That's all for today folks. While the market has extended its decline don't get disheartened and hold on to your portfolio for the long run.

In a market landscape that is increasingly obsessed with immediate gratification, two of the industry’s leading investment voices are sounding a stern warning against 'myopia'.

Read more here.

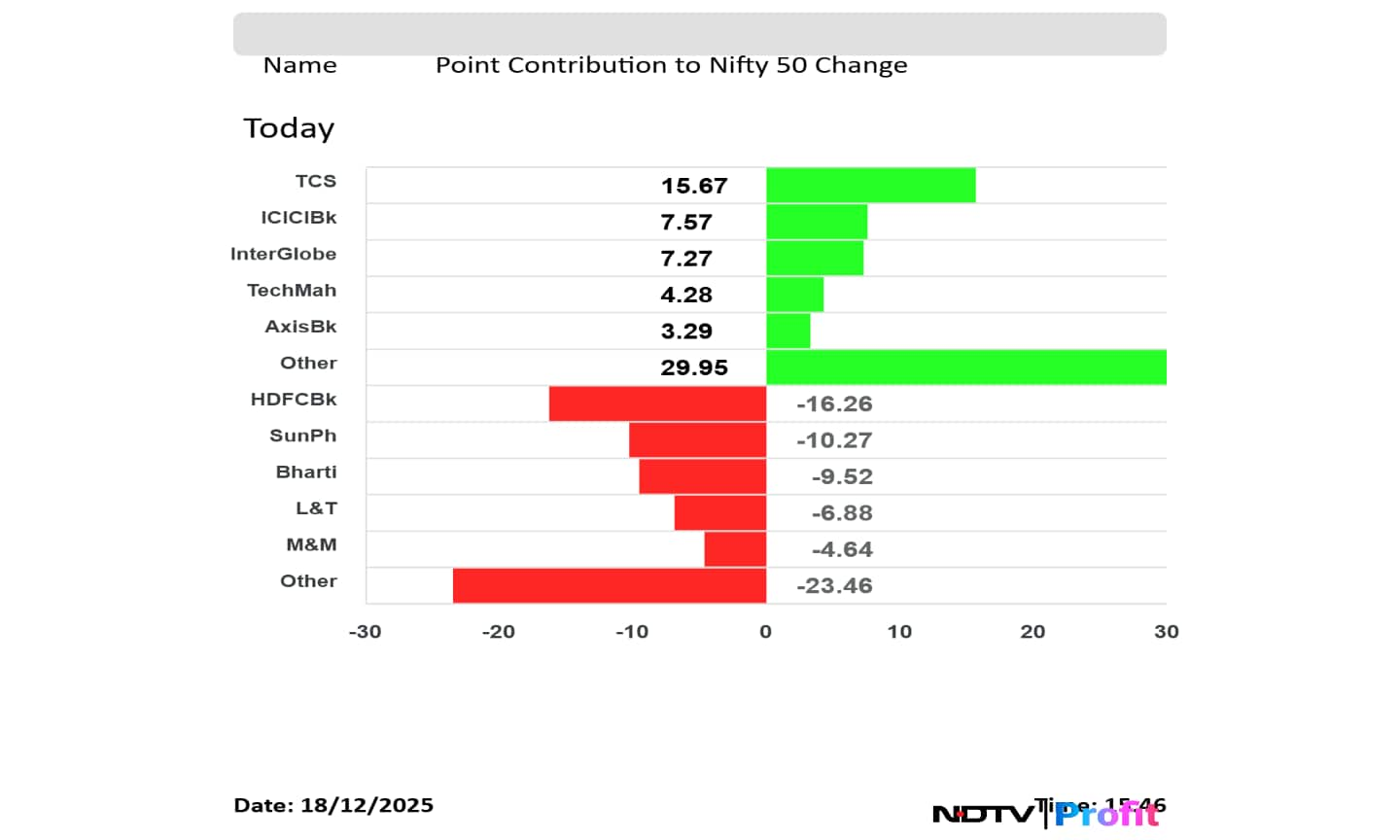

TCS, ICICI Bank, InterGlobe Aviation, Tech Mahindra and Axis Bank emerged as the top gainers for the day.

On the other hand, HDFC Bank, Sun Pharma, Bharti Airtel, L&T and M&M were the worst performers of the Nifty 50 index.

TCS, ICICI Bank, InterGlobe Aviation, Tech Mahindra and Axis Bank emerged as the top gainers for the day.

On the other hand, HDFC Bank, Sun Pharma, Bharti Airtel, L&T and M&M were the worst performers of the Nifty 50 index.

Broader indices closed mixed. Nifty Midcap 150 ended 0.21% higher and Nifty Smallcap 250 closed 0.11% lower. Nifty Smallcap closes lower for the third straight session.

The market breadth was skewed in the favour of sellers, as 2,505 stocks declined, 1,631 advanced and 209 remained unchanged on the BSE.

Nifty PSU Bank gains for the second consecutive day.

Nifty Realty snap three day losing streak.

Nifty Auto falls for the fourth consecutive day.

Nifty Metal gains for the second consecutive day.

Nifty Financials snaps three-day losing streak.

Nifty Bank and FMCG falls for the third consecutive day.

Nifty Media falls for the second consecutive day.

