Adani Ports and Special Economic Zones Ltd. is set to be the latest inclusion to the country's oldest benchmark index—BSE Sensex.

The 30-stock gauge includes shares of companies with the highest average free-float market capitalisation over the last six months, further filtering on the basis of annualised traded value.

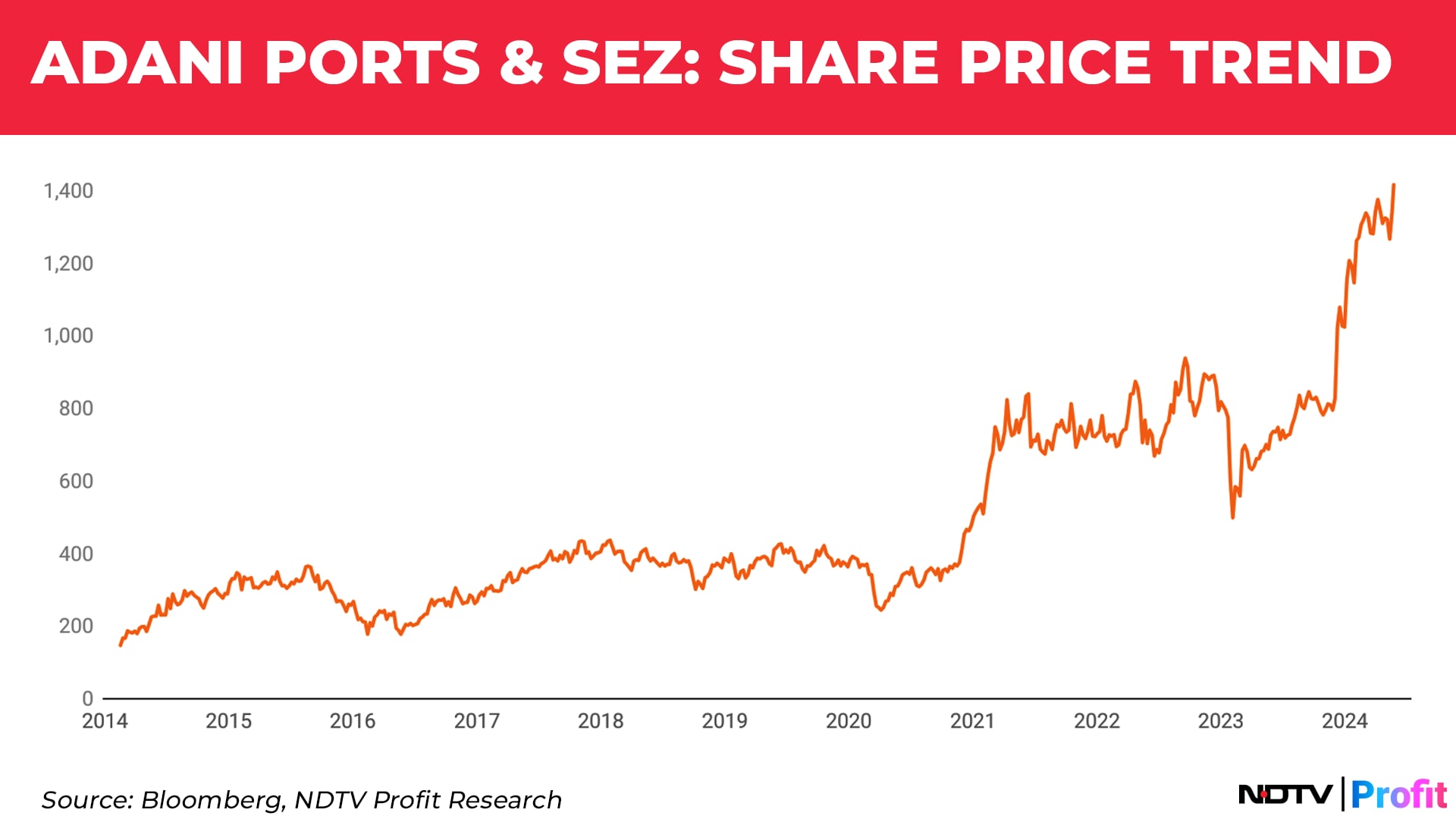

Share price of the country's biggest private port operator has tripled since the Hindenburg allegations in January 2023. Market capitalisation of the company has also grown over threefold since the lowest point around the same time.

