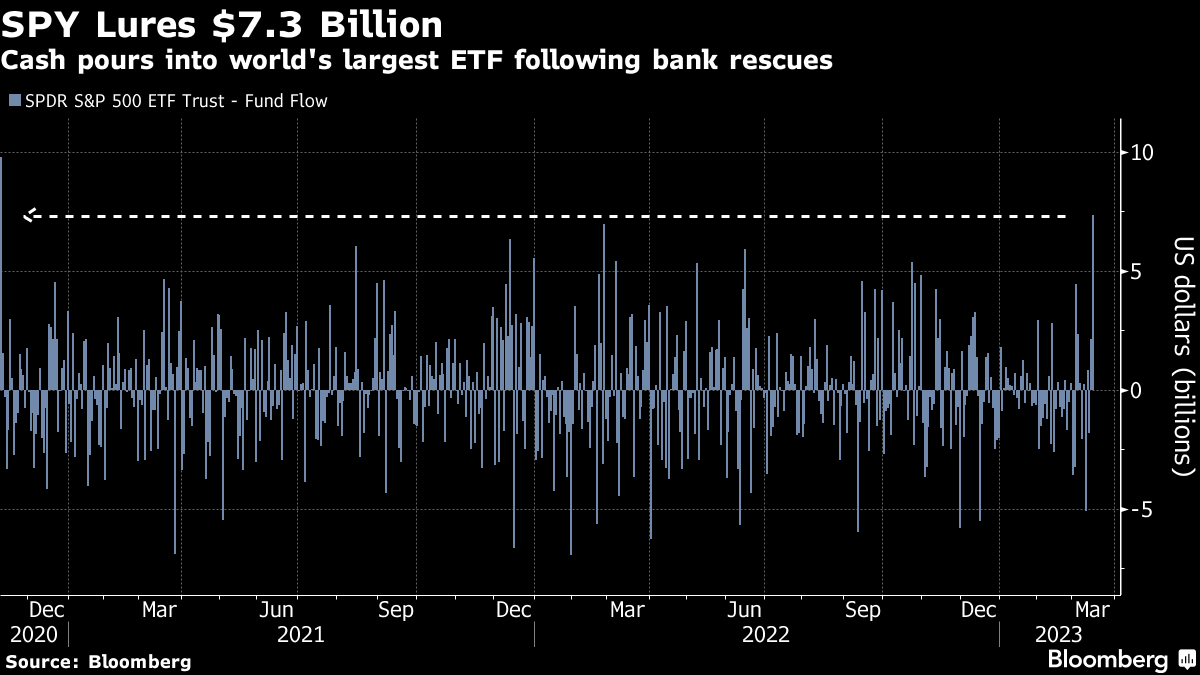

(Bloomberg) -- Investors rushed back into risk assets amid Thursday's stock market rebound, pouring $7.3 billion in a single day into the biggest ETF tracking US equities.

The flow into the $361 billion SPDR S&P 500 ETF Trust (ticker SPY) was the most since a vaccine for Covid was announced in November 2020, and the sixth largest in over a decade, according to data compiled by Bloomberg.

The influx of cash came as some of America's biggest banks agreed to help rescue another troubled regional lender, First Republic Bank, after the high-profile collapse of three institutions this month triggered widespread market turmoil. Hours earlier, the Swiss National Bank moved to support the embattled financial giant Credit Suisse Group AG, further soothing investor nerves.

It was all a huge reversal from recent days. In the week through March 15, as the bank crisis unfolded, money market funds absorbed $112.7 billion, according to Bank of America Corp. citing data from EPFR Global. That was the biggest dash to cash since the pandemic hit.

Thursday's reassuring news from the banking sector spurred other large inflows. The $30 billion Financial Select Sector SPDR Fund (XLF) posted $1.2 billion of new cash, the most since 2021. The $4.1 billion SPDR S&P Regional Banking ETF (KRE), the largest regional bank fund, lured $756 million. That was the ETF's third-largest ever haul, days after it attracted a record $1.1 billion on Tuesday.

In other signs of broader risk appetite reviving: The $12.8 billion iShares iBoxx High Yield Corporate Bond ETF (HYG), which tracks riskier junk debt, added $888 million in its biggest influx for six weeks. The $34.8 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) saw $502 million of new money, the most since November.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.