L&T Technology's share price logged its biggest jump since Oct. 19, 2021 on Thursday, as investors assessed commentary from various brokerages a day after it released its third quarter results.

The stock rose even as the company recorded no growth in profit of Rs 319.5 crore sequentially in the quarter ended Dec. 31, 2024. This missed the consensus estimate of Rs 373 crore, shared by analysts tracked by Bloomberg.

Its revenue grew by 3.1% to Rs 2,653 crore for the October-December quarter of fiscal 2025, compared with the Rs 2,663-crore consensus estimate of analysts tracked by Bloomberg.

While brokerages are concerned about its margins, given Intelliswift acquisition, they like the valuation. HSBC's note said third quarter was decent, with marginal downward revision in FY25 guidance, which remains quite a challenging target. "We note margins could be down by 100-150 bps and the company could take the next couple of years to build back margins to 16%," it said.

"We believe that in a normalised growth environment, LTTS offers the best visibility on growth, backed by a well-diversified revenue profile and top-class investments in capabilities," HSBC said. Compared with peers, such as Persistent Systems Ltd. or even pure-play IT services companies such as Coforge Ltd., LTTS has better operating margin profile and management is confident of moving it up to 16%. For Persistent it is down to 12-13% and is likely to move up to 15%.

LTTS is gaining market share as well, the brokerage noted. Following a sharp drop in first quarter, second quarter was good and the company continues to guide for a strong second half. "Even if it misses the 8% FY25 revenue growth guidance, we believe the company is well positioned to grow by double digits in FY26," it said.

HSBC has a 'buy' on the stock, with a target of Rs 6,000 per share, implying 27.5% upside.

Nomura retained its 'neutral' rating with unchanged target of Rs 4,900. Stronger-than-expected revenue growth on the back of strong deal wins is a key upside risk, according to the brokerage. Key downside risk is weaker-than-expected margin improvement over FY25-27.

Nuvama has retained 'hold' as its sceptical about the near-term growth prospects for the ERD industry as a whole, but it likes the fundamentals. Its target price has been raised to Rs 5,150 from Rs 5,050 earlier.

The stock has significantly underperformed peers in the last 12 months trading 12% lower, as it struggled with either growth or margins (sometimes both), the brokerage said. "Deal wins this quarter bring in some positivity, but the margins profile continues to deteriorate due to takeovers (first SWC, now Intelliswift)," it said.

Citi Research's note said organic revenue guidance was revised down. The stock was down 10% in last one month likely factoring in the guidance risk.

Meanwhile, organic ask rate of 7% QoQ in fourth quarter will likely be aided by SWC seasonality (India led) and some of the large deals won in third quarter getting ramped up in fourth quarter. Softness in auto vertical was indicated by peers as well, given North America and Europe is weak and margin trajectory is to be monitored, Citi said.

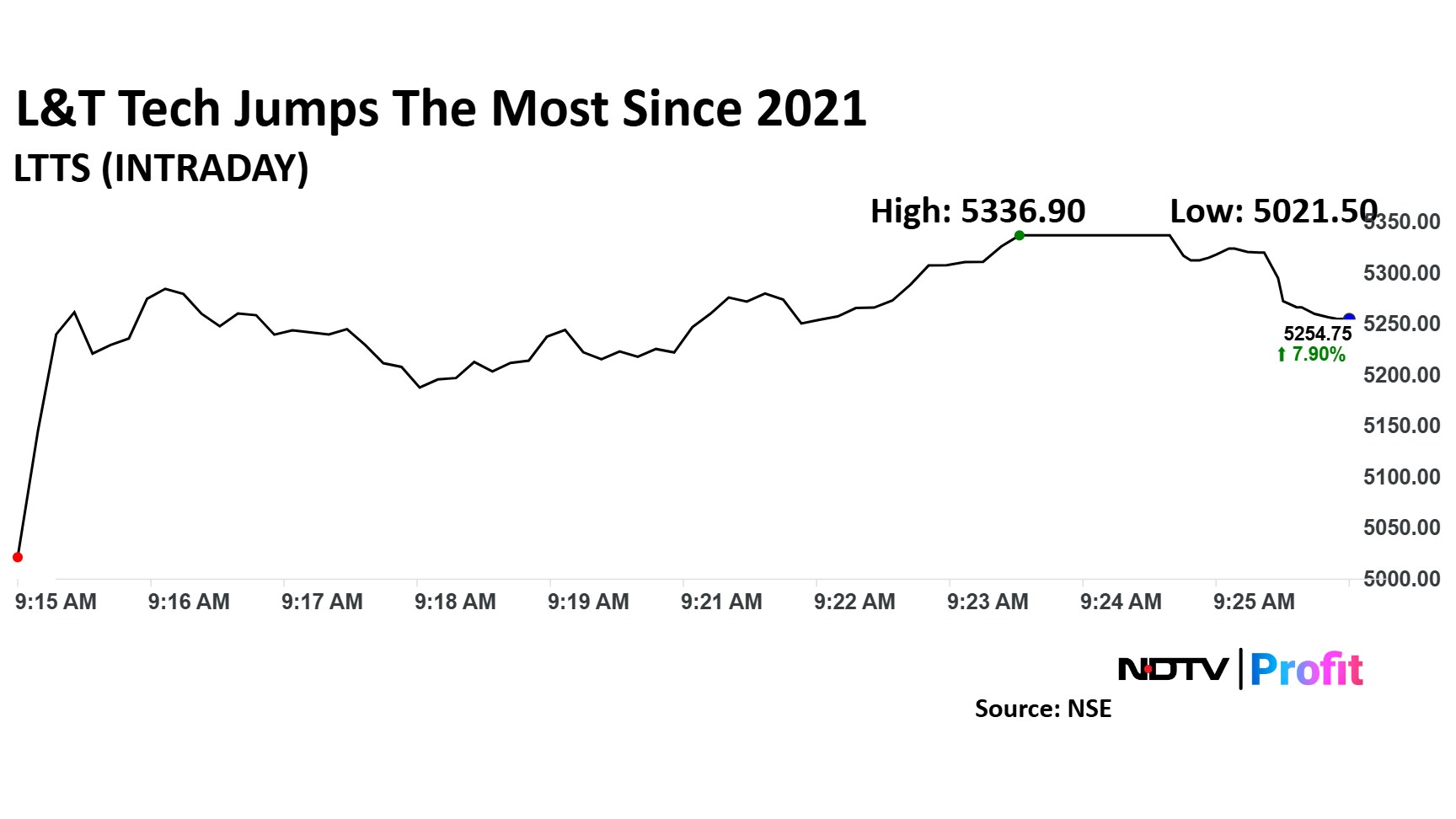

L&T Tech Share Price Today

Shares of L&T Tech rose as much as 10% to hit the upper circuit limit at Rs 5,336.90 apiece, the highest level since Dec. 16. They pared gains to trade 8.2% higher at Rs 5,246.05 apiece, as of 9:57 a.m. This compares to a 0.4% advance in the NSE Nifty 50.

The stock has fallen 6% in the last 12 months. Total traded volume so far in the day stood at 6.12 times its 30-day average. The relative strength index was at 62.11.

Out of 30 analysts tracking the company, nine maintain a 'buy' rating, eight recommend a 'hold' and 13 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 3.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.