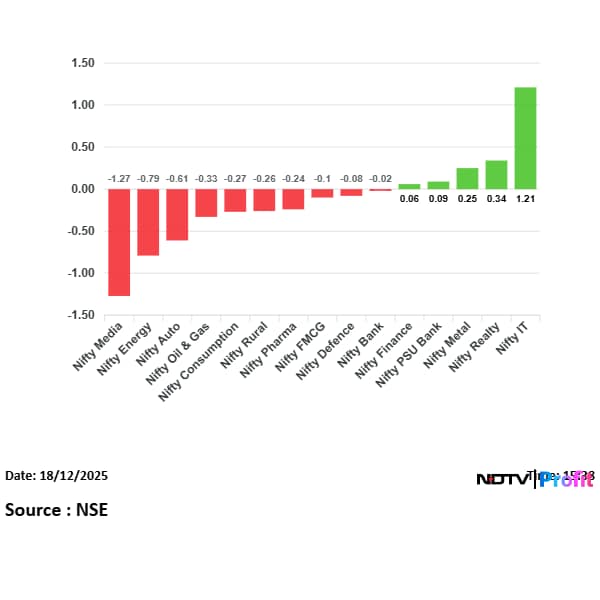

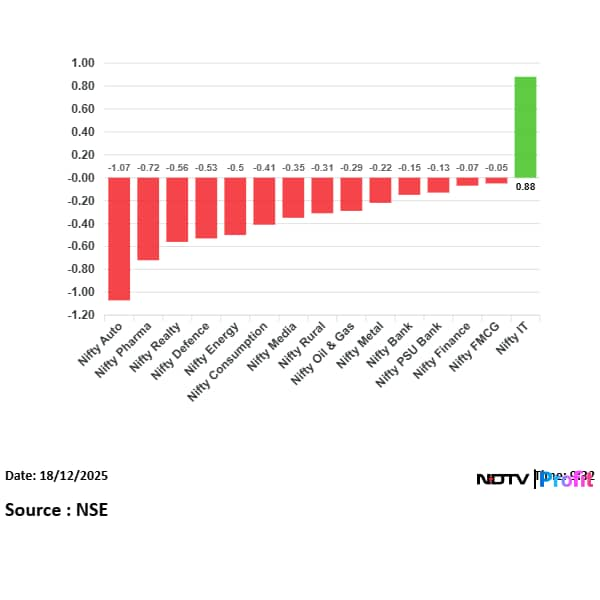

Most sectoral indices fell with Nifty Media leading the decline. Nifty IT emerges as the top gaining sector ahead of Accenture first quarter results

TCS and LTTS are the top gainers in Nifty IT.

Most sectoral indices fell with Nifty Media leading the decline. Nifty IT emerges as the top gaining sector ahead of Accenture first quarter results

TCS and LTTS are the top gainers in Nifty IT.

The benchmark equity indices extend loosing streak for the fourth day on Thursday. This was after the markets had gained nearly 0.30%.

Intraday, both Nifty and Sensex had fallen nearly 0.36%.

Nifty ends 3 points or 0.01% lower at 25,815.55.

Sensex ends 77.84 points or 0.09% down at 84,481.81.

The benchmark equity indices extend loosing streak for the fourth day on Thursday. This was after the markets had gained nearly 0.30%.

Intraday, both Nifty and Sensex had fallen nearly 0.36%.

Nifty ends 3 points or 0.01% lower at 25,815.55.

Sensex ends 77.84 points or 0.09% down at 84,481.81.

Maintain Buy with target price of Rs 1500, implying a 45% upside

Max Enters Pune Market with 450 Bed Hospital Project

Pune market is a major urban centre and one of Maharashtra’s key healthcare hub

This aligns with its broader expansion strategy

Max continues to show solid execution in existing assets

Believe that the recent stock correction provides an attractive entry point

An FIR has been filed against Sammaan Capital; ED probes alleged fund misappropriation, as per media reports.

Sameer Gehlot, firm accused of deliberate fraud amid ED investigation.

Shares of Ola Electric Mobility Ltd. remained under pressure, trading at record lows after a sharp sell-off triggered by promoter stake monetisation and rising concerns over the company’s competitive position. The stock slipped over 5% intraday to around Rs 31.13 on the NSE.

On the institutional side, mutual funds and global asset managers have not exited en masse despite the sharp correction. Motilal Oswal Asset Management holds about 2.5%, while Citigroup, Mirae Asset, Vanguard Group, Norges Bank and BlackRock continue to feature among the top shareholders, albeit with smaller individual stakes.

For India’s multiplex business, December is less about the calendar and more about whether audiences will step out, spend, and stay long enough to make the numbers work. The box office run of Dhurandhar has emerged as a defining factor in PVR INOX’s strong year-end performance, helping the multiplex chain convert December into one of its best months of the year, according to Gautam Dutta, the Chief Executive Officer – Revenue and Operations at PVR INOX.

Read the full story here.

Among other important news on Thursday, the Lok Sabha passed on Thursday the Viksit Bharat — Guarantee for Rozgar and Ajeevika Mission (Gramin) Bill or the VB G RAM G Bill.

The bill, which seeks to repeal the two-decade-old Mahatma Gandhi National Rural Employment Guarantee Act, increases the number of guaranteed wage employment days in a fiscal year to 125 from 100 offered under MGNREGA.

At a time when semiconductor manufacturing capabilities are deciding the power dynamics of the global tech world, Intel India President Gokul V Subramaniam has hailed the nation as a great market for chip manufacturing.

In a conversation with NDTV Profit, Subramaniam highlighted that India remains an attractive market for Intel, more so because of the talent pool the country has to offer.

Read more here.

Over 1.4 million shares of Federal Bank were traded via a block deal on Thursday. The share of Federal Bank rose as much as 1.33% to Rs 266.75 apiece.

Indian equities were trading higher snapping its three-day loosing streak. Nifty fell nearly 0.22% at 25,801.80 and Sensex fell nearly 194.61 points to 84,485.25 as of 12 p.m.

Intraday, both Nifty and Sensex fell nearly 0.40% before it saw recovery.

Nifty fell 0.36% at 25,726.30 but recovered to hit intraday high of 0.27% at 25,888.05.

Sensex fell 0.38% to 84,238.43 before it recovered and gained as much as 0.22% to 84,744.21.

Broader indices were trading mixed. Nifty Midcap 150 rose 0.28%; Nifty Smallcap 250 was trading 0.04% lower.

Most sectoral indices rose, led by Nifty IT and Nifty Metal. Nifty Media and Nifty Auto were among sectors in the red.

