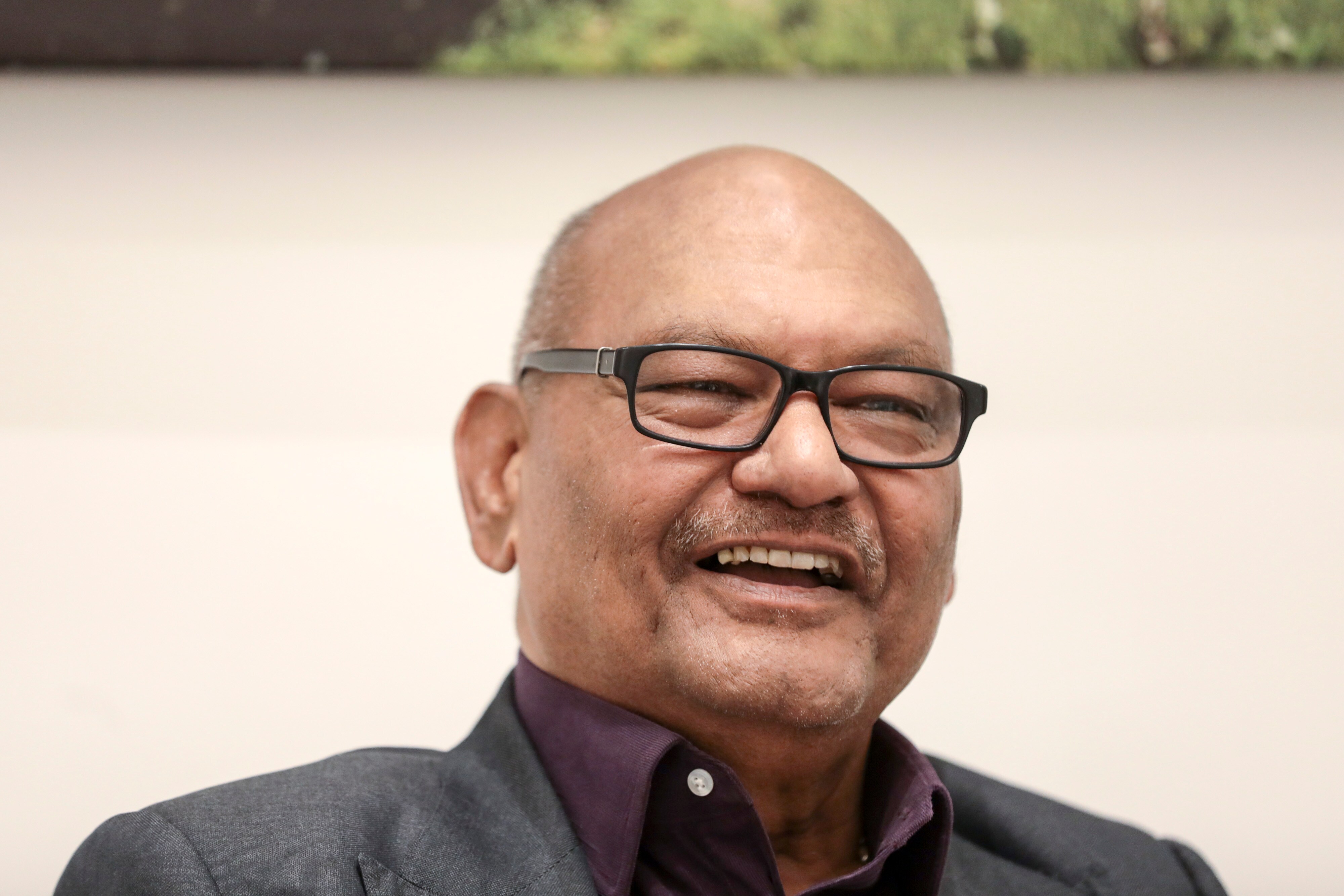

(Bloomberg) -- Vedanta Ltd. will give an interim dividend for a fourth time this financial year as billionaire Anil Agarwal seeks to collect funds to pay off debt obligations at parent Vedanta Resources Ltd.

The Indian mining company's total disbursements so far in the year to March come to 301.12 billion rupees. That includes 46.5 billion rupees ($570 million) in dividends for the third quarter, according to an exchange filing Friday.

The latest announcement comes even as the group's net income tumbled 41% to 24.6 billion rupees in the October-December quarter. However, that beat the average analysts' estimate for a profit of 17.4 billion rupees.

Agarwal has been sucking up cash through dividends from the Mumbai-listed firm and its unit Hindustan Zinc Ltd. as debt maturities at Vedanta Resources loom. Last week, Vedanta Ltd. announced plans to sell its international zinc operations for $2.98 billion to Hindustan Zinc, the group's cash cow, which announced a third-quarter dividend of about 55 billion rupees.

The London-based parent has bonds worth $4.7 billion maturing in the next 3 1/2 years, including $900 million of notes due in the first half of 2023, according to data compiled by Bloomberg.

Revenue at Vedanta Ltd. was little changed at 336.9 billion rupees during the three months. Total costs climbed 17% to 313.3 billion rupees.

Shares of Vedanta Ltd. declined 2% in Mumbai on Friday before the earnings were published. There are 9 buy recommendations on the company, 4 holds and two sells, according to data compiled by Bloomberg.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.