In FY21, the company had guided for Rs 30,000 crore revenue by FY25, but has already achieved Rs 26,700 crore revenue in fiscal 2024.

Adani Ports has strong international operations with presence in Australia, Tanzania and Sri Lanka. It also operates Israel's largest port, Haifa Port.

Post the reconstitution, which is set to take place on June 24, Adani Ports will command a weightage of 1.2% in the index level, replacing Indian tech giant Wipro Ltd., which had the lowest weightage among any stock in the index.

Incorporated over two decades ago, the company has maintained a track record of stable growth, leading up to this inclusion.

Here's how the company's performance fared through the years.

Market capitalisation of the company stands above Rs 3.1 lakh crore, with a compounded annual growth rate of 55% over four years.

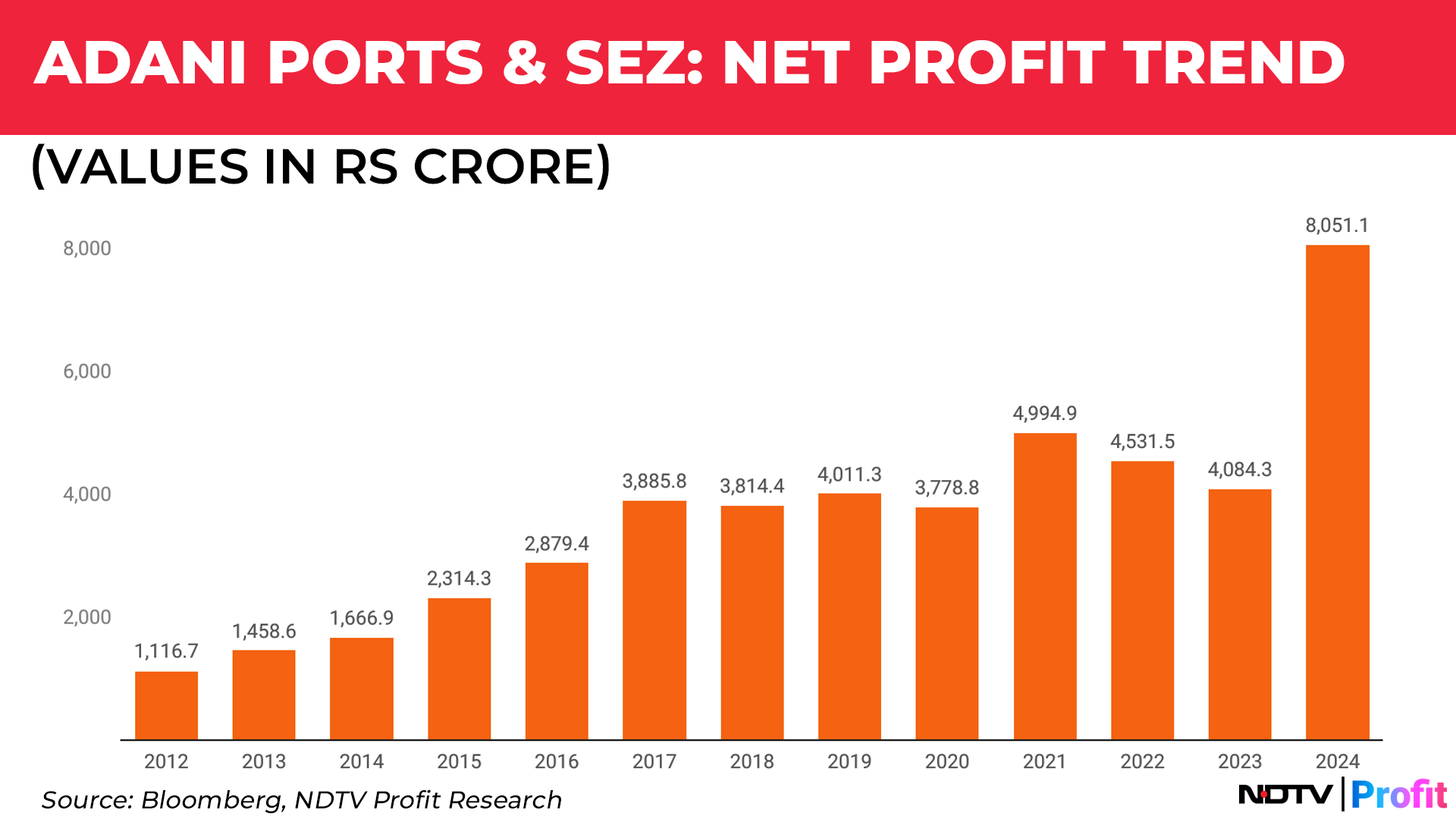

Profit after taxes for the company, which had seen a steady uptrend over the past 10 years, surged two-fold in the financial year ended March 2024, and crossed Rs 8,000 crore.

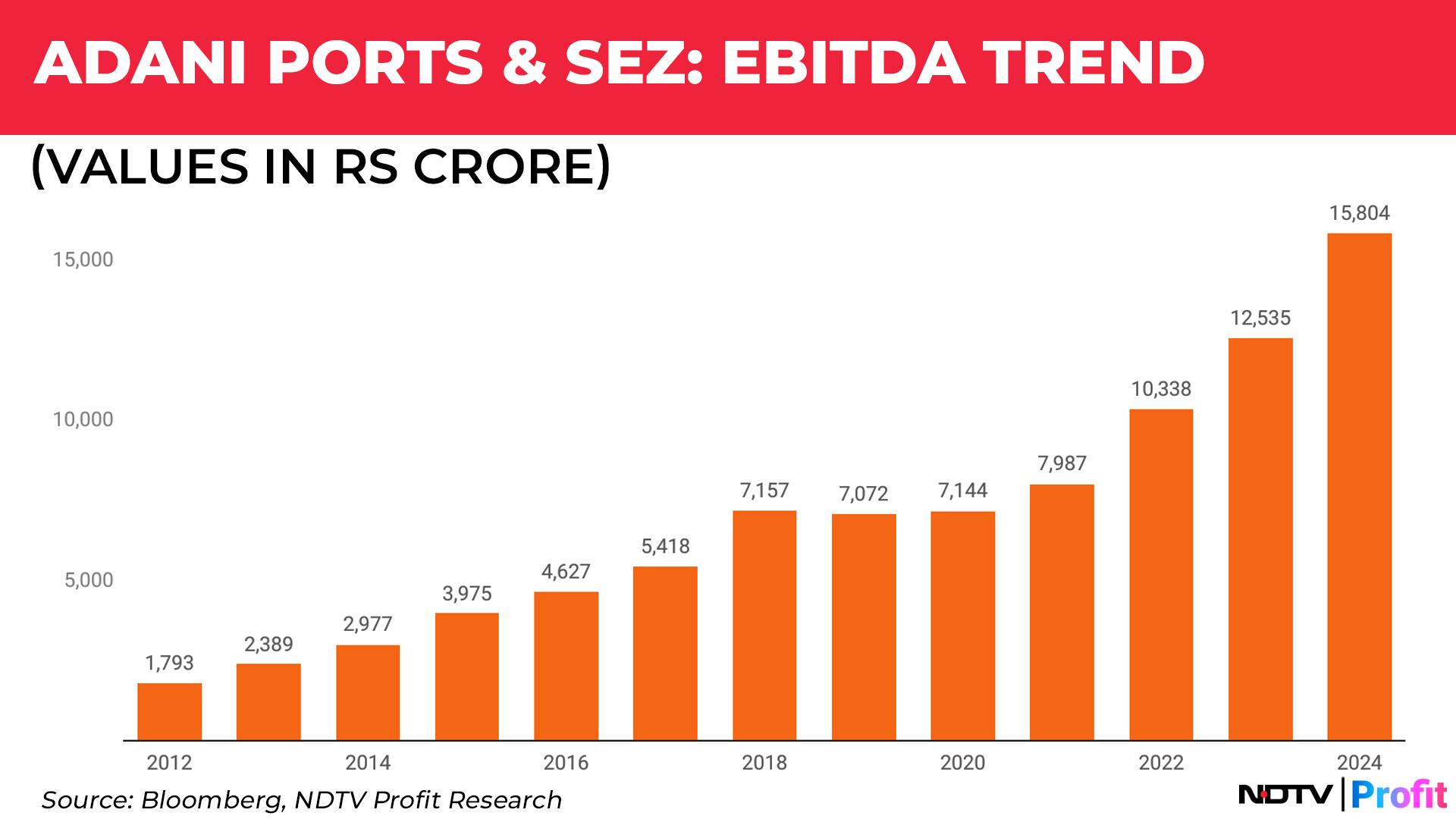

Operating profit for the company crossed Rs 15,000 crore in FY24, growing at a CAGR of 21% over 13 years.