Nifty Bank rose 0.41%, Nifty IT was up nearly 0.92%.

ICICI Bank, TCS, RIL, InterGlobe and Axis Bank were top Nifty gainers.

Sun Pharma, HDFC Bank, M&M, Power Gird and NTPC were top Nifty losers.

Over 2.01 million shares of ICICI Prudential were traded via a block deal on Thursday. The share of Power Grid rose as much as 0.76% to Rs 635.60 apiece.

Delhi Airport Sources:

22 flights cancelled at Delhi Airport due to fog

11 departures & 11 arrivals have been cancelled

ICICI Prudential Life Insurance Co. has 2.01 million shares change hands in a block trade. Shares of the company are currently trading 0.50% up at Rs 633.65 apiece.

Morgan Stanley says:

Indonesian government announced that, effective Jan. 1, 2026, it will impose a 1% to 5% tax on coal exports.

In the current demand and pricing scenario, if costs were to be fully absorbed, Tata Power’s FY27-28 EPS would be impacted by 4-5%.

Miners could look to pass on the impact of the tax to their customers.

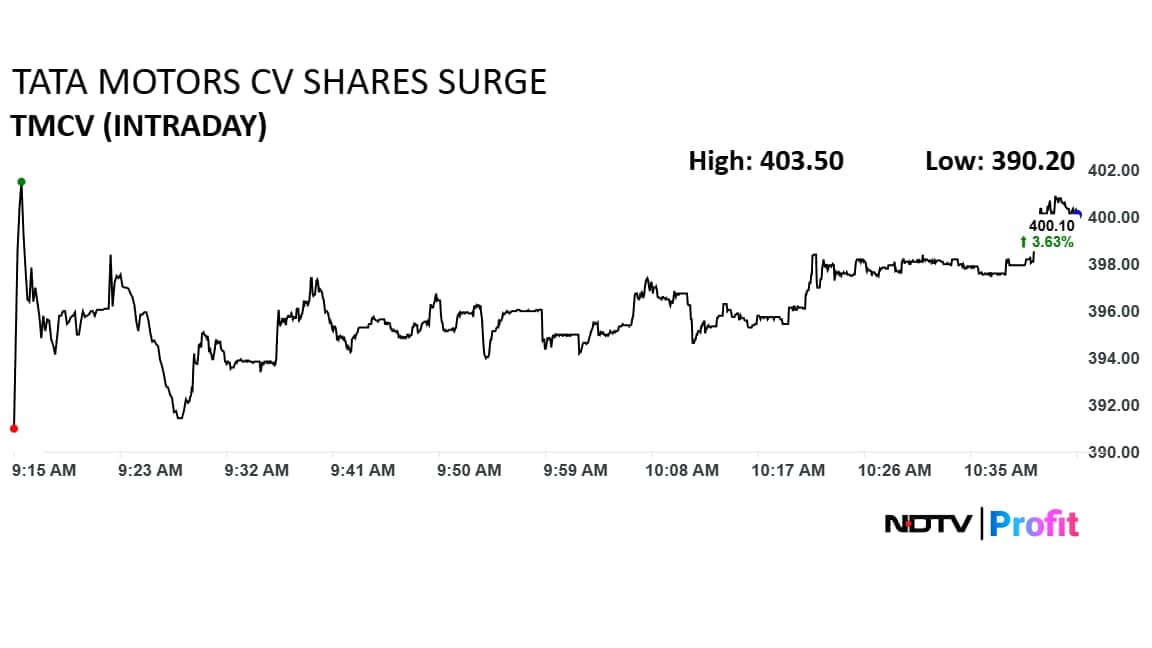

Shares of Tata Motors Commercial Vehicle Ltd. have surged in trade on Thursday after top brokerages such as JPMorgan and Bank of America initiated their coverage on the counter.

The stock is currently trading at Rs 400, reaching an intraday high of 403. This accounts for gains of more than 3.5% compared to Wednesday's closing price of Rs 386.1.

Shares of Tata Motors Commercial Vehicle Ltd. have surged in trade on Thursday after top brokerages such as JPMorgan and Bank of America initiated their coverage on the counter.

The stock is currently trading at Rs 400, reaching an intraday high of 403. This accounts for gains of more than 3.5% compared to Wednesday's closing price of Rs 386.1.

The shares of Crompton Greaves Consumer rose as much as 6% on Thursday after MOSL initiates buy coverage with a target price of Rs 350 per share.

The shares of Crompton Greaves Consumer rose as much as 6% on Thursday after MOSL initiates buy coverage with a target price of Rs 350 per share.

