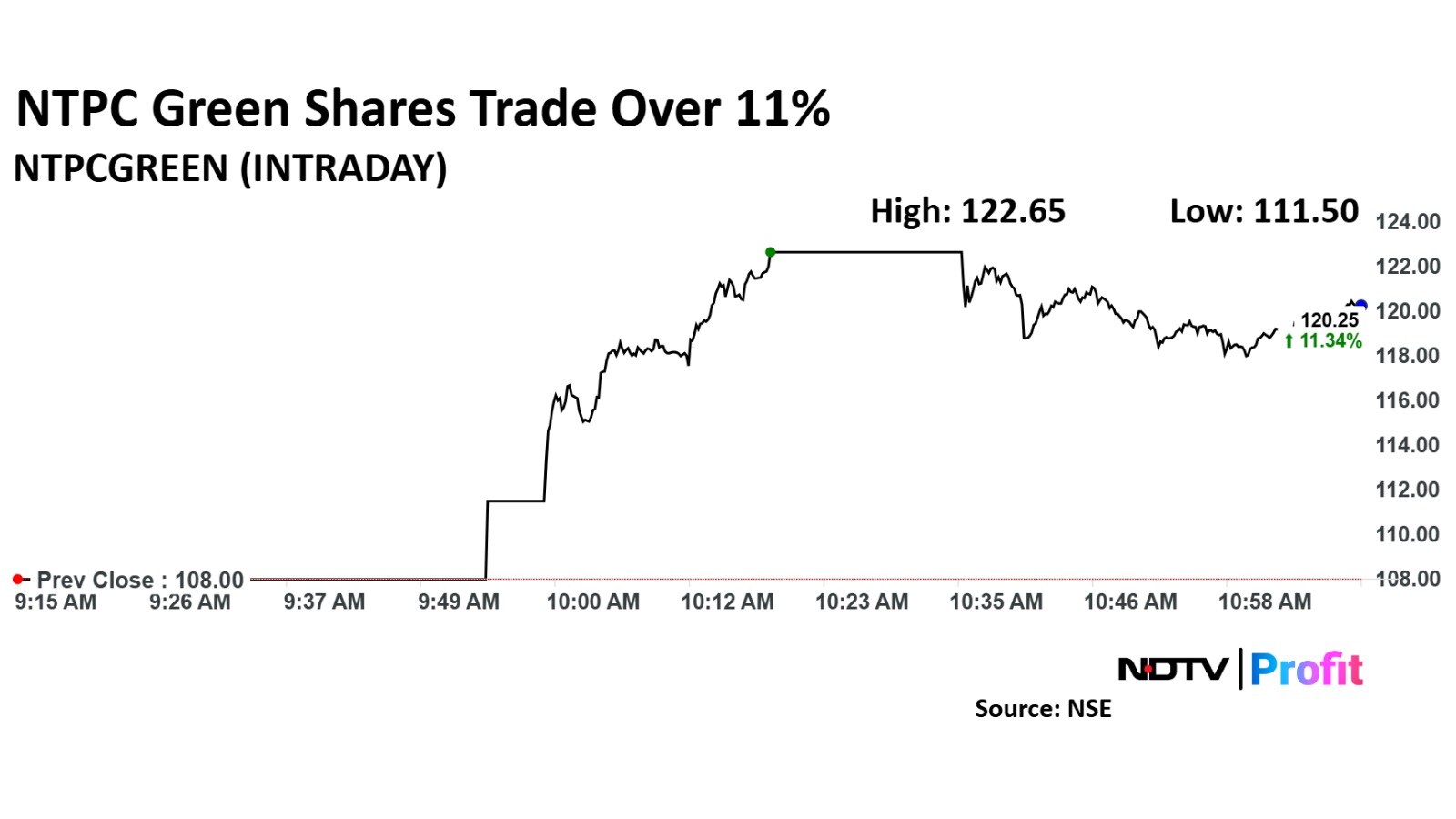

Shares of NTPC Green Energy Ltd., the renewable energy arm of NTPC Ltd., closed at Rs 121.3 apiece on the BSE, marking a premium of 12.31% over the issue price. On the National Stock Exchange, the scrip closed at a premium of 11.94% at Rs 121.25.

The state-run entity's stock debuted on the BSE at Rs 111.6 apiece, at a premium of 3.33% over the upper end of the initial public offering price of Rs 108. The stock listed on the NSE at Rs 111.5 per share, marking a premium of 3.24%.

As trading progressed, NTPC Green drew investors' interest, as the stock subsequently hit a 10% upper-circuit on both the bourses.

The company's listing came in the backdrop of a Rs 10,000-crore IPO, which was India's third largest this year after the issues launched by Hyundai Motor India Ltd. and Swiggy Ltd.

NTPC Green's IPO, which closed on Nov. 22, was subscribed 2.42 times, with the demand led by retail investors. The IPO comprises only a fresh issuance of shares, with no offer-for-sale component.

The company also raised Rs 3,960 crore from anchor investors a day before its IPO opened for bidding.

NTPC Green plans to utilise 75% or Rs 7,500 crore of the IPO proceeds towards debt repayment. The company plans to repay debt worth Rs 4,000 crore in the current fiscal and Rs 3,500 crore in the next fiscal.

The proceeds will also be used for capital expenditure, "as we have a huge capacity addition lined up", said Jaikumar Srinivasan, director of finance at NTPC Green Energy Ltd. "On a more immediate basis, we'll be retiring debts on the balance sheet."

IDBI Capital Market Services Ltd., HDFC Bank Ltd., IIFL Securities Ltd. and Nuvama Wealth Management Ltd. are the book running lead managers of the NTPC Green Energy IPO, while Kfin Technologies Ltd. is the registrar for the issue.

NTPC Green Share Price Hits Upper Circuit

NTPC Green Business

Incorporated in April 2022, NTPC Green's total portfolio stands at 25.67 gigawatts, with an operational portfolio of 2.93 GW. Its contracted and awarded capacity stands at 14.7 GW and projects under pipeline stand at 10.98 GW. Its total portfolio consists of 20.32 GW of solar capacity and 5.35 GW of wind capacity.

As of fiscal 2024, NTPC Green's market share, depending on how many bids it won, stood at 7%. This has declined from 18% in fiscal 2022, according to Morgan Stanley.

The company also plans to expand its portfolio and intends to install battery energy storage systems and hybrid contracts. It is also developing a green hydrogen hub in Andhra Pradesh.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.