Shares of Central Depository Services (India) Ltd. closed over 10% higher on Monday. Rising about 11% during the day, the stock's sharp rise may not be based on fourth quarter results as the company's net profit dipped 22% and stood at Rs 100 crore.

Shining the light onto a larger industry trend, this expert brings to perspective a few other key market developments that explain the sudden buying interest for the stock.

Why Is CDSL Stock Soaring?

Weighing in on the sudden jump, Kranthi Bathini, director of equity strategy at WealthMills Securities, said the movement is due to a couple of factors in the industry.

"One thing is, the market is trying to price in the NSDL listing, which is round the corner," Bathini said. "The buying interest is building around MIAs or market infrastructure institutions, this is the reason why we are seeing a buying interest around CDSL."

CDSL: Buy, Sell Or Hold

Zooming out on these developments, Bathini also concludes that the valuation on the stock may be a slightly stretched as well.

"With respect to valuations, the stock valuations look stretched to me. With the kind of rally we have witnessed, there is nothing wrong in taking some profit from the table at this point of time. One can take some profit from the table and stay invested for the remaining," said Bathini.

In the medium to short term, there is nothing wrong in booking some profit, he emphasised. The revenue of CDSL dipped by 4.3% to Rs 256 crore on a year-on-year basis in the fourth quarter. On an operational basis, the Ebitda declined 27% to Rs 107.35 crore, while the margin fell to 47.8% from 61.4% earlier.

CDSL Share Price

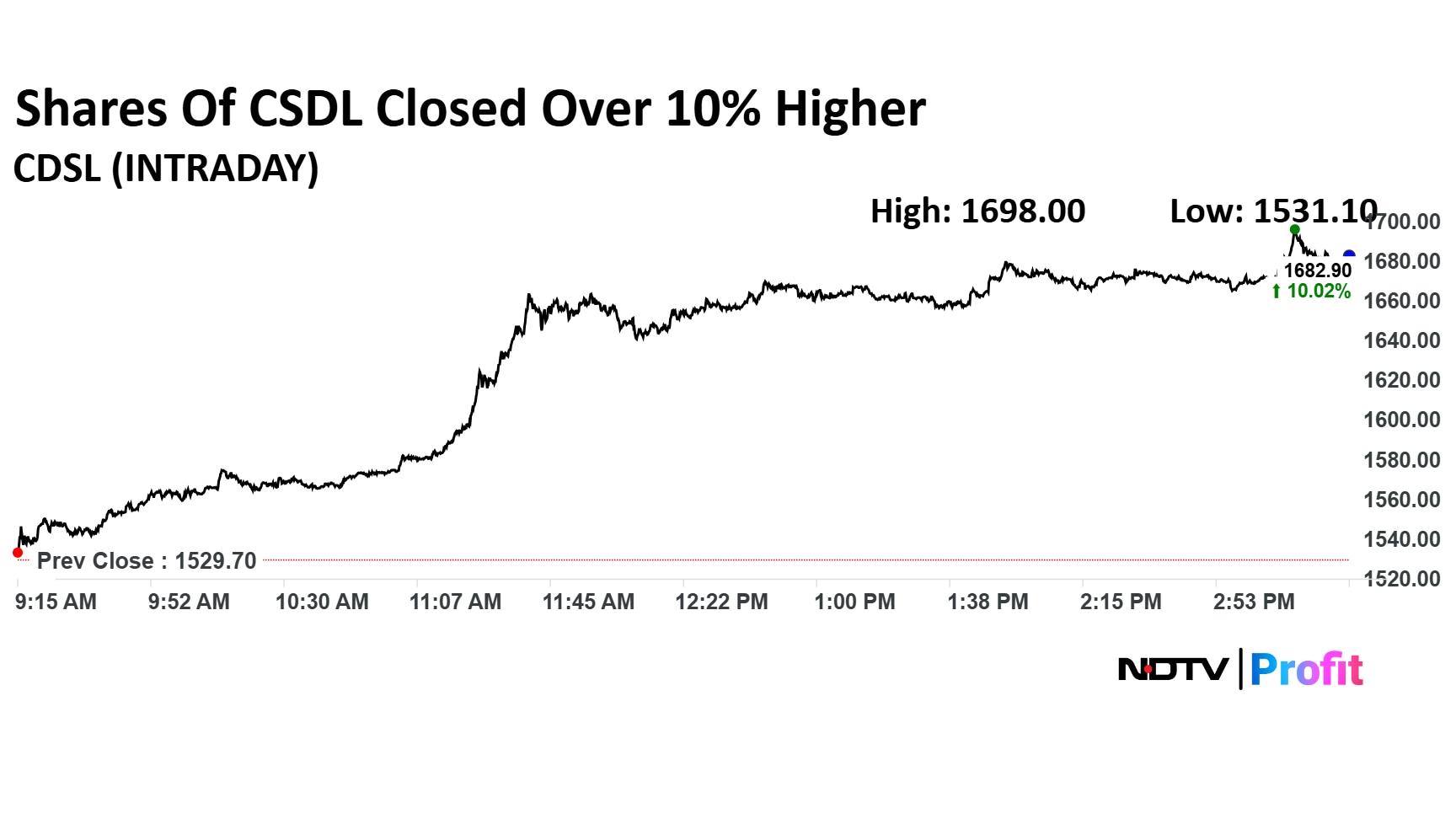

CDSL stock rose as much as 11% during the day to Rs 1,698 apiece on the NSE. It closed 10.2% higher at Rs 1,682.9 apiece, compared to a 0.14% decline in the benchmark Nifty 50 at close.

It has risen 61.84% in the last 12 months and declined 4.31% on a year-to-date basis. The total traded volume so far in the day stood at 3.5 times its 30-day average.

Three out of the 10 analysts tracking the company have a 'buy' rating on the stock, five recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 1,246.3, implying a downside of 25.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.