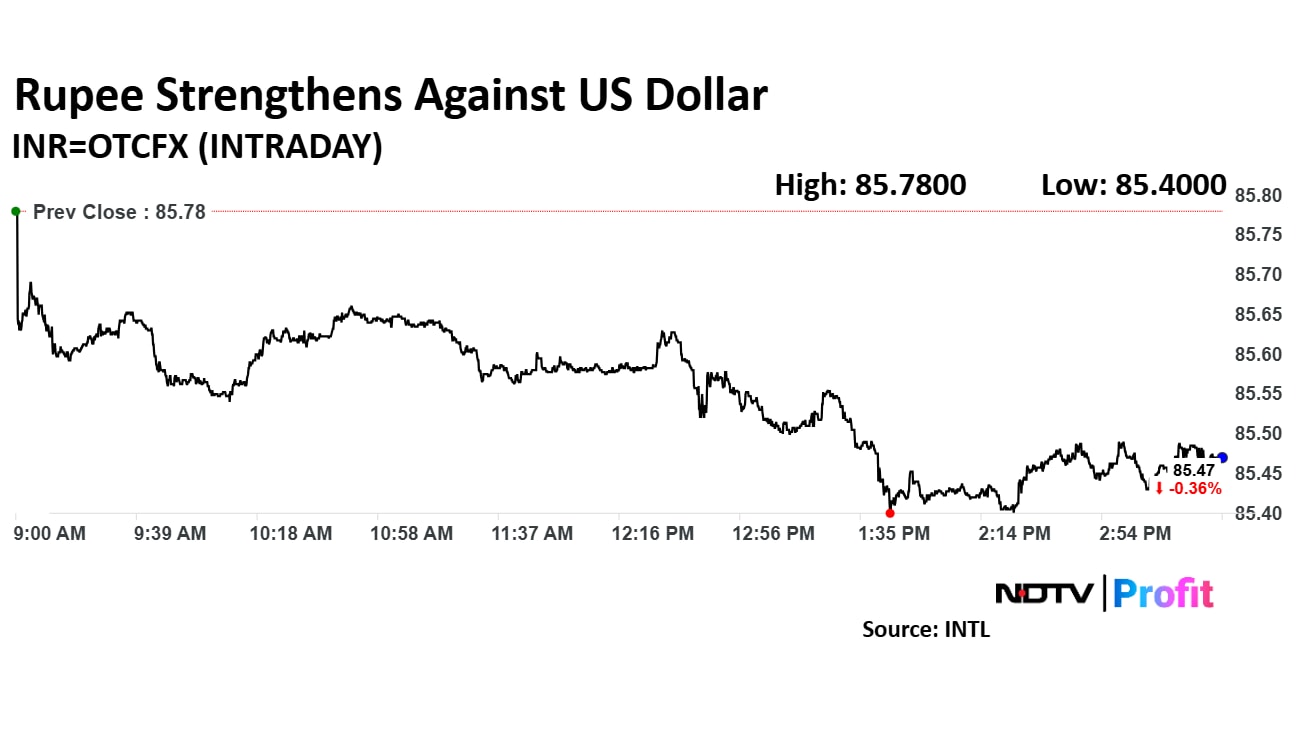

The rupee closed at the highest level in three months against the US dollar. The Indian unit closed 33 paise higher at 85.46 against the dollar.

"A key driver of INR strength appears to be the RBI, which is reportedly advising banks to avoid large arbitrage bets between onshore and offshore markets," said Abhishek Goenka, founder and chief executive officer, India Forex & Asset Management. "The RBI's $10 billion FX swap auction—oversubscribed by double—further boosted liquidity and confidence. Notably, the rupee has retraced marginally over 50% of its 2024 depreciation."

The rupee opened 13 paise higher at 85.66 against US dollar. In the second half of the trade, the Indian unit jumped 38 paise to the day's high of 85.41 against the US dollar.

The dollar index was trading in a narrow range throughout the day, as market participants await the release of the US Personal Consumption Expenditure index, which is scheduled to be released later today.

The dollar index was trading 0.07% higher at 104.41 as of 3:28 p.m.

Crude oil prices were trading in losses, which supported the Indian unit. The June future contract was trading 0.03% higher at $74.05 a barrel as of 3:30 p.m.

"Given the current global and domestic market dynamics, the USD/INR pair is likely to find strong support in the 85.40-85.50 range. On the upside, 85.90 will serve as a key resistance level, and a breakout above this could open the path toward 86.40-86.50," said Amit Pabari, managing director, CR Forex Advisors.

The domestic unit settled 7 paise weaker at 85.78 against the greenback on Thursday, according to data on Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.