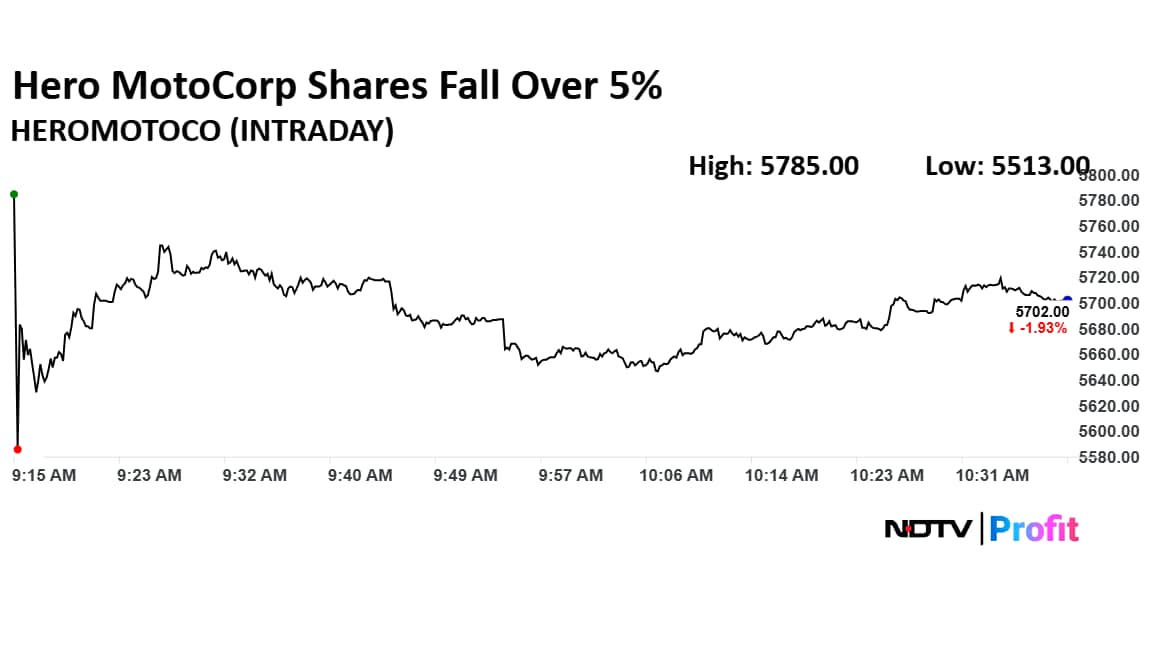

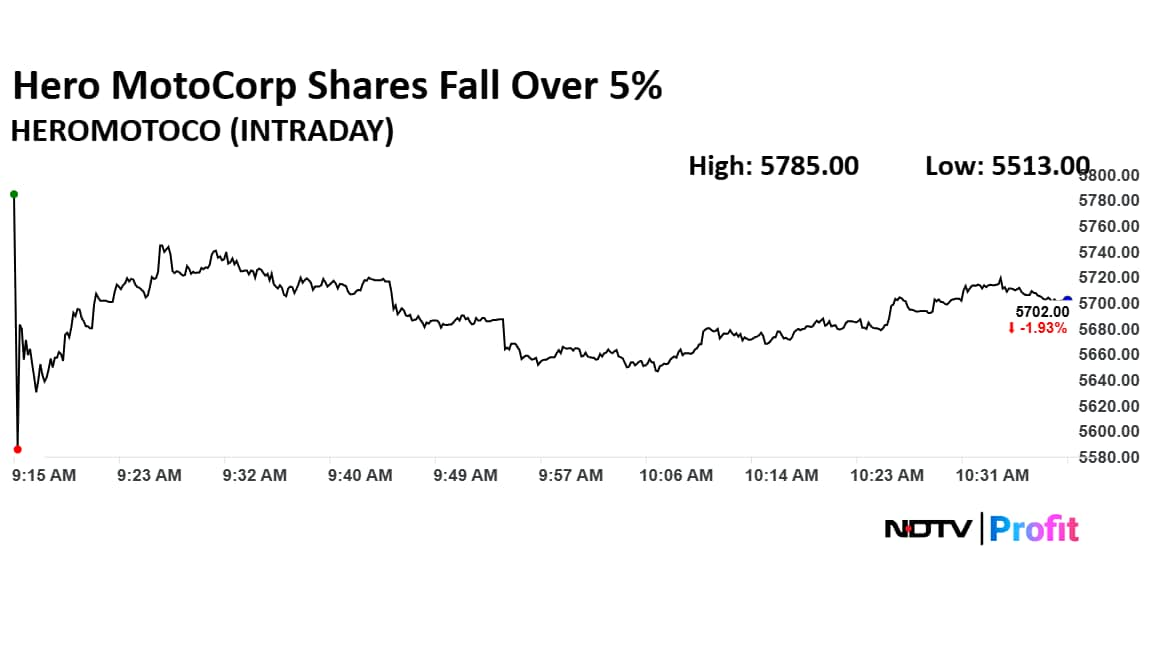

Hero MotoCorp shares fall over 5% after Jefferies downgrades it to Underperform from Hold and cut its target price to Rs 4,950 from Rs 5,550, implying a downside of around 15%.

Hero MotoCorp shares fall over 5% after Jefferies downgrades it to Underperform from Hold and cut its target price to Rs 4,950 from Rs 5,550, implying a downside of around 15%.

The world’s best-performing stock is turning into a cautionary tale for investors chasing outsized returns from the artificial-intelligence boom.

Little-known until recently even within its home market of India, RRP Semiconductor Ltd. became a social-media obsession as its shares surged more than 55,000% in the 20 months through Dec. 17 — by far the biggest gain worldwide among companies with a market value above $1 billion.

Read more here.

