(Bloomberg) -- A surge in the cost of physical crude cargoes as China and India rush to replace Russian flows is prompting refiners in other parts of Asia to consider cutting run rates, according to traders.

Oman crude and Abu Dhabi's Murban, the most-referenced Middle Eastern grades, have jumped over the past week, showing how the impact of the Jan. 10 US sanctions on Russia are rippling through the global energy market. This has pushed up feedstock costs for processors and eroded margins, which have even gone negative, the traders said.

So-called merchant refiners, which are more dependent on exports due to their small domestic markets, are the most vulnerable to the rising prices. These processors — many of which are in South Korea, Singapore and Taiwan — typically rely on Saudi Arabian oil, priced against benchmarks such as Oman, for their baseload supply, as well as spot purchases from the Middle East and elsewhere.

Soaring freight costs due to the fallout from the US sanctions are also adding to the costs faced by refiners. Some of the merchant processors have temporarily halted their purchases of additional spot cargoes and are considering run cuts or temporary closures, the traders said.

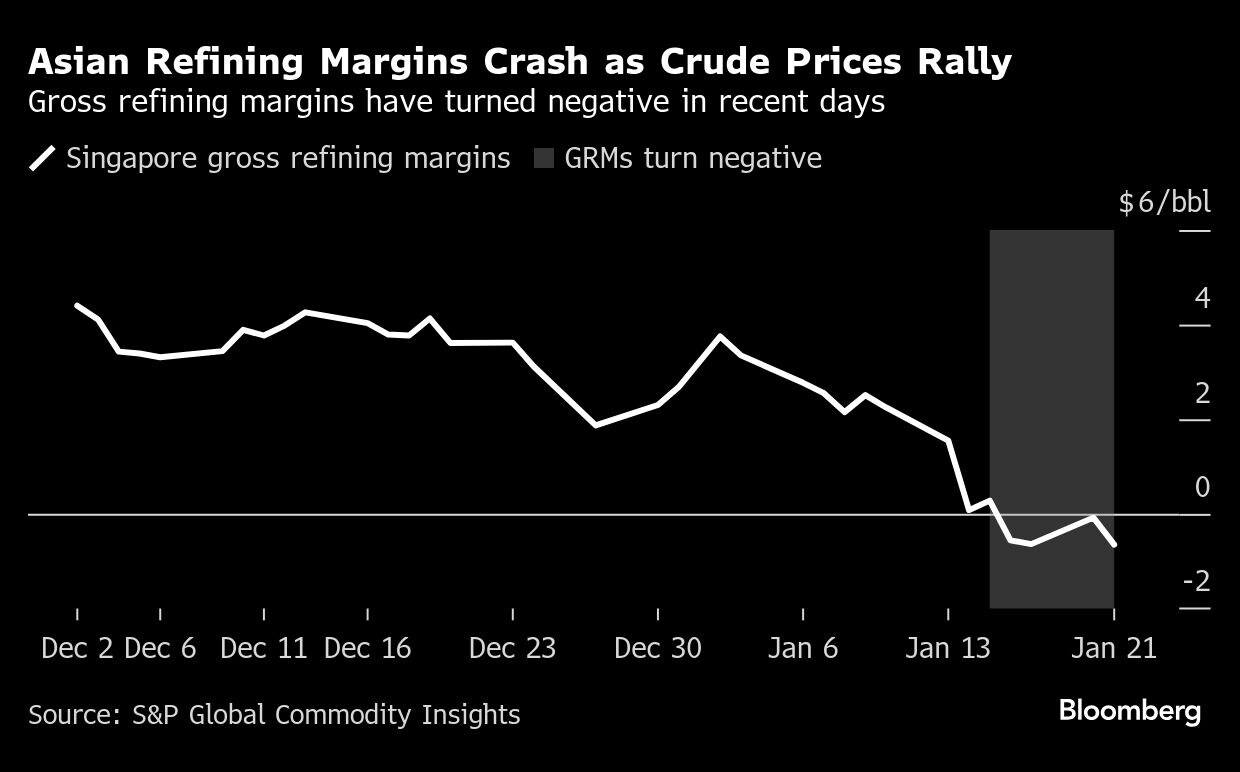

Merchant refiner margins have dropped from between $2 and $3 a barrel to a small loss, they said. Gross refining margins in Singapore, a benchmark for Asia, fell to minus 65 cents this week from as high as $3.75 earlier this month, S&P Global Commodity Insights data show.

Middle Eastern crudes have seen the biggest price jumps so far as they're the go-to grades for Chinese and Indian buyers trying to make up for lost Russian flows. Demand for shipments from the Atlantic Basin has also been supported.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.