- TCS Q2 net profit fell 5.4% sequentially to Rs 12,075 crore due to restructuring costs

- Revenue from operations rose 3.7% to Rs 65,799 crore in the second quarter

- Operating profit (EBIT) increased 7% to Rs 16,565 crore with a 25.2% margin

Tata Consultancy Services Ltd. shares fell during early trade on Friday, after its second-quarter financial results. The management highlighted that clients remain cautious, leading to tight discretionary budgets and project delays.

Consolidated net profit dropped of 5.4% sequentially to Rs 12,075 crore, due to exceptional restructuring expenses. Revenue from operations rose 3.7% to Rs 65,799 crore.

On the operating front, the core profitability or EBIT (earnings before interest and taxes) of the IT major rose 7% to Rs 16,565 crore compared to Rs 15,514 crore on a sequential basis. EBIT margin expanded 25.2%.

Total contract value (TCV) of deals in the Sept. quarter stood at $10 billion, compared to $9.4 billion in the July quarter.

TCS announced a second interim dividend of Rs 11 per equity share for FY26. The company will distribute nearly Rs 3,979 crore to shareholders.

Analysts had a split view on India's largest IT player, with some maintaining a cautious or neutral stance, and others more optimistic, focusing on strong deal momentum and bottoming-out trends. The stock received share price target hikes from multiple brokerages.

Read TCS Q2 Results — Five Key Highlights

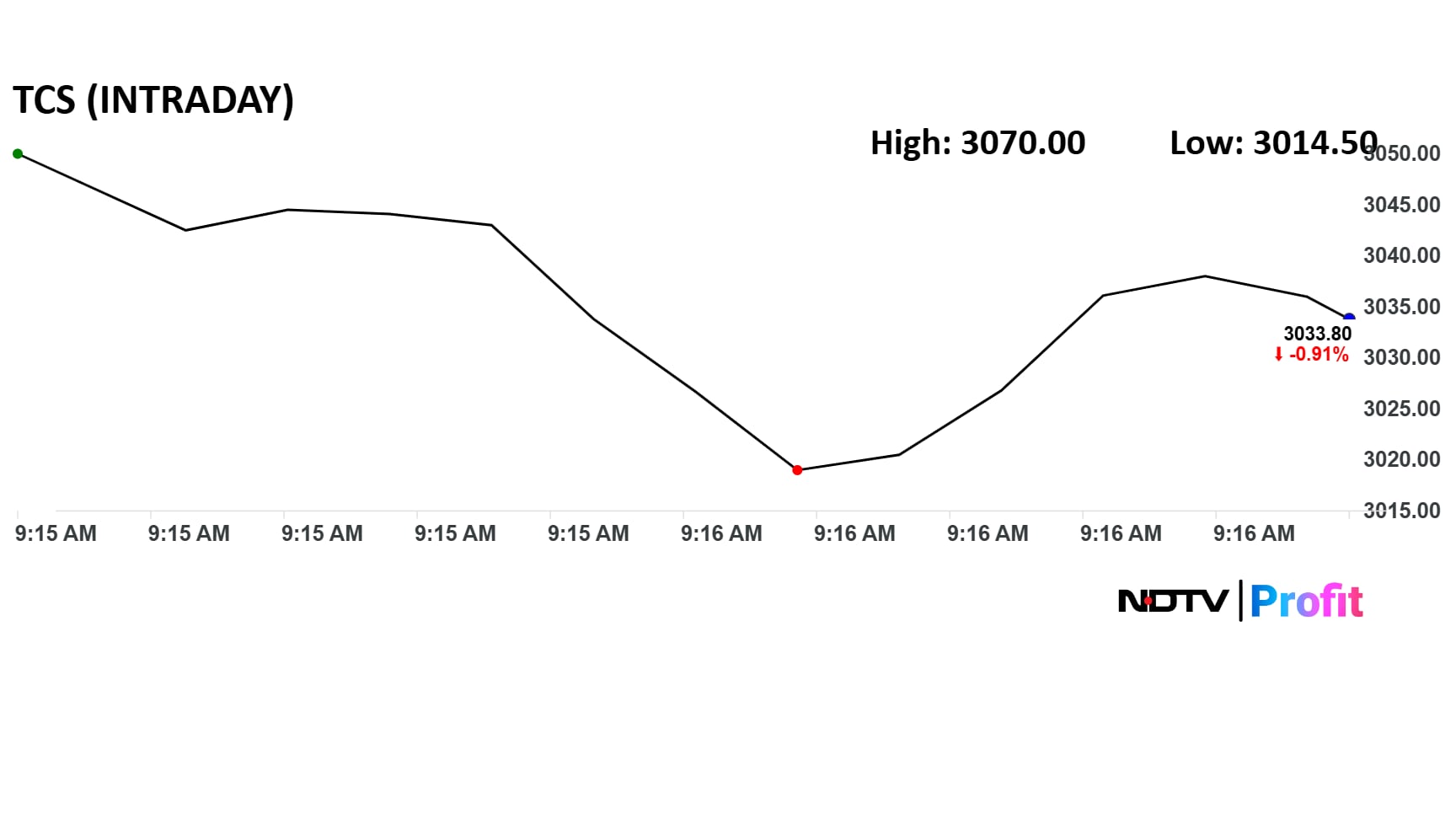

TCS Share Price Movement

TCS share price fell 1.5% intraday to Rs 3,014 apiece.

TCS share price fell 1.5% intraday to Rs 3,014 apiece. The benchmark Nifty 50 was up 0.1%.

The total traded turnover was Rs 371 crore on the NSE. The relative strength index was at 61.

The TCS share price has declined 25% so far this year and 33% from its all-time high in August 2024.

Out of the 51 analysts tracking TCS, 33 have a 'buy' rating on the stock, 13 recommend a 'hold', and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets is Rs 3,517, which implies a potential upside of 15% over the previous close.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.