The Indian benchmark indices extended their losses to the third consecutive week as earnings woes continue to hurt investor sentiments. The key gauges snapped their two-day gains on Friday, weighed by a fall in heavyweights HDFC Bank Ltd. and Reliance Industries Ltd.

The S&P BSE Sensex closed 329.92 points or 0.43% down at 76,190.46, while the NSE Nifty 50 was 113.15 points or 0.49% lower at 23,092.20. During the day, the Nifty fell 0.67% to 23,050, and the Sensex declined 0.56% to 76,091.7.

The Indian rupee strengthened 26 paise to close at 86.21 against the greenback. Global funds continued to be net cash sellers to the tune of Rs 61,094 crore, to date this month, according to National Securities Depository Ltd.

Net selling by foreign investors are adding pressure on the market performance, according to Shrikant Chouhan, head of equity research at Kotak Securities. Third-quarter earnings season has been largely in line with our subdued expectations, he said.

Most Asian stocks advanced on Friday on US President Donald Trump's push for interest-rate cuts and a potentially softer approach toward tariffs on China. The yen strengthened, while Japanese stocks rose after the central bank raised interest rates to the highest level in 17 years. Trump said in an interview with Fox News that he would rather not have to use tariffs against Beijing.

Multiple events, including global events, upcoming Union Budget, RBI policy and ongoing earnings season, will continue to shape market movements over the next fortnight, Chouhan said.

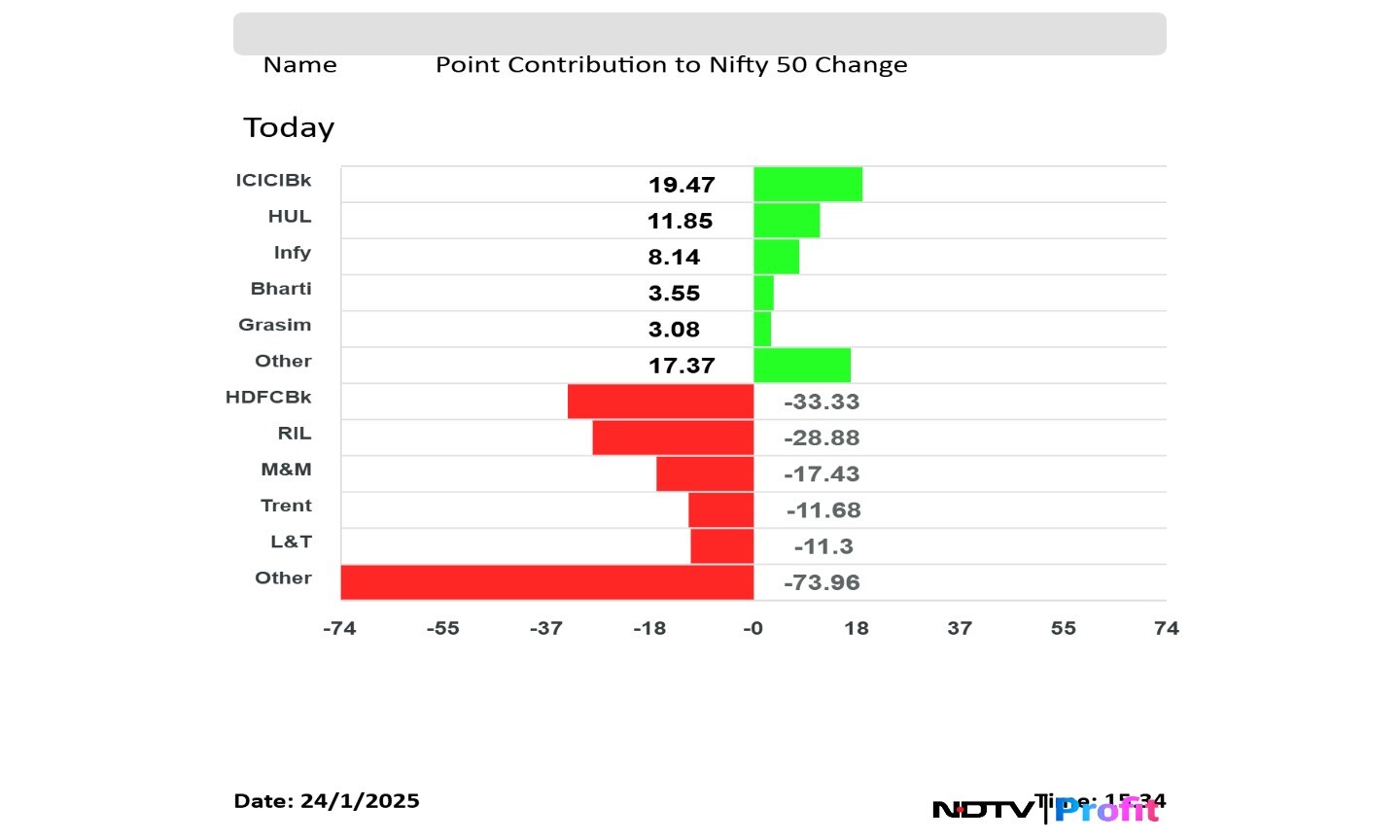

ICICI Bank Ltd., Hindustan Unilever Ltd., Infosys Ltd., Bharti Airtel Ltd. and Grasim Industries Ltd. contributed the most to the gains in the Nifty 50.