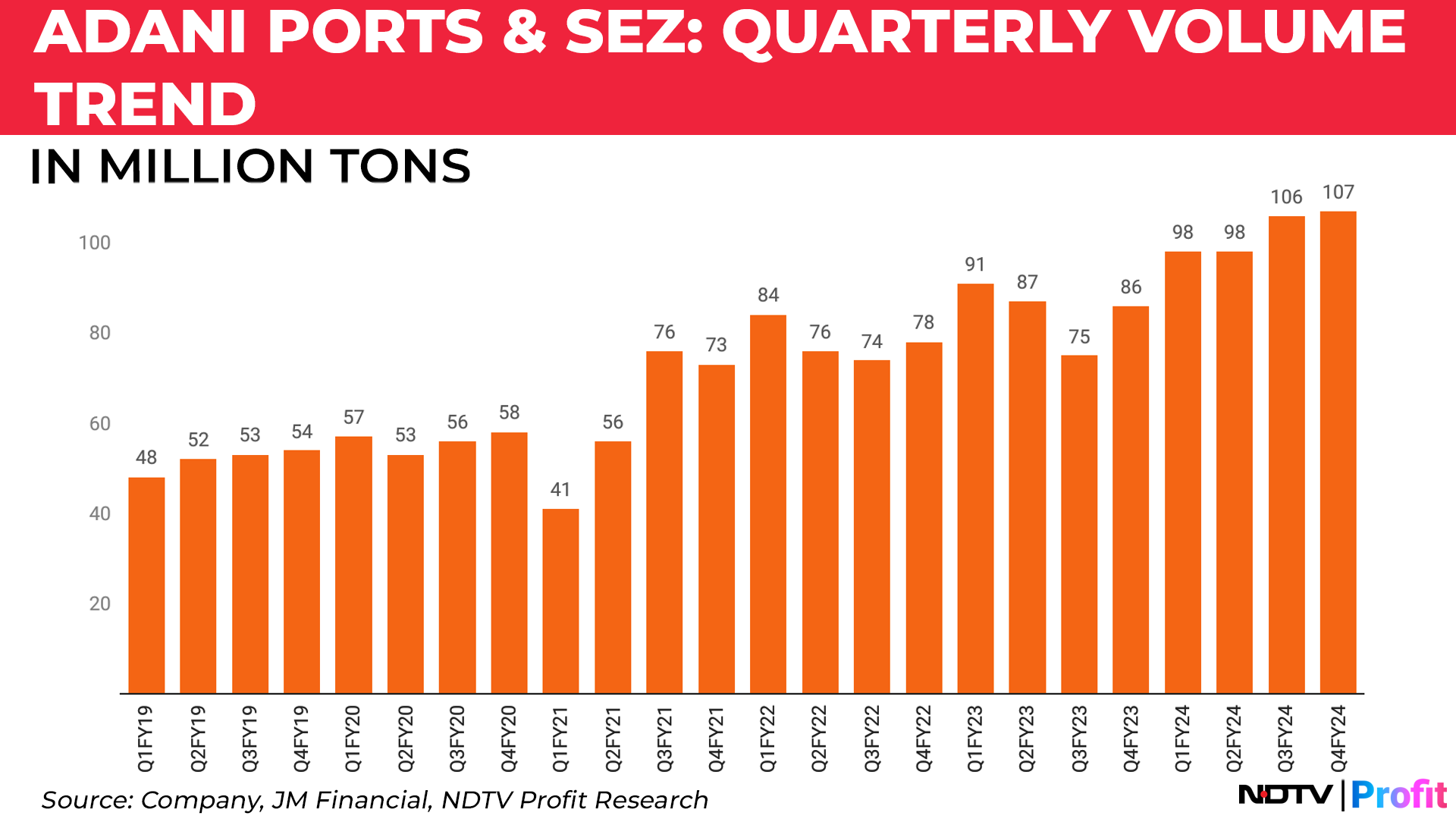

Quarterly volumes crossed 100 million tons in the third quarter of fiscal 2024 and stand at 107 million tons as of the quarter ended March.

