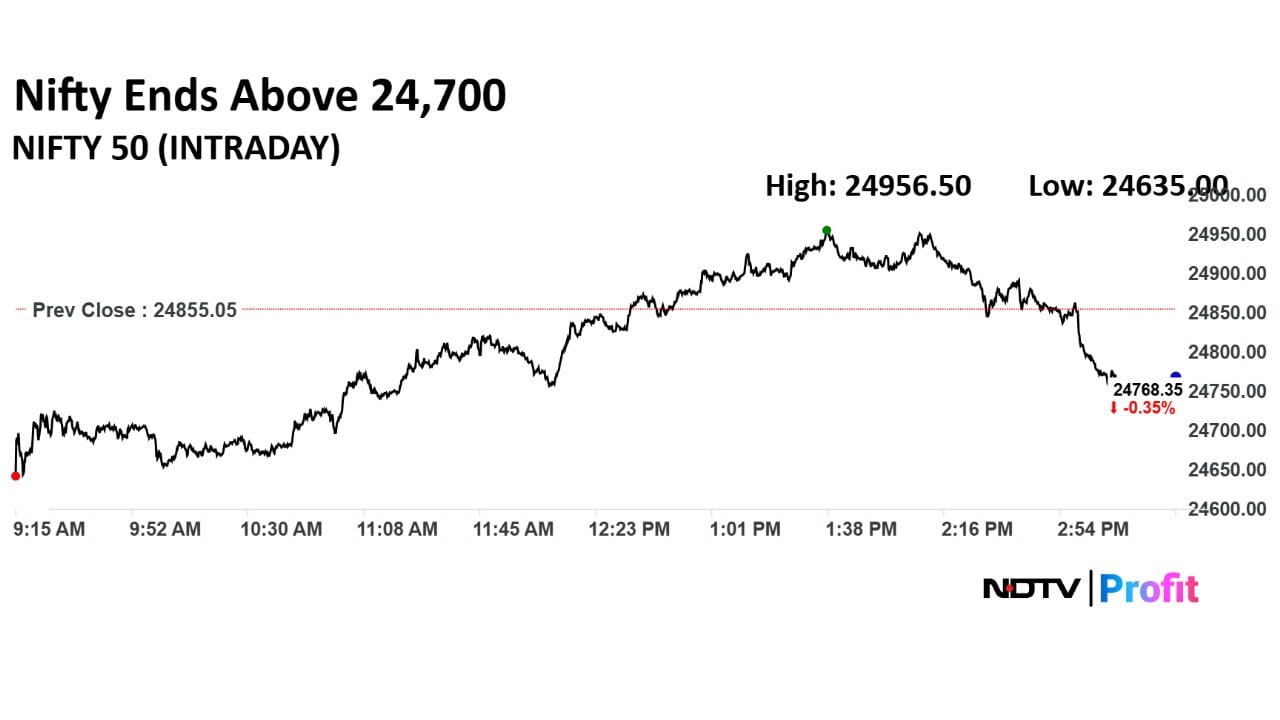

The NSE Nifty 50's key support is seen at 24,650 and 24,600 levels, after the indices ended in the red amid tariff tensions with the US and flight of foreign capital, according to Shrikant Chouhan, head of equity research at Kotak Securities.

The Nifty formed a bullish candle with a long upper shadow, highlighting intraday volatility amid continuation of the consolidation around the 100 days exponential moving average, Bajaj Broking Research said.

"Volatility is anticipated to remain elevated in coming sessions, driven by key macro triggers, including the US-India tariff decision and the RBI rate decision. We foresee the index continuing to consolidate within a defined range of 24,500–25,000 over the near term," its analysts said.

On the higher side, the market could move up to 25,000 and 25,050. On the other side, below 24,600, the sentiment could change. Below the same, traders may prefer to exit out from the trading long positions, Chouhan said.

"While a move above 25,000 will open further pullback towards the key resistance area of 25,250 being the almost identical high of the last 2 weeks," it said.