HDFC Bank Ltd., Reliance Industries Ltd., Mahindra & Mahindra Ltd., Trent Ltd. and Larsen & Toubro Ltd. contributed negatively to the benchmark index.

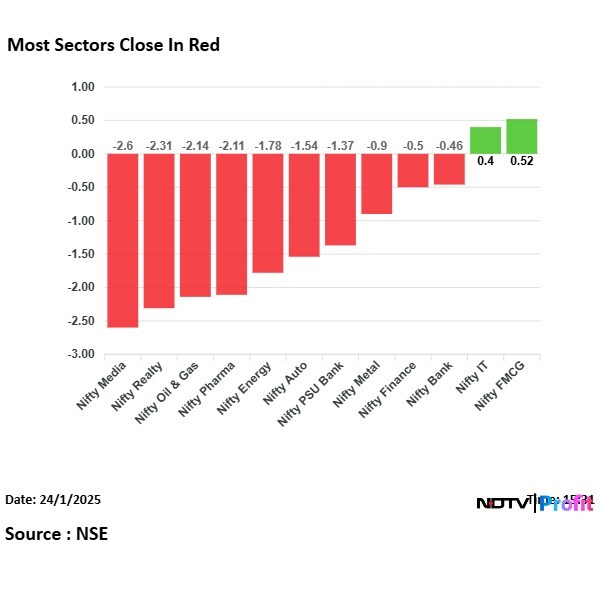

Ten out of the 12 sectors on the NSE declined, with the Nifty Media and Realty falling the most on Friday. The Nifty FMCG and IT rose the most in trade. The Oil & Gas index fell for the fourth day in a row.

The broader indices underperformed as the BSE MidCap closed 1.6% lower and SmallCap ended 2.2% lower.

Only two sectoral indices of the 21 on the BSE ended higher and remaining fell. BSE Realty fell the most.

The market breadth was skewed in favour of the sellers as 2,888 stocks fell, 1,052 rose and 119 remained unchanged on the BSE.

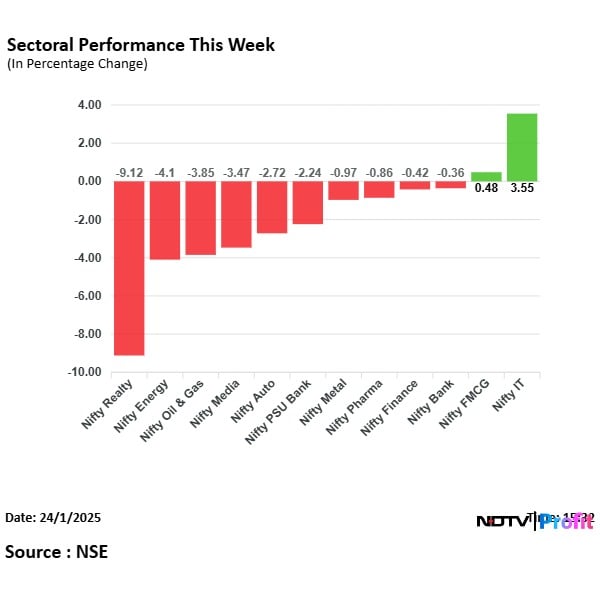

On a weekly basis, the Nifty fell 0.48%, while the 30-stock Sensex slipped 0.56%, led by a fall in Reliance Industries Ltd. and Trent Ltd. The information-technology stocks outperformed all sectors during the week.

The Nifty Realty fell for the 4th week in a row to end the five sessions lower by 9.12%. This was followed by losses in Energy and Oil & Gas stocks. Nifty realty recorded worst week in 10 months, while Nifty Bank declined for the fourth week in a row. Nifty Pharma and Nifty Auto fell for the third week in a row

Here's What To Watch Out For

What To Watch

India Forex Reserves

US PMI Data

China PMI Data

Earnings

Balkrishna Industries

ICICI Bank

IDFC First Bank

JK Cement

Macrotech Developers

NTPC

NTPC Green Energy

Yes Bank

360 One WAM

ACC

Adani Total Gas

Adani Wilmar

Bajaj Housing Finance

Coal India

IOCL

Tata Steel

Shares To Exit Lock-In

Ventive Hospitality

Unimech Aerospace and Manufacturing

Senores Pharmaceuticals

Carraro India

Sanstar

Netweb Tech

Godavari Biorefineries

Epack Durables

Corporate Actions

KEI Industries: Record Date Interim Dividend Rs 4 per share.

Tanla Platforms: Record Date Interim Dividend Rs 6 per share.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.