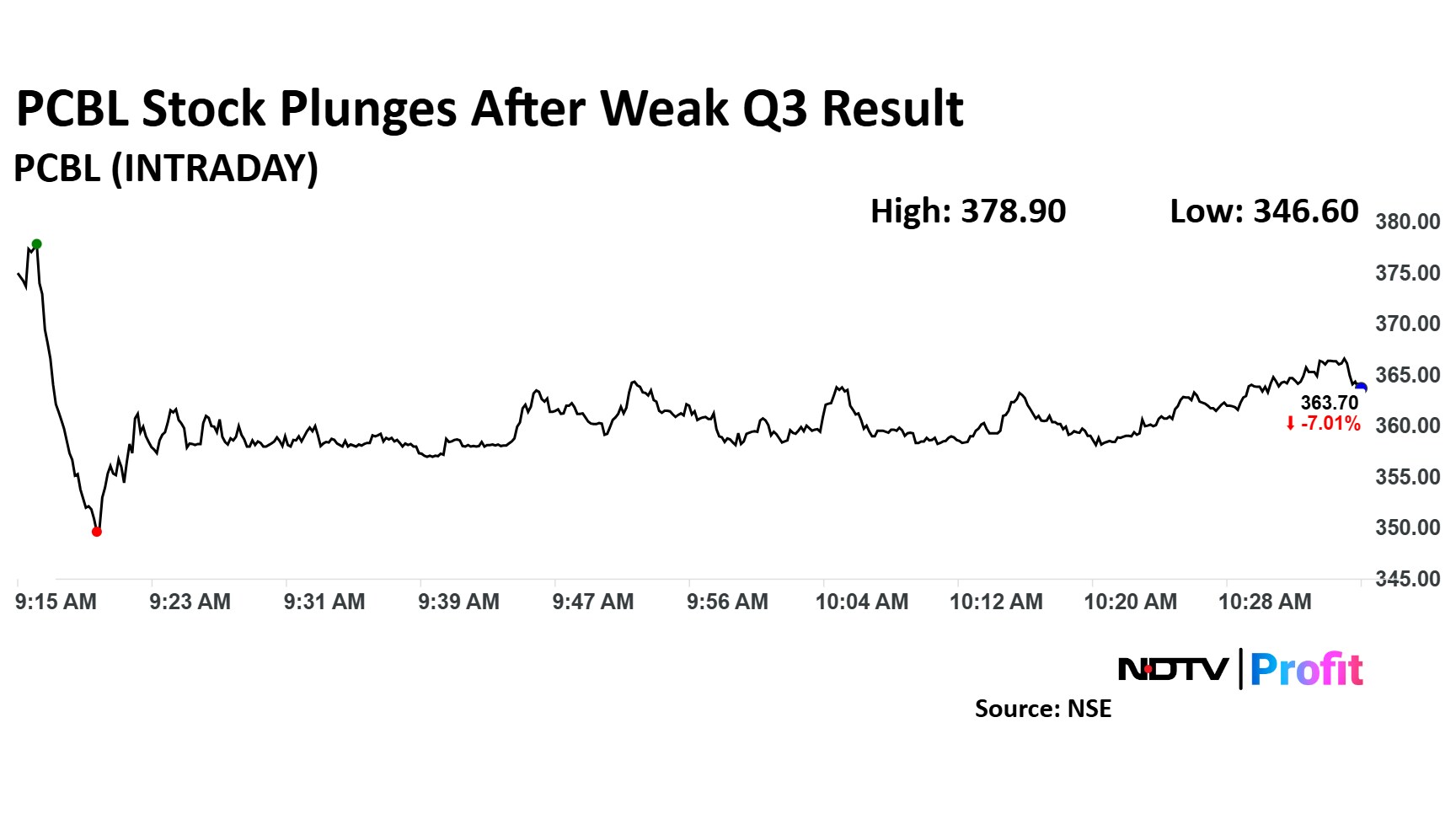

PCBL Share Price Movement

PCBL share price fell as much as 11.4% intraday to Rs 346 apiece. The scrip was trading 7% lower by 10:35 a.m. The benchmark NSE Nifty 50 was up 0.4%.

The stock has risen 30% in the last 12 months. The total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 41.86.

Seven out of the 10 analysts tracking PCBL have a 'buy' rating on the stock, and three recommend a 'hold', according to Bloomberg data. The average 12-month analyst price target of Rs 471 implies a potential upside of 31%.

The company is part of RP‑Sanjiv Goenka Group and produces carbon black and specialty chemicals.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.