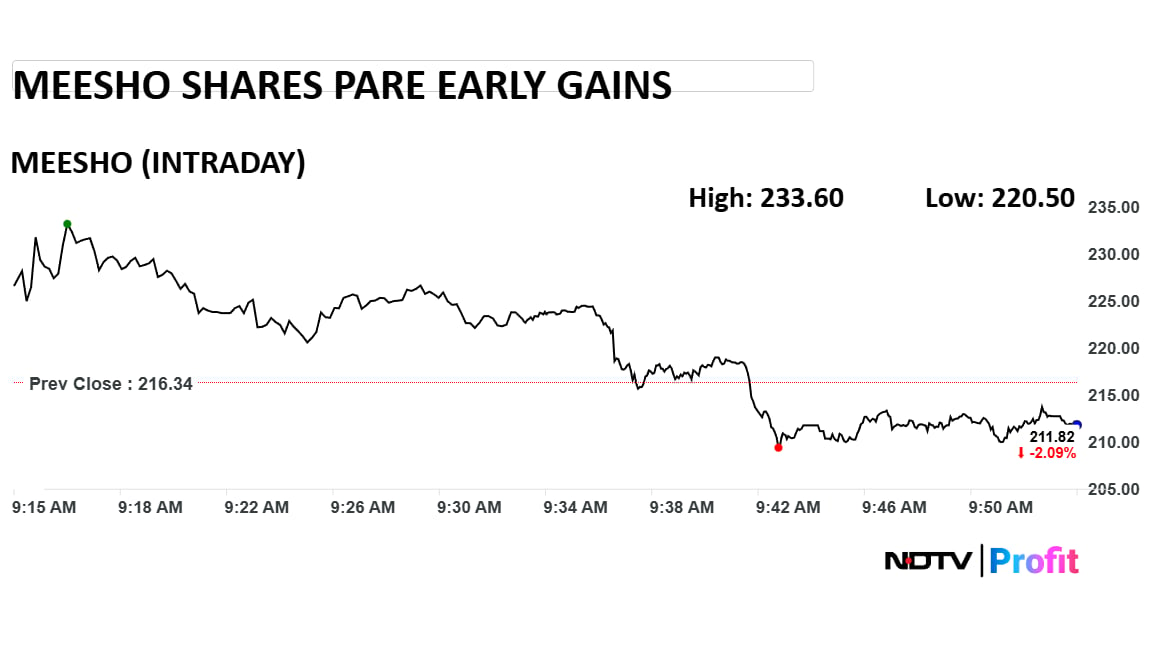

After being locked in an upper circuit on Wednesday, shares of Meesho had initially continued their upward trend on early Thursday trade, rising up to 4%. However, since then, the stock has fallen considerably.

The stock is currently trading at Rs 211, which accounts for fall of more than 2%. This compares to Wednesday's closing price of Rs 216.

After being locked in an upper circuit on Wednesday, shares of Meesho had initially continued their upward trend on early Thursday trade, rising up to 4%. However, since then, the stock has fallen considerably.

The stock is currently trading at Rs 211, which accounts for fall of more than 2%. This compares to Wednesday's closing price of Rs 216.

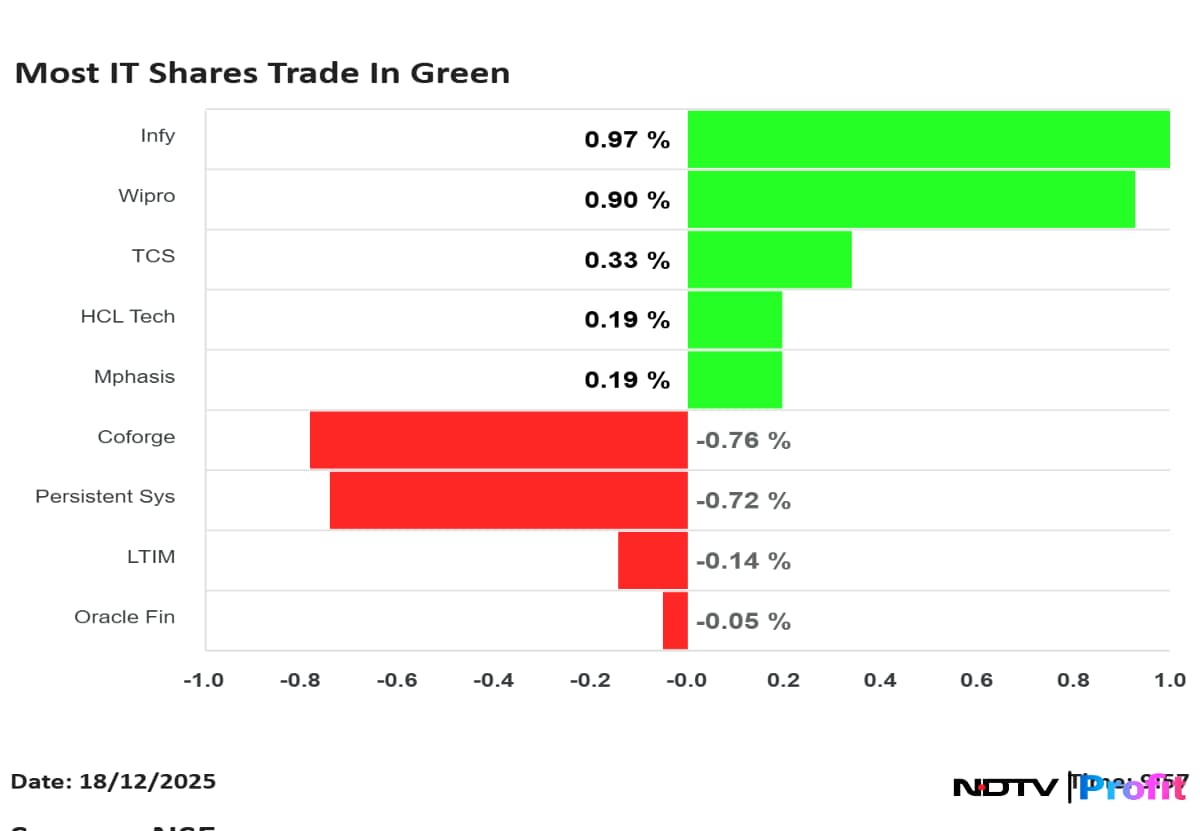

Nifty IT was the only sector to trade in the green, the gains were led by Infosys, Wipro and TCS.

Nifty IT was the only sector to trade in the green, the gains were led by Infosys, Wipro and TCS.

