Emerging market stocks rose to recoup their losses for the year, as investors expect the assets class to benefit from eroding confidence in US equities.

The MSCI Emerging Markets Index gained as much as 1.7% on Wednesday, with South Korea's Kospi gauge recovering its drop seen in the wake of US reciprocal tariffs. India was the first major market to wipe out such tariff-induced declines last week.

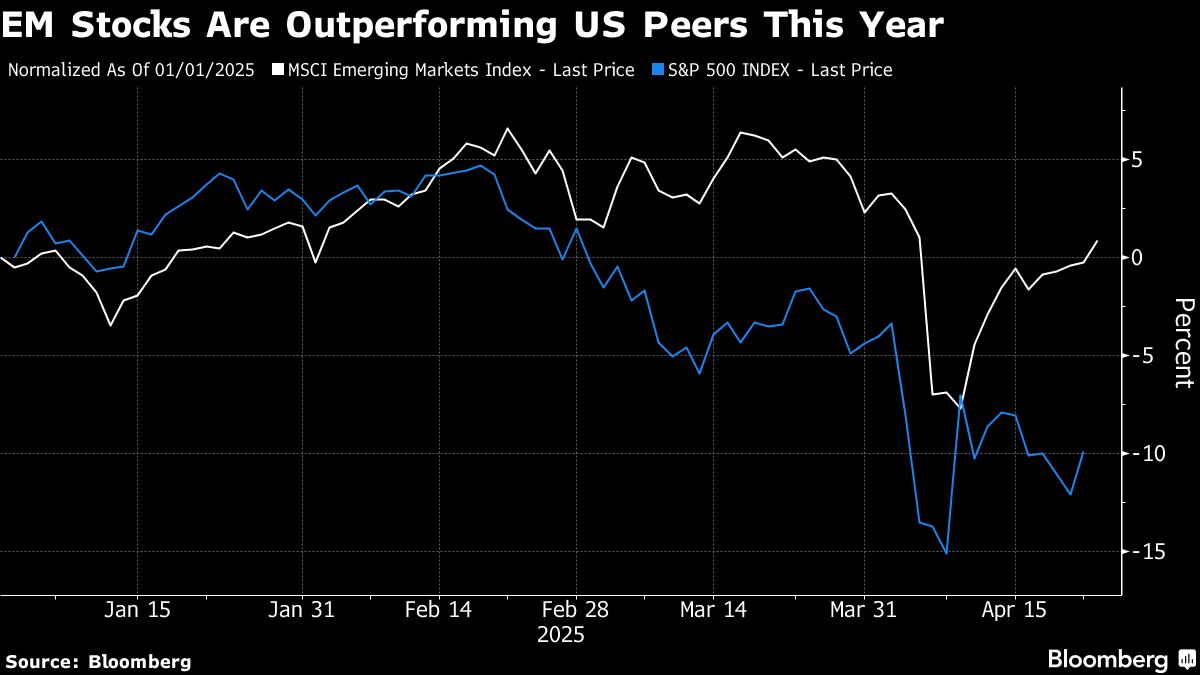

The resilience stands out as US stocks remain 10% down for the year. The divergence reflects a so-called “sell America” trade, which has gained traction after the Trump administration's flip-flops on tariffs and other policies undermined the outlook for the US economy. Money managers are adjusting to new market norms after years of bullish bets on American stocks.

EM currencies have also been rallying over the past week, aided by a weaker dollar. The region's local-currency bonds have seen the best start of the year since 2022 against their dollar-denominated peers, amid expectations of interest-rate cuts and lower inflation.

“Everything that's happening in the political landscape in the US has prompted investors, particularly foreign investors, to reassess what should be the risk premium of US assets,” Jenny Zeng, deputy head of fixed income at Allianz Global Investors, said in a Bloomberg TV interview. “People are voting by feet saying, okay, now let's reassess the status of the US and let's diversify first.”

In a growing sign that global investors are looking to shift away from the US, Janus Henderson Investors said it sees a potential 10% reduction in clients' exposure to the market. Amundi SA says it's seeing a major reallocation as clients pull away from the US and pile into European funds

EM markets also got a boost on Wednesday following softer US rhetoric on China and the Federal Reserve. Trump said he had no intention of firing Fed Chair Jerome Powell. On China, the US president said he plans to be “very nice” in any trade talks and that US tariffs will come down “substantially” from their current level of 145%.

While the backtracking is soothing market jitters, it's also another piece of evidence of how US policy can shift on Trump's whims.

MSCI Inc.'s broadest gauge for EM stocks is set for its fifth day of gain, widening its year-to-date outperformance over the S&P 500 Index to more than 10 percentage points.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.