.jpg?downsize=773:435)

Shares of Tata Steel Ltd., Raymond Ltd. and Thomas Cook Ltd. were in focus on Tuesday, after the companies announced their fourth quarter results.