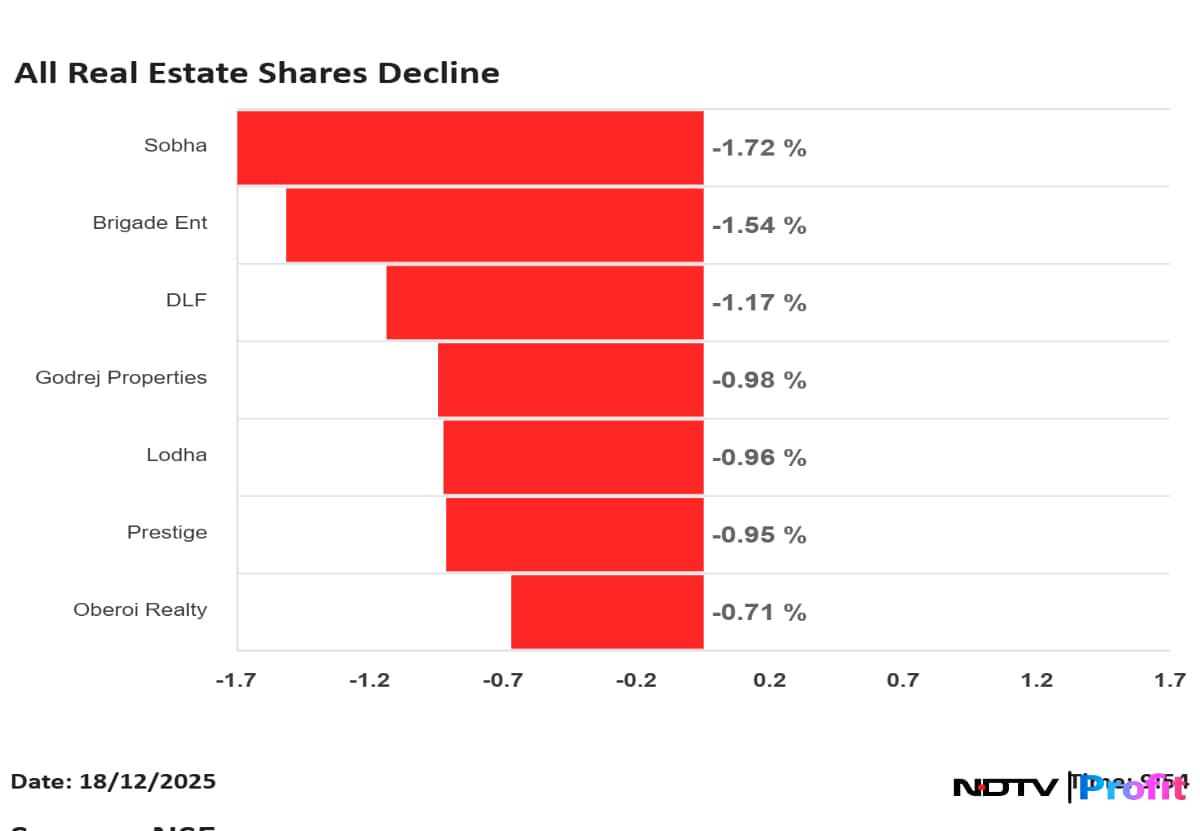

The markets have been painted in red mostly, with all real estate stocks trading lower. Sobha and Brigade Enterprises lead the decline.

The markets have been painted in red mostly, with all real estate stocks trading lower. Sobha and Brigade Enterprises lead the decline.

Shares of Ola Electric Mobility Ltd. on Thursday fell by 3% at Rs 32.22 a piece.

Wednesday, Bhavish Aggarwal, Ola Electric Mobility Ltd. founder and promoter, sold another lot of shares worth Rs 142 crore via open market transactions.

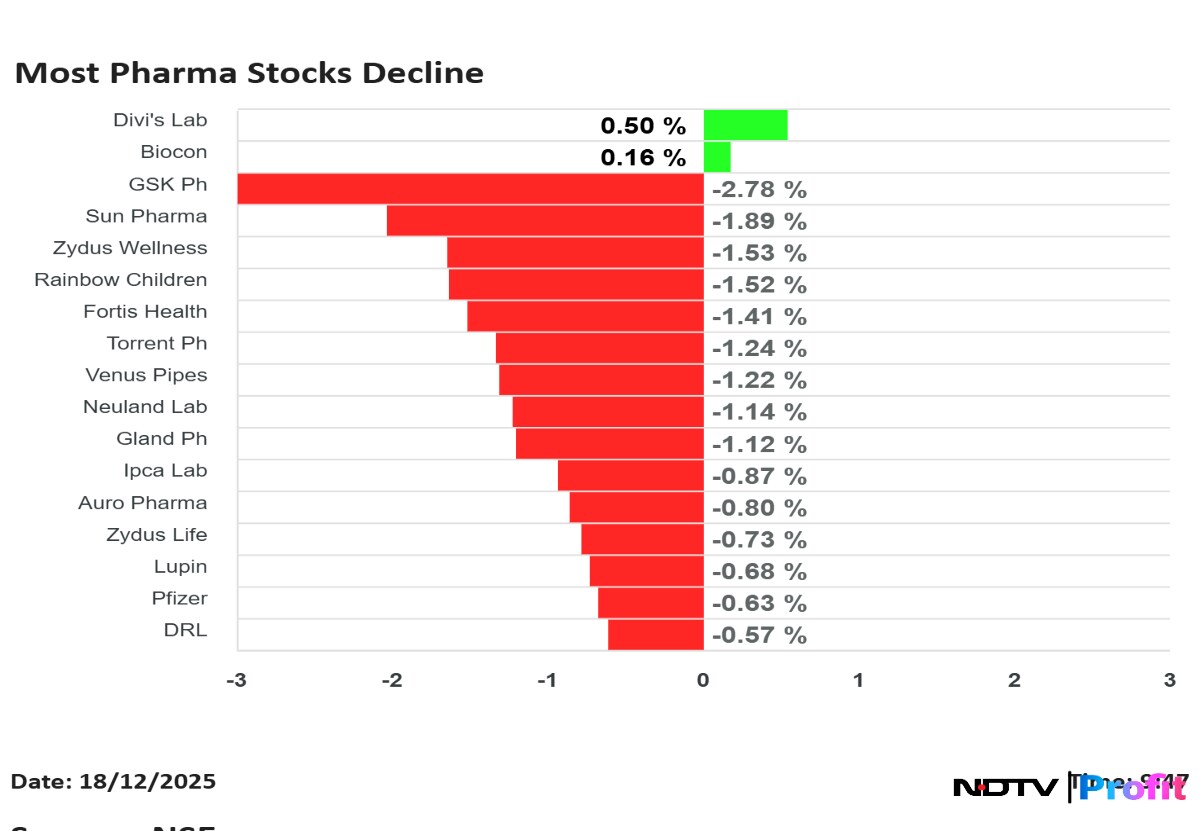

Most pharma shares decline on Thursday with GSK Pharma and Sun Pharma leading the decline. However, Divi's Lab and Biocon were the only shares in green.

