(Bloomberg) -- Hedge funds turned more bullish on oil for the first time in almost three months as heightened war risks to global energy shipments help prices rebound.

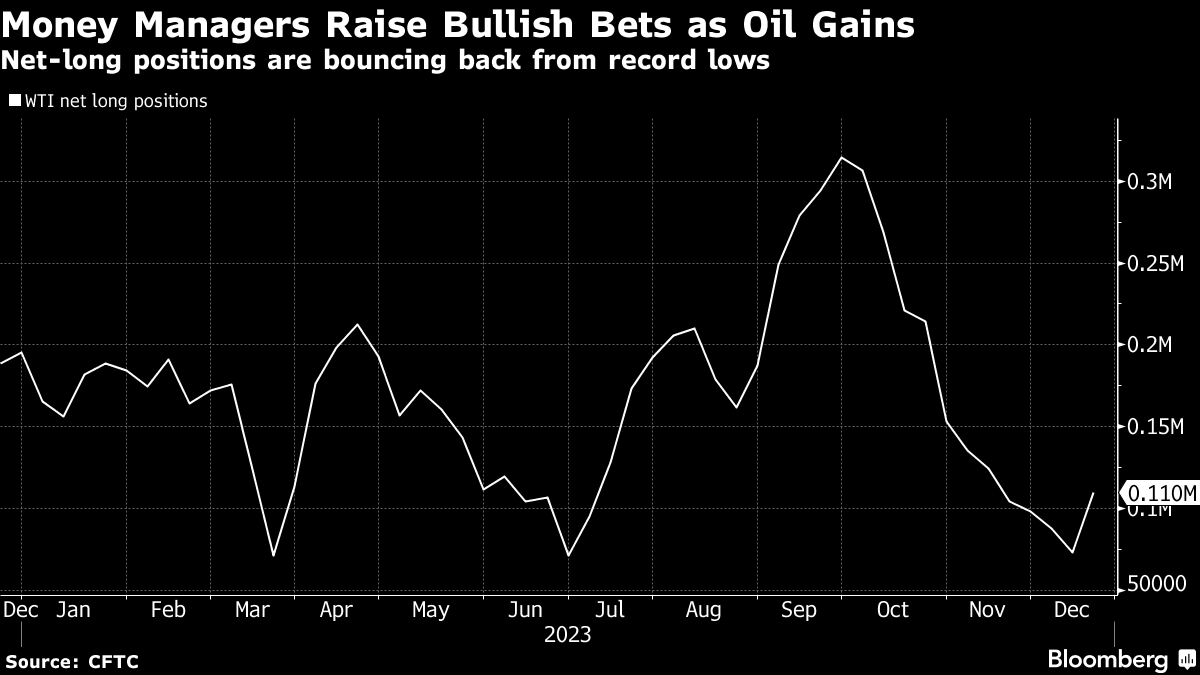

Money managers boosted net long positions in the West Texas Intermediate benchmark to 109,723 lots after taking the most bearish stance ever the week prior, according to data from ICE Futures and the Commodity Futures Trading Commission. The gain in net longs — the first since late September — was driven primarily by a 32,678 lot drop in short positions.

The bullish move came as oil posted the largest weekly gain in months, fueled by Houthi militant attacks in the Red Sea that threaten months of disruptions. Still, the longer-term outlook for crude remains challenged, with the US poised for record output next year while demand gains are expected to slow.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.