Shares of JBM Auto Ltd. surged more than 8% on Thursday after the government unveiled a new EV subsidy scheme.

The government has approved for two years a new Rs 10,900 crore EV subsidy scheme, in yet another attempt to step up adoption of electric mobility in the world's third largest automotive industry.

This would benefit the company from the second half of the next financial year, Nishant Arya, the managing director of JBM Auto, told NDTV Profit. "For any such project, it takes a period of 9 to 12 months for new buses to hit the road," he said.

The scheme, with a total outlay of Rs 10,900 crore, will support 14,028 electric buses, along with 24.79 lakh electric two-wheelers and 3.16 lakh electric three-wheelers. However, it excludes electric cars and hybrid vehicles.

In fiscal year 2024, around 35% of the company's topline came from the e-buses segment, Arya said. The company's market share stands at 35-40%, he added.

"We expect 40-50% topline CAGR growth over the next five years," he said. The company is guiding for a revenue of Rs 6,500 crore in fiscal year 2025, which is higher than the revenue of Rs 5,009 crore reported in fiscal 2024, added Arya.

Nearly 40% of the EV subsidy scheme's outlay, or Rs 4,391 crore, has been marked for the procurement of 14,028 electric buses by public transport agencies, according to him.

A key highlight of the scheme is the emphasis on charging infrastructure—a major bottleneck in large-scale adoption of electric vehicles in India. Around 72,000 charges would be set up, including 1,800 for e-buses, under the scheme. This will "reduce the range anxiety" of end customers, and play a critical role in evolving the market, Arya said.

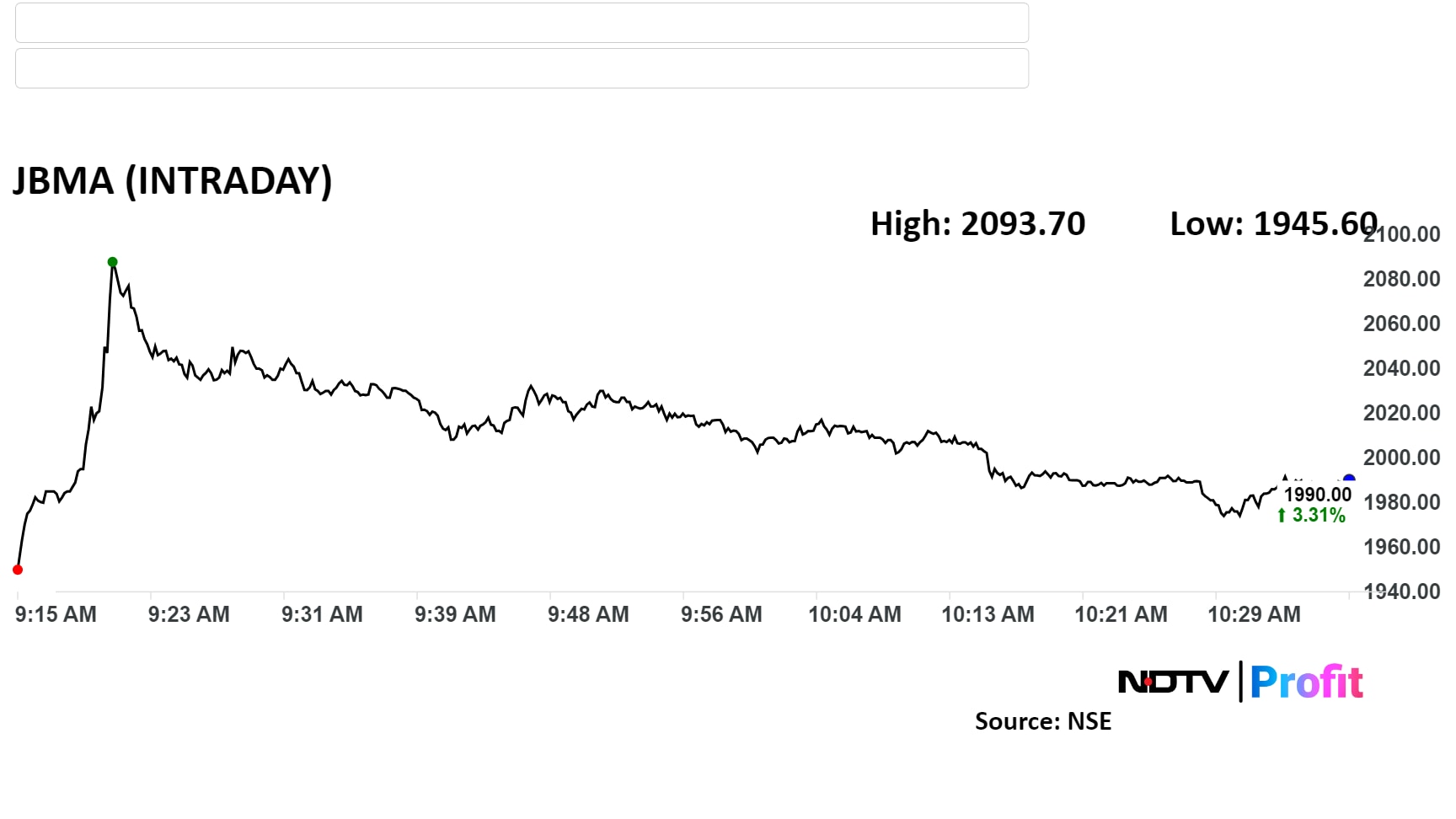

Shares of JBM Auto climbed as much as 8.6% to Rs 2,093.7 apiece on the NSE. At 10:41 a.m., the stock was trading 3.7% higher at Rs 1,997.7 per share, compared to a 0.41% rise in the benchmark Nifty 50.

The company's stock has risen by 36.8% during the last 12 months and has advanced by 35.6% year-to-date. The total traded volume so far in the day stood at 5.6 times its 30-day average. The relative strength index was at 56.87.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.