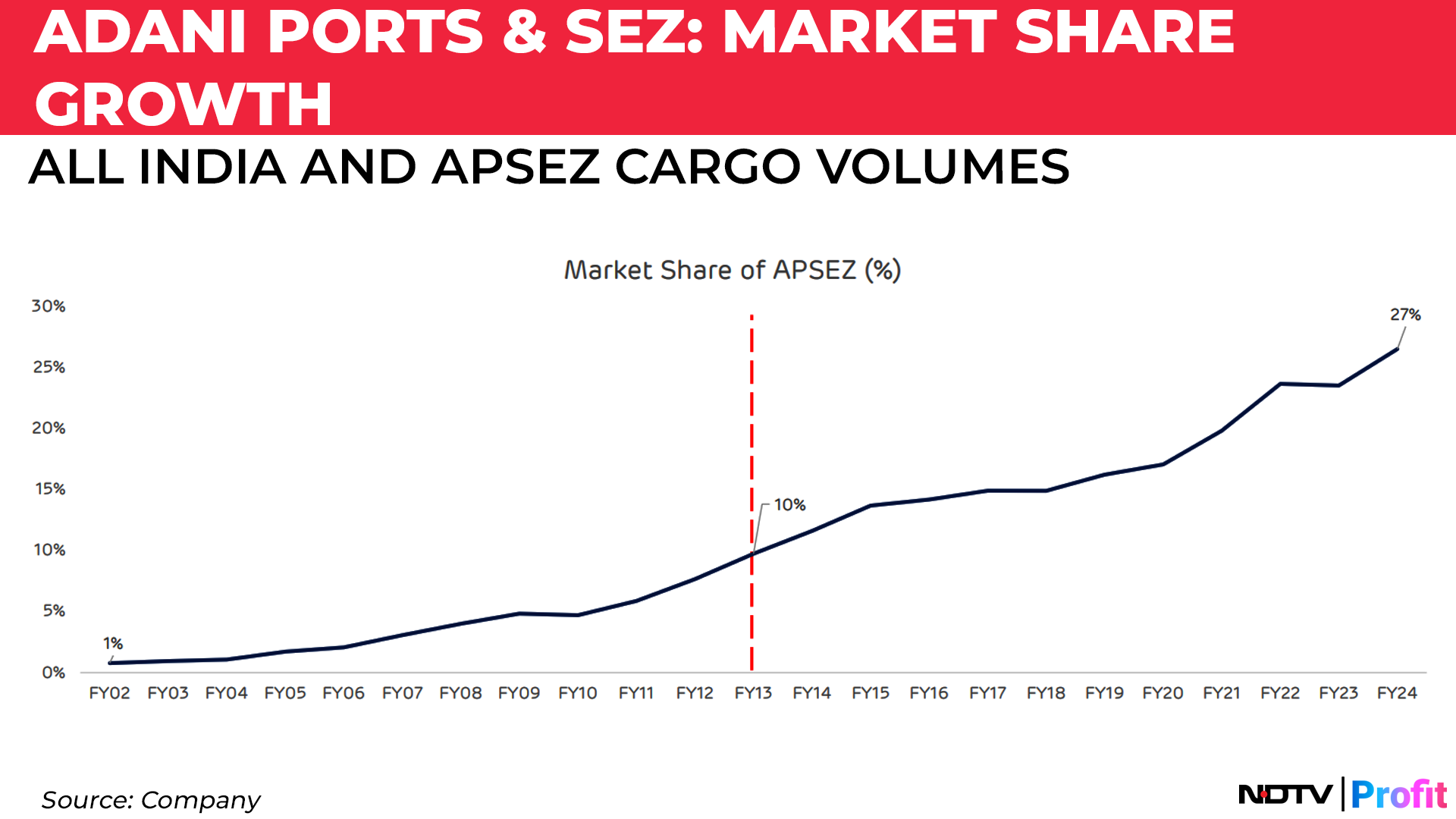

Over the past decade, market share of the company's cargo volumes have nearly tripled since hitting the 10% mark for the first time in FY13, to 27% in FY24.