Most pharma shares decline on Thursday with GSK Pharma and Sun Pharma leading the decline. However, Divi's Lab and Biocon were the only shares in green.

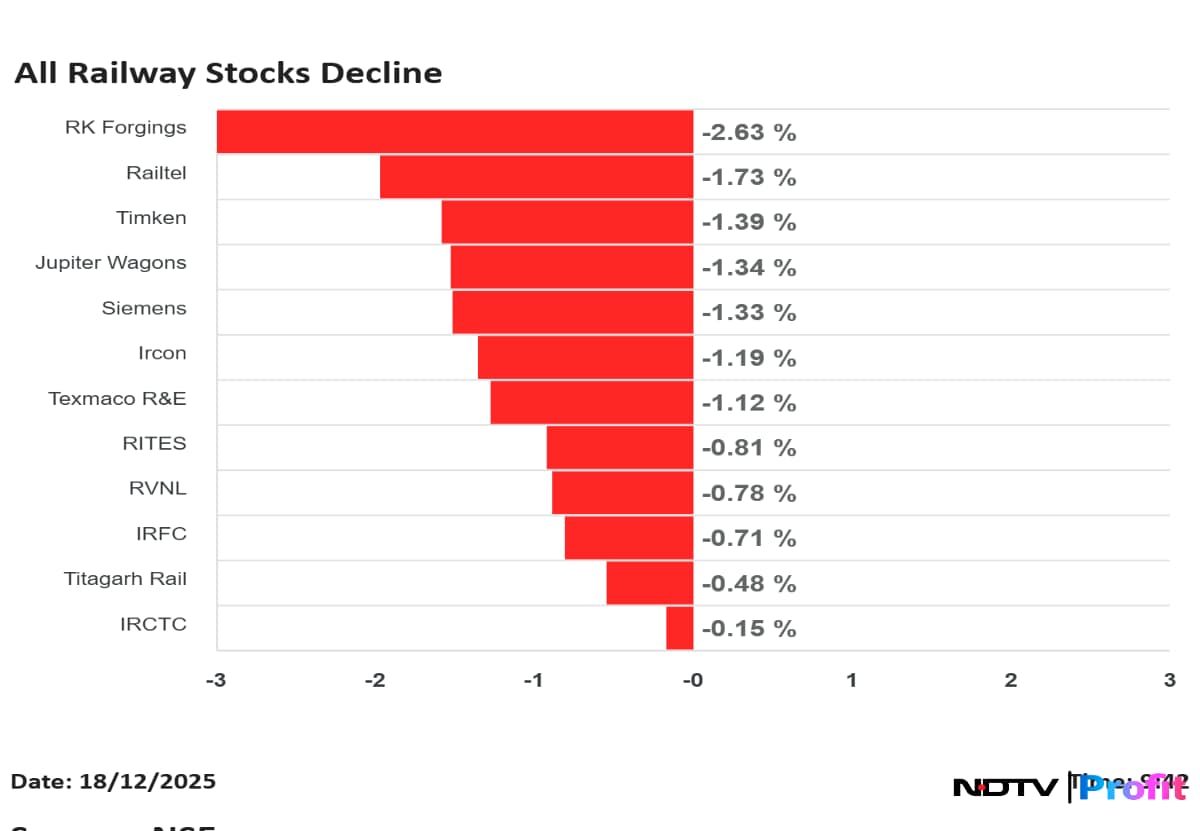

As the markets extend decline for the fourth day, with RK Forgings and Railtel leading the decline.

As the markets extend decline for the fourth day, with RK Forgings and Railtel leading the decline.

Shares of KPI Green Energy are buzzing on Thursday's trade after the company announced a memorandum of understanding (MoU) with government of Botswana for large-scale renewable energy and power infrastructure development.

The stock is currently trading at Rs 430, which accounts for gains of 3.3% compared to Wednesday's closing price of Rs 416.9. Over a year-to-date period, the stock has fallen just over 21%.

On NSE, 14 of the 15 sectors were in the red. Nifty Auto fell the most while Nifty IT was the only sector in green.

Broader markets were also in the red, with the NSE Midcap 150 trading 0.18% lower and NSE Smallcap was trading 0.38% lower.

On NSE, 14 of the 15 sectors were in the red. Nifty Auto fell the most while Nifty IT was the only sector in green.

Broader markets were also in the red, with the NSE Midcap 150 trading 0.18% lower and NSE Smallcap was trading 0.38% lower.