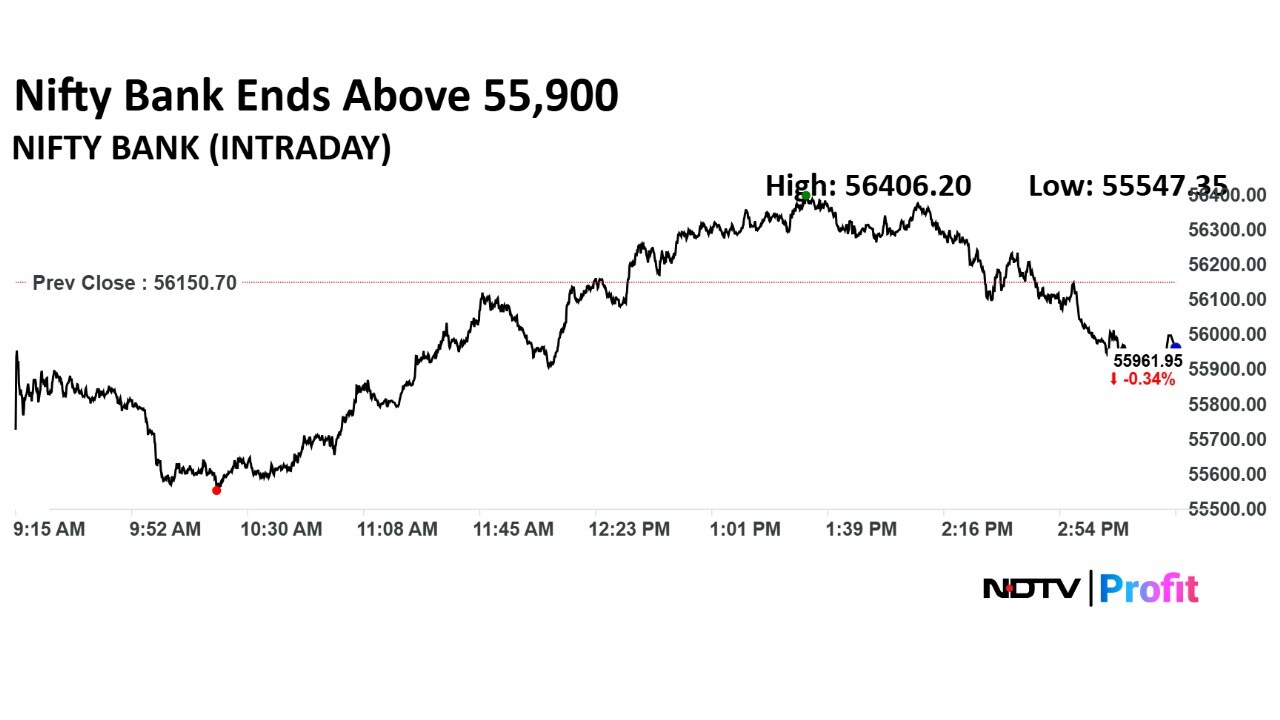

The Bank Nifty formed a bull candle with a long lower shadow, signalling consolidation amid stock-specific action on the monthly futures and options expiry.

"On the higher side, key resistance is placed at 56,300-56,500 levels being the lower band of the recent breakdown area. Overall, the index is likely to consolidate in the range of 55,000-56,400 in the coming sessions.," the analysts from BajaJ Broking said.

Market Recap

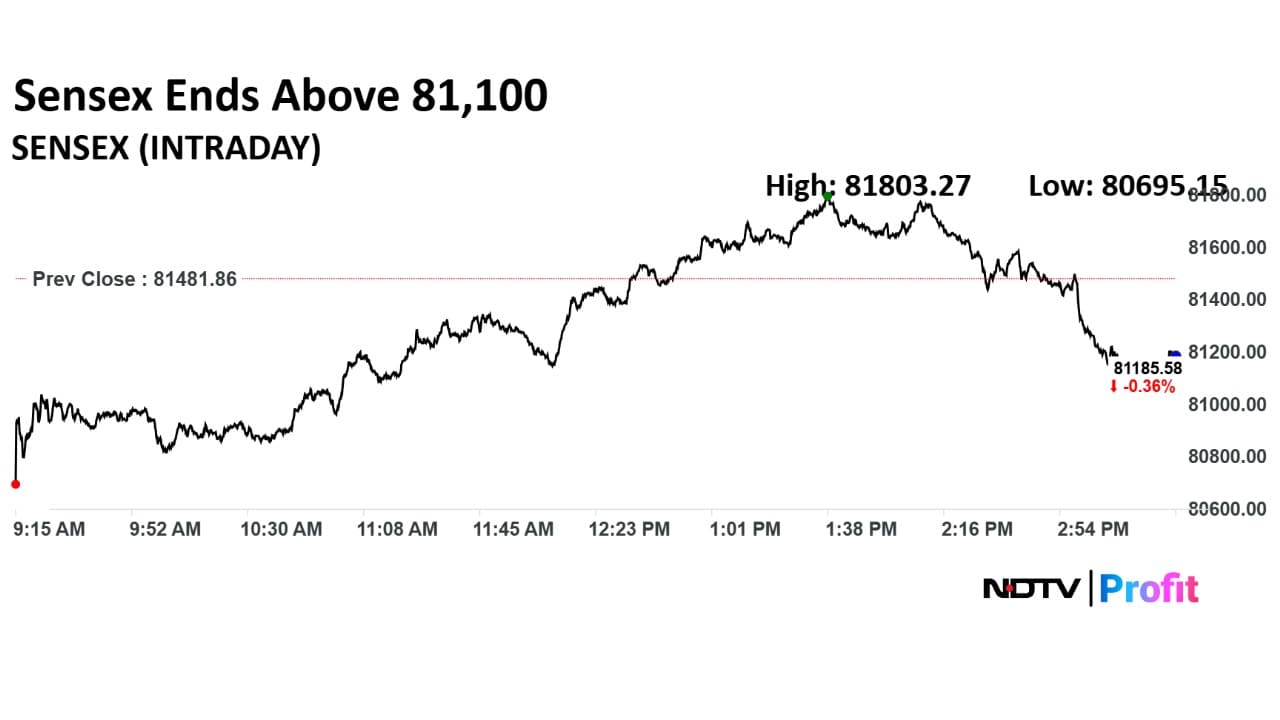

Indian stock markets snapped a four-month rally to end July in losses as simmering trade tensions with the US triggered a risk-off sentiment and caused a flight of foreign capital. Both the Nifty 50 and BSE Sensex shed 2.9% this month.

The Nifty settled 86.7 points or 0.35% lower at 24,768.35 on Thursday, when monthly futures contracts expired. The BSE Sensex lost 296.28 points or 0.36% to close at 81,185.58.

Currency Recap

The Indian rupee closed 17 paise weaker at 87.6 against the dollar on Thursday, extending its decline amid rising India-US trade tensions and firm crude oil prices.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.