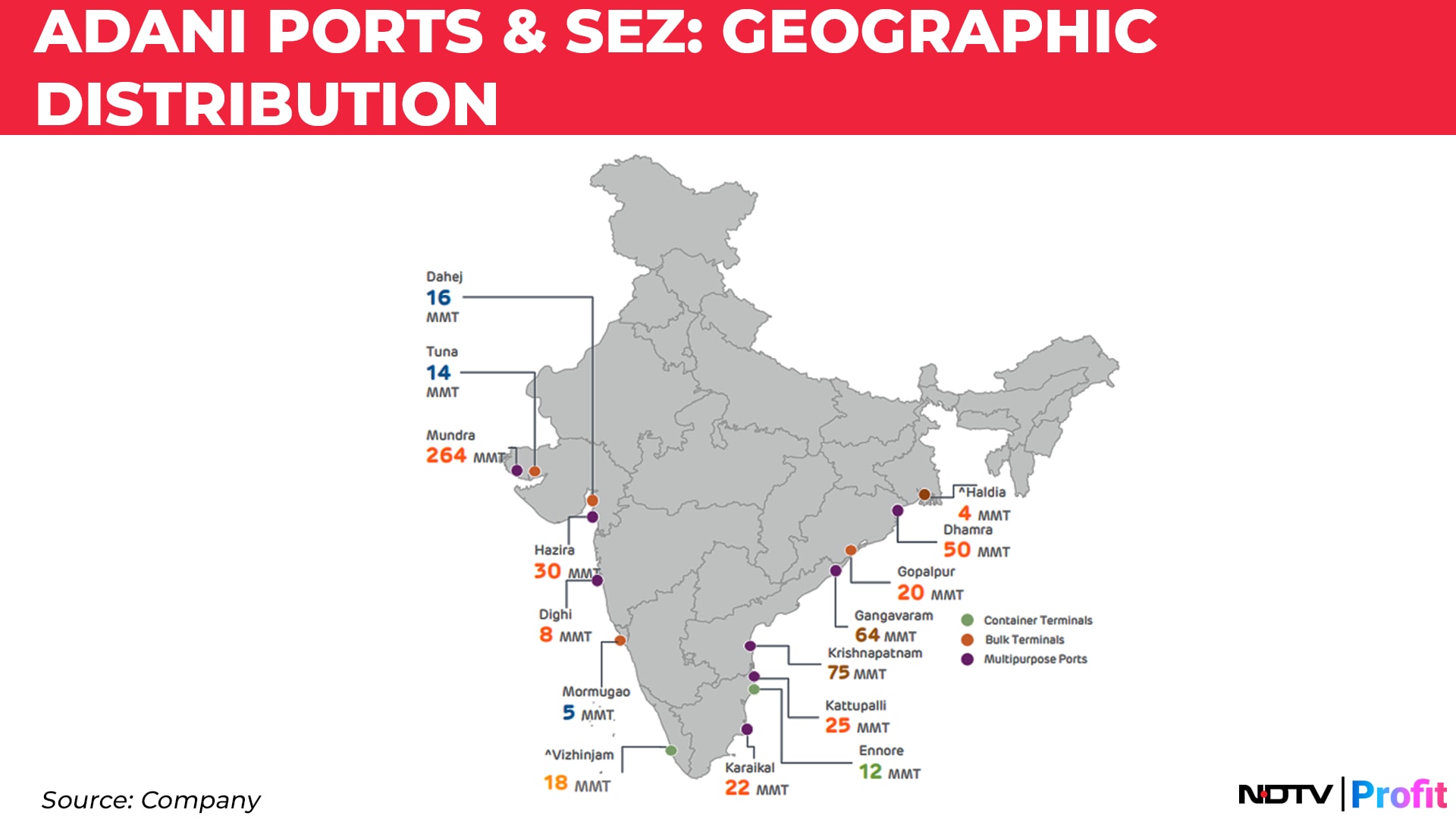

The company has 15 ports under its portfolio, with an approximate capacity of 627 million metric tons.

Of these, Vizhinjam port in Kerala and Haldia port in West Bengal are still under construction, with a capacity of 18 and 4 million metric tons respectively.

Disclaimer: NDTV Profit is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.