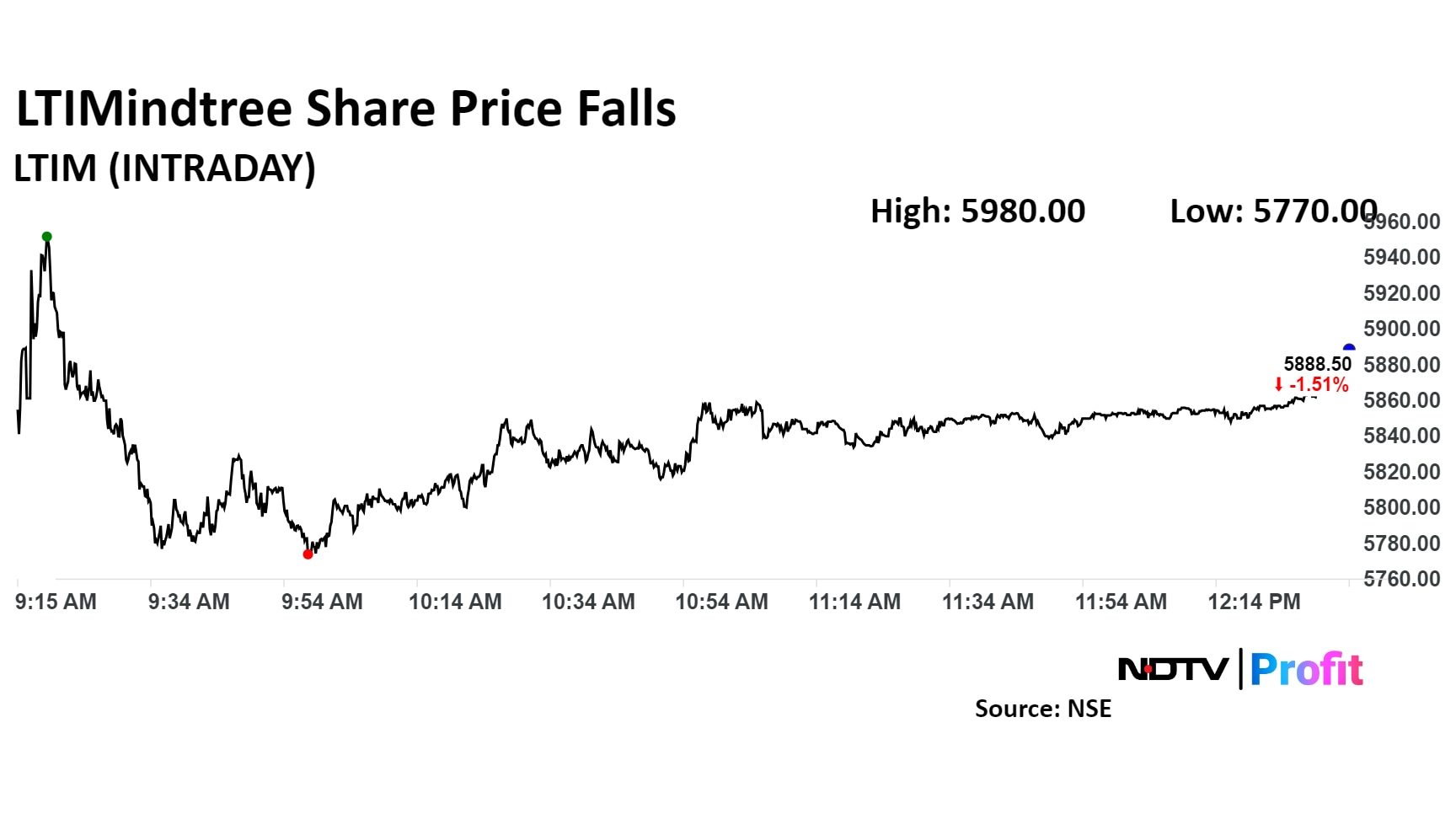

LTIMindtree share price snapped its two-day rise and fell on Friday as brokerages were concerned about the company's margins after it detailed its December-quarter results.

The information technology major posted a bottomline of Rs 1,086.7 crore, according to an exchange filing on Thursday. This was lower than the estimate of Rs 1,144 crore.

Motilal Oswal's report said the company's margins remain a concern and the biggest risk to brokerage's thesis of the company outperforming its large-cap peers. However, it has reiterated its 'buy' rating due to superior offerings in data engineering and ERP modernisation, positioning it well to capture pre-GenAI expenditures.

The brokerage has a target price of Rs 7,700 for the stock, implying a 29% upside.

IDBI Capital's report said LTIM has multiple headwinds in margins like calibration of utilisation, re-investment in business and increasing depreciation on account of building office spaces & capabilities around AI/Gen AI. "Management stated that it would take couple of quarters to maintain the normal level of margins of 15-16%," it said. "Hence, we expect the aspirational range of 17-18% to get deferred."

The brokerage has a target price of Rs 6,100, implying an upside of 2%.

Nomura has lowered its estimates for FY25-27 EPS by less than 1%. "Our FY25-27F EPS are lower than consensus by 6-12% mainly on account of lower margin expectations," it said as it lowers its target Rs 5,070 from Rs 5,090.

Upside risks to the brokerage's call is strong large-size deal wins and higher-than-expected margin expansion. "We prefer Infosys and Wipro in the large-cap India IT services space," it said.

The scrip fell as much as 3.5% to Rs 5,770 apiece, the lowest level since Jan 15. It pared losses to trade 1.8% lower at Rs 5,875.70 apiece, as of 12:36 p.m. This compares to a 0.4% decline in the NSE Nifty 50 Index.

It has risen 7.9% in the last 12 months. Total traded volume so far in the day stood at 1.24 times its 30-day average. The relative strength index was at 47.8.

Out of 42 analysts tracking the company, 23 maintain a 'buy' rating, six recommend a 'hold,' and 13 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8%.

Watch LIVE TV, Get Stock Market Updates, Top Business, IPO and Latest News on NDTV Profit.