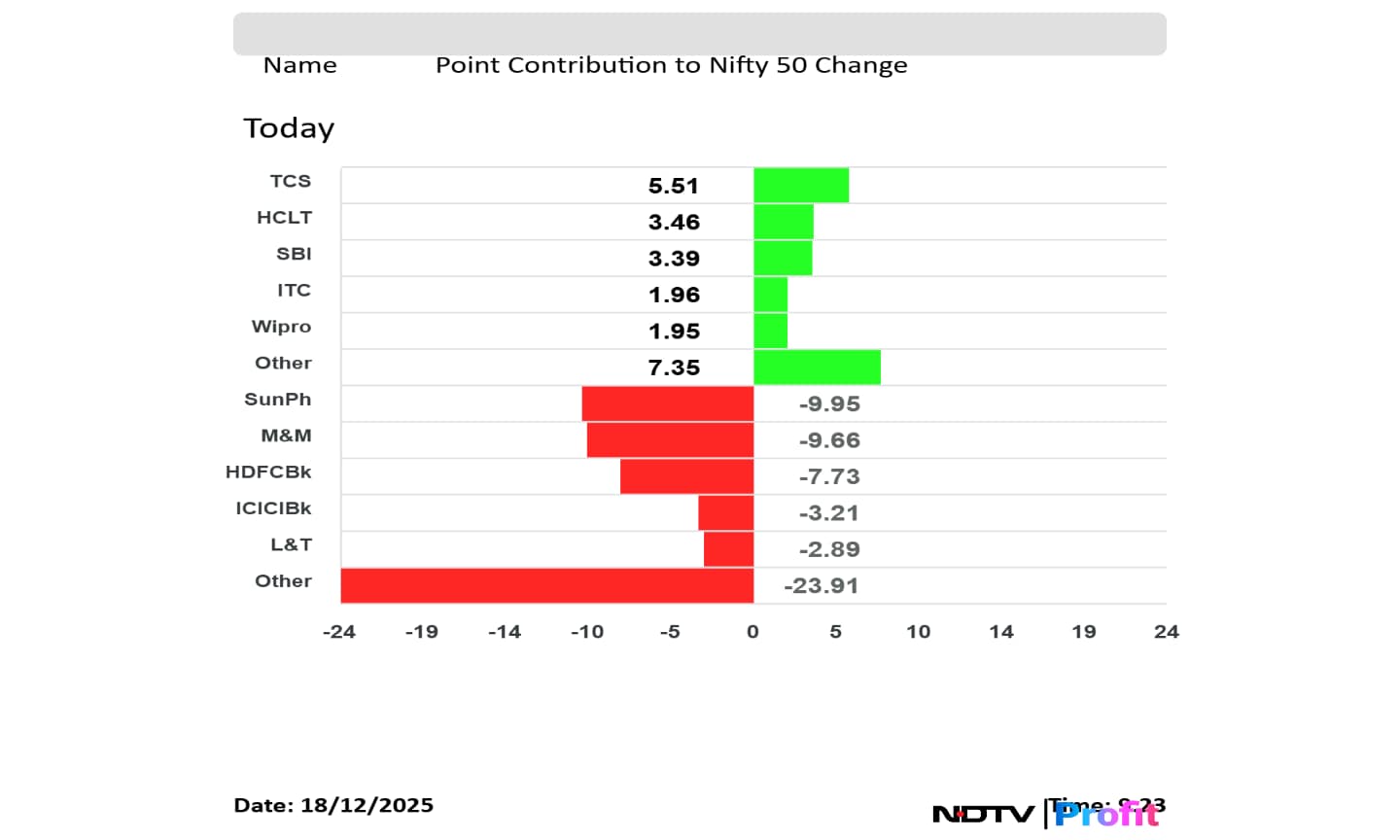

Sun Pharma, M&M, HDFC Bank, ICICI Bank and L&T weighed on the Nifty 50 index.

TCS, HCLT, SBI, ITC and Wipro added to the Nifty 50 index.

Sun Pharma, M&M, HDFC Bank, ICICI Bank and L&T weighed on the Nifty 50 index.

TCS, HCLT, SBI, ITC and Wipro added to the Nifty 50 index.

At pre-open, the NSE Nifty 50 was trading 53.85 points or 0.21% lower at 25,764.70. The BSE Sensex was down 0.08% or 68.35 points at 84,491.30.

Rupee opens flat at 90.37 against US Dollar. It closed at 90.38 on Thursday.

Source: Bloomberg

Shares of Tata Motors Commercial Vehicles Ltd. will be worth keeping an eye on, heading into Thursday's trade, after two big brokerage houses - JPMorgan and Bank of America - initiated coverage on the counter with a positive rating.

Interestingly, both brokerage firms have given an identical target price on Tata Motors CV, which is the commercial vehicle arm of the Tata Motors entity that got demerged recently.

Read full story here.

Shares of One97Communication, the parent organisation of payment aggregator platform Paytm, will be in focus heading into Thursday's day of trade following a recent authorisation from the Reserve Bank of India.

The central bank has granted Paytm the authorisation to operate not only as an online but an offline payment aggregator as well. RBI has also given authorisation for Paytm to operate cross-border transactions for both inward and outward flows, the company confirmed through an exchange filing.

Nifty December futures down by 0.12% to 25,910 at a premium of 92 points.

Nifty December futures open interest up by 1.69%.

Nifty Options on Dec 23: Maximum Call open interest at 26,000 and Maximum Put open interest at 25,000.

The US Dollar index is up 0.04% at 98.070.

Euro was down 0.01% at 1.1739.

Pound was down 0.05% at 1.3366.

Yen was up 0.08% at 155.78.

Volatility rattled Wall Street as high-priced technology stocks and cryptocurrencies slid, while bonds trimmed earlier losses after a senior Federal Reserve official hinted there was scope for interest-rate cuts.

Technology shares bore the brunt of the selloff amid rising doubts over the sustainability of the artificial-intelligence rally. Nvidia Corp. dropped 3.8%, and losses deepened after the S&P 500 slipped below a key technical level, ending the session down 1.2%. The Nasdaq 100 fared worse, sliding 1.9%, reports Bloomberg.

Asian stocks started the day on a weaker note after losses on Wall Street, as global markets slipped back into a risk-off mood. Concerns around technology shares weighed on equities, while shorter-dated Treasuries and precious metals found support.

Good morning readers.

The GIFT Nifty was trading above 25,800 early on Thursday. The futures contract based on the benchmark Nifty 50 fell 0.12% at 25,859 as of 7:05 a.m. indicating a negative start for the Indian markets.

In the previous session on Wednesday, the benchmark equity extended decline for the third day. The NSE Nifty 50 ended 41.55 points or 0.16% lower at 25,818.55, while the BSE Sensex closed 120.21 points or 0.14% lower at 84,559.65.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.