- Asian stocks rose following a tech rebound and strong US economic data

- MSCI Asia Pacific Index gained with record highs in South Korea

- Oil steadied above $65 after a sharp rise amid US-Iran tension reports

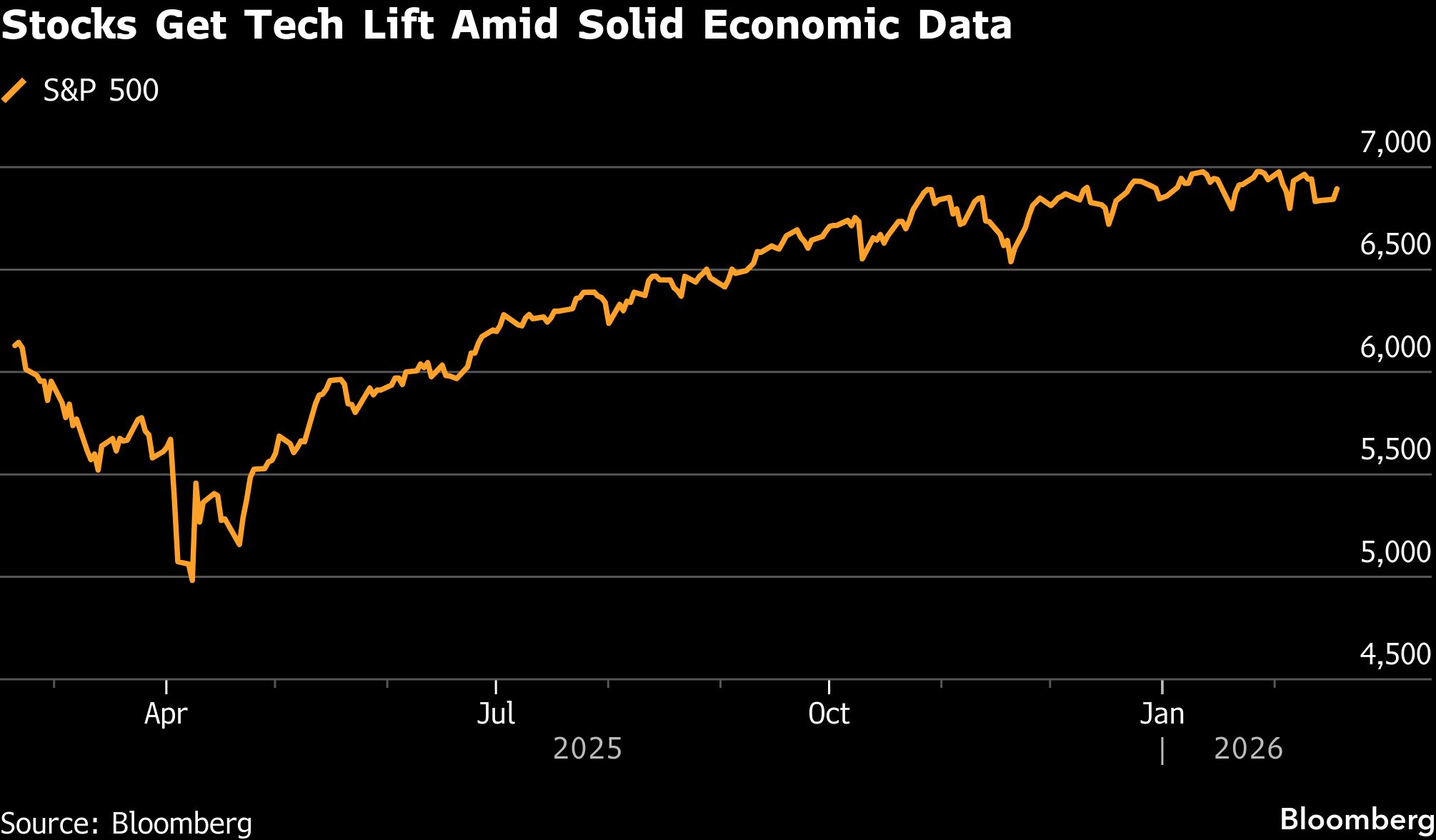

Asian stocks advanced after a rebound in tech and robust economic data boosted US equities. Oil held gains after its biggest jump since October.

The MSCI Asia Pacific Index gained for a second day, as shares rallied in Australia and Japan, and South Korea's benchmark rose to a record. That was after the S&P 500 gained 0.6% Wednesday and the tech-heavy Nasdaq 100 climbed 0.8%. Financial markets remained shut in mainland China, Hong Kong and Taiwan for the Lunar New Year holiday.

The rebound in tech shares offered a sign that concern over the disruption of artificial intelligence were easing, just as several stock pickers surveyed the wreckage for buying opportunities.

The software stock selloff is likely “overdone” as that was a largely knee-jerk reaction, with investors trying to figure out the winners and losers from AI, said Paul Stanley, managing partner at Granite Bay Wealth Management. “While AI is very promising, investors should not assume that all companies will win on the AI front.”

Oil steadied in Asia after jumping Wednesday following a report that American military intervention in Iran may come sooner than expected.

West Texas Intermediate traded above $65 a barrel after gaining 4.6% on Wednesday, while Brent crude closed above $70 for the first time in more than two weeks. Axios reported that any US military operation would likely be a weeks-long campaign and that Israel's government is pushing for a scenario targeting regime change in the Islamic Republic.

The dollar edged lower versus most of its Group-of-10 peers after Bloomberg's gauge of the greenback gained 0.5% on Wednesday. Treasuries were little changed after dropping in the New York session, when a $16 billion sale of 20-year bonds drew lackluster demand.

US economic data published Wednesday showing the biggest increase in US industrial production in January bolstered investor sentiment, while orders for business equipment rose in December by more than projected and housing starts hit a five-month high.

What Bloomberg strategists say...

“The S&P 500's proximity to previous all-time highs shows the current rotation within US equity markets — which favors alpha stars like materials — isn't an indictment of the US economy. It's simply a reflection of a more discerning market, now that AI capital expenditure has become debt-fueled at a time when inflation jitters are coming back in focus.”

— Ed Harrison, Macro Strategist, Markets Live. For the full analysis, click here.

Stock market bulls shrugged off minutes of the Federal Open Market Committee's January meeting that revealed “several participants” said they would have preferred a post-meeting statement that raised the possibility of raising the federal funds rate “if inflation remains at above-target levels.”

Fed funds futures pricing on Wednesday indicated traders slightly pared bets on rate cuts this year but still expect a further two 25 basis-point reductions in 2026.

“From our perspective, the minutes support our view that rate cuts are off the table for the foreseeable future,” said Charlie Ripley, a fund manager at Allianz Investment Management.

Gold was little changed in Asia, after jumping 2% on Wednesday, with some Asian markets closed for Lunar New Year holidays and traders focused on the Fed's next move on interest rates.

Corporate Highlights:

- Mark Zuckerberg testified that it's “very difficult” to enforce Instagram's age limits as he sought to defend the platform during a landmark trial over social media addiction.

- Elliott Investment Management is pressing London Stock Exchange Group Plc to launch a review of its portfolio and pursue a £5 billion ($6.8 billion) share buyback over the next 12 months, according to people familiar with the matter.

- World Labs, a startup from AI pioneer Fei-Fei Li, raised $1 billion in a new round of funding to pursue a novel approach to AI development.

- Alphabet Inc. unveiled several new initiatives to support its expansion in India, including new fiber-optic routes that will connect the country with the US and other locations in the Southern Hemisphere.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:30 a.m. Tokyo time

- Nikkei 225 futures (OSE) rose 0.4%

- Japan's Topix rose 0.4%

- Australia's S&P/ASX 200 rose 1.1%

- Euro Stoxx 50 futures fell 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1790

- The Japanese yen was little changed at 154.73 per dollar

- The offshore yuan was little changed at 6.8909 per dollar

Cryptocurrencies

- Bitcoin was little changed at $66,354.23

- Ether rose 0.6% to $1,952.66

Bonds

- The yield on 10-year Treasuries was little changed at 4.08%

- Japan's 10-year yield advanced one basis point to 2.145%

- Australia's 10-year yield advanced two basis points to 4.74%

Commodities

- West Texas Intermediate crude fell 0.1% to $65.12 a barrel

- Spot gold fell 0.2% to $4,967.93 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.