The Reserve Bank of India's Monetary Policy Committee unanimously voted to reduce the benchmark repo rate by 25 bps and decided to continue with a ‘neutral' policy stance. RBI Governor Sanjay Malhotra-led rate-setting panel also raised the FY26 economic growth estimate to 7.3% from 6.8% earlier and reduced the retail inflation forecast to 2% from 2.6% earlier.

The central bank has been tasked by the government to ensure that the consumer price index-based inflation remains at 4% with a margin of 2% on either side. Also, the Indian economy has clocked better-than-expected gross domestic product growth of 8.2% in the second quarter of FY26.

RBI MPC Raises FY26 GDP Estimate

RBI's policymakers raised the full fiscal economic growth projection to 7.8% after recent government data showed that India's GDP registered a six-quarter high growth of 8.2% in the July-Sept. quarter, underpinned by resilient domestic demand amidst global trade and policy uncertainties.

RBI's Sanjay Malhotra said economic activity during the first half of 2025-26 benefited from income tax and goods and services tax rationalisation, softer crude oil prices, front-loading of government capital expenditure, and facilitative monetary and financial conditions with benign inflation.

"High-frequency indicators suggest that domestic economic activity is holding up in the October-December quarter, although there are some emerging signs of weakness in few leading indicators," he said. On the external front, the governor said the foreign direct investment to India increased at a robust pace during the first half of the year.

Here are the quarterly estimates:

FY26 GDP Growth Projection At 7.3% Vs 6.8% Earlier

Q3 FY26 GDP Growth Projection At 7% Vs 6.4% Earlier

Q4 FY26 GDP Growth Projection At 6.5% Vs 6.2% Earlier

Q1 FY27 GDP Growth Projection At 6.7% Vs 6.4% Earlier

Q2 FY27 GDP Growth Projection At 6.8%

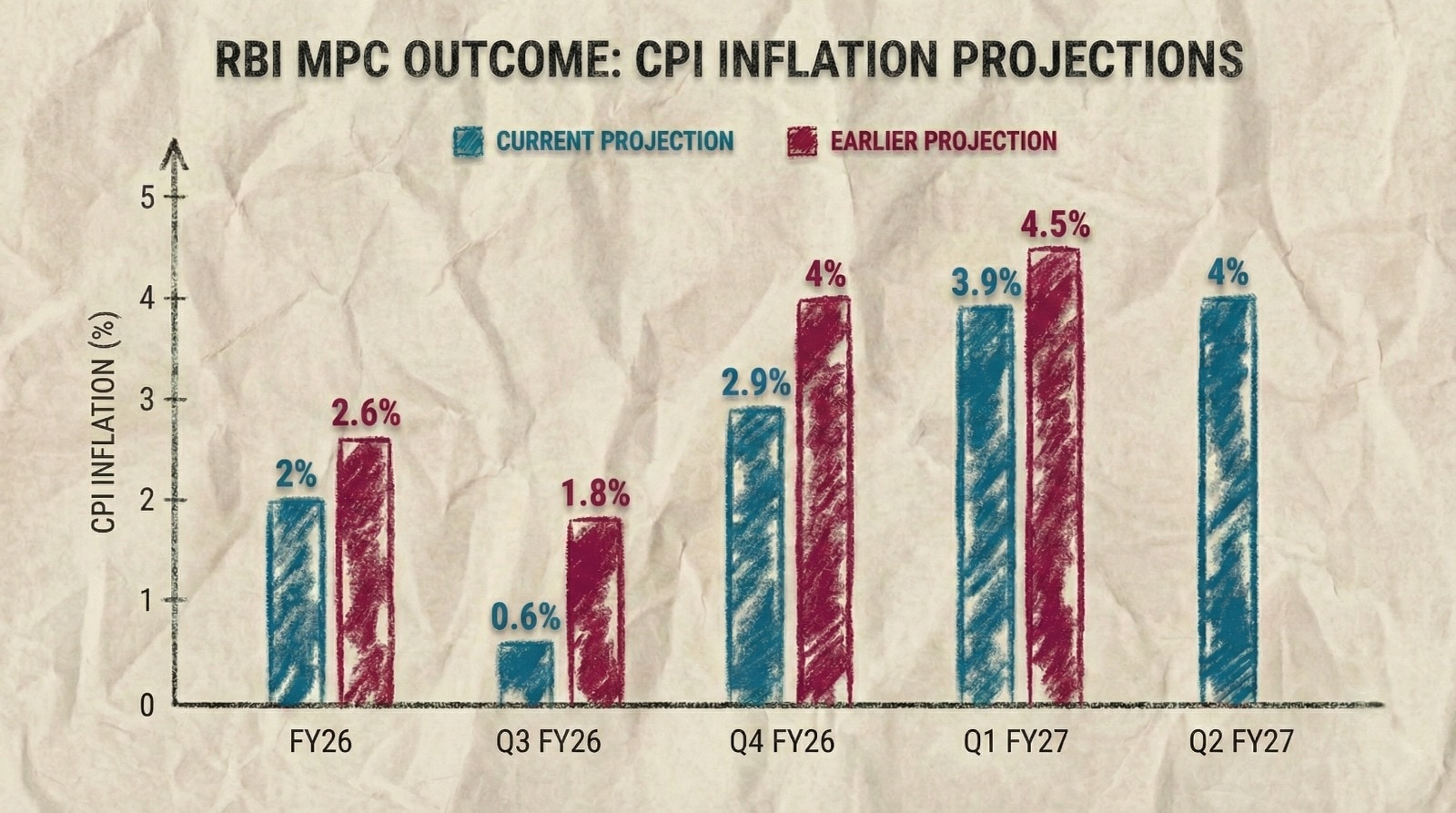

RBI MPC Lowers FY26 Inflation Forecast

RBI's monetary policy panel also significantly lowered the overall inflation projection for the current fiscal to 2% from 2.6% estimated earlier as the economy continues to witness rapid disinflation. India's retail inflation dropped to a historic low of 0.25% in October, marking the lowest level since the CPI series was introduced.

The retail inflation is trending below 4% since February this year. RBI Governor Malhotra said that core inflation (CPI headline excluding food and fuel) remained mostly stable in September and October, despite ongoing price pressures from precious metals.

Excluding gold, core inflation decreased to 2.6% in October. ''In general, the reduction in inflation has become more widespread," he said. Notably, India's CPI inflation is ruling below the 2% lower band mandated by the government for the last three months.

Here are the quarterly estimates:

FY26 CPI Inflation Projection Lowered To 2% Vs 2.6% Earlier

Q3 CPI Inflation Projection At 0.6% Vs 1.8% Earlier

Q4 CPI Inflation Projection At 2.9% Vs 4% Earlier

Q1 FY27 CPI Inflation Projection At 3.9% Vs 4.5% Earlier

Q2 FY27 CPI Inflation Projection At 4%

RBI's Monetary Policy For Dec. 2025

On Dec. 5, RBI's policymakers slashed the key benchmark interest rate for the first time in six months and took steps to boost liquidity to support a 'goldilocks' economy in the face of high US tariffs. RBI cut interest rate by a quarter-point to 5.25% in a bid to further bolster economic growth.

The RBI also took steps to boost liquidity to support a 'goldilocks' economy in the face of high US tariffs. "While economic growth has remained strong, India's economy has since October experienced rapid disinflation leading to a breach of the central bank's lower threshold of tolerance," he said.

This is the fourth rate cut by the central bank since February 2025. It held interest rates in August and October bi-monthly monetary policy meetings. Based on the MPC's recommendation, the RBI reduced repo rate by 25 bps each in February and April, and 50 bps in June on easing retail inflation.

"The unanimous nature of the decision in cutting rates by 25 bp reflects the consensus in the MPC that giving further boost to growth is a risk worth taking even in the context of depreciating rupee," said Dr. V K Vijayakumar, Chief Investment Strategist, Geojit Investments Ltd

''The projection of 7.3% GDP growth for FY 26 is positive for the market. Banks will like the policy decision but are unlikely to respond positively to the rate cut since their NIMs will come under pressure and they will face difficulties in mobilising deposits if deposit rates are lowered,'' added Dr. V K Vijayakumar.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.