Yes Bank Ltd.'s share price surged in early trade on Tuesday amid discussions of a potential stake sale by the bank to the Japan-based Sumitomo Mitsui Banking Corp., as per people familiar with the matter.

State Bank of India, currently the largest shareholder in Yes Bank, will likely be involved in the transaction. The proposed deal could pave the way for SMBC to eventually launch an open offer, to acquire a majority stake in the private lender.

Negotiations have been ongoing since last year. However, progress was reportedly limited due to regulatory restrictions preventing SMBC from exceeding a 26% cap on voting rights, a measure designed to prevent any single shareholder from having excessive power on the board.

According to a person in the know, the transaction will allow SMBC to have a stronger presence in India, beyond its three branches currently. Currently, SMBC also owns majority stake in SMFG Credit India, a non-bank finance company previously called Fullerton India Credit Co.

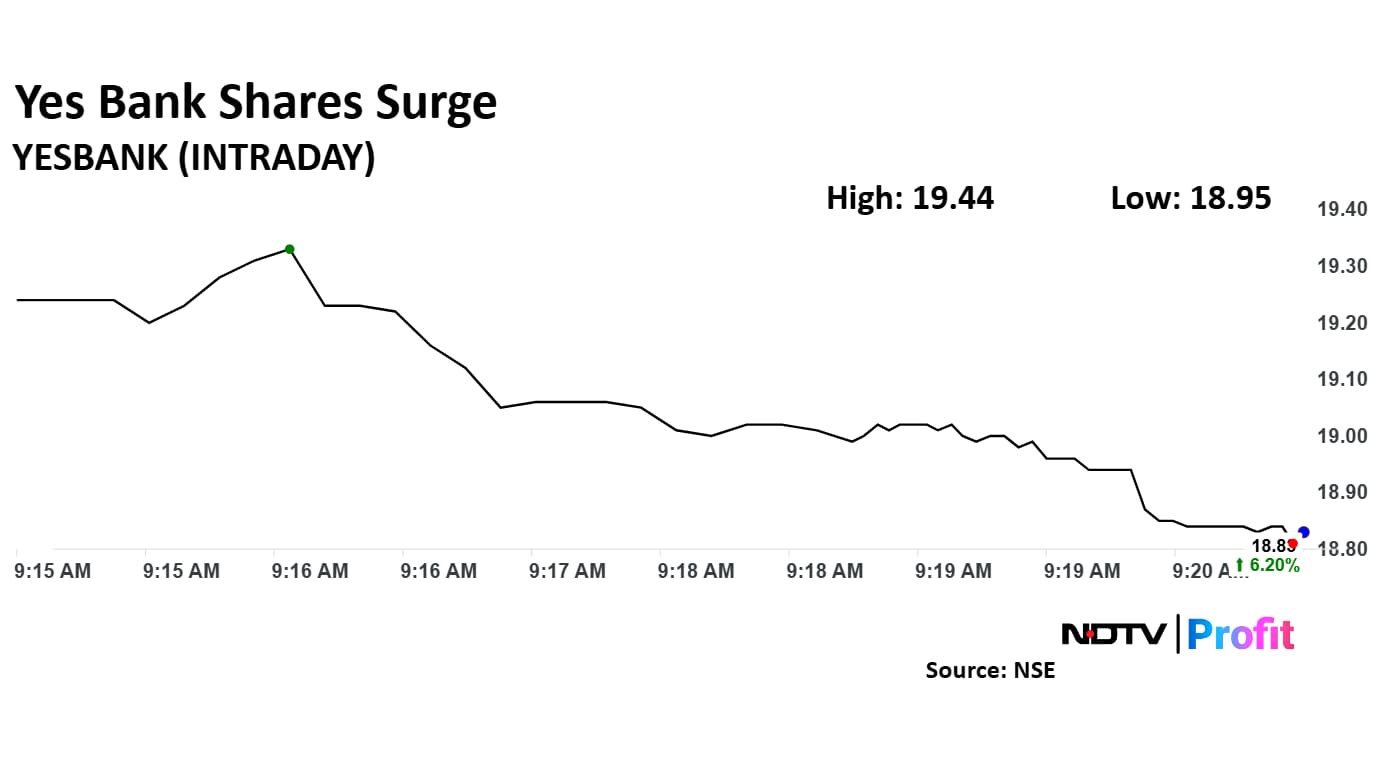

Yes Bank Share Price Today

The scrip rose as much as 9.64% to Rs 19.44 apiece, the highest level since Feb. 6. It pared gains to trade 7.33% higher at Rs 19.03 apiece, as of 09:18 a.m. This compares to a 0.02% advance in the NSE Nifty 50.

It has fallen 3.01% on a year-to-date basis, and 21.08% in the last 12 months. Total traded volume so far in the day stood at 0.92 times its 30-day average. The relative strength index was at 58.17.

Out of 12 analysts tracking the company, two recommended a 'hold', while 10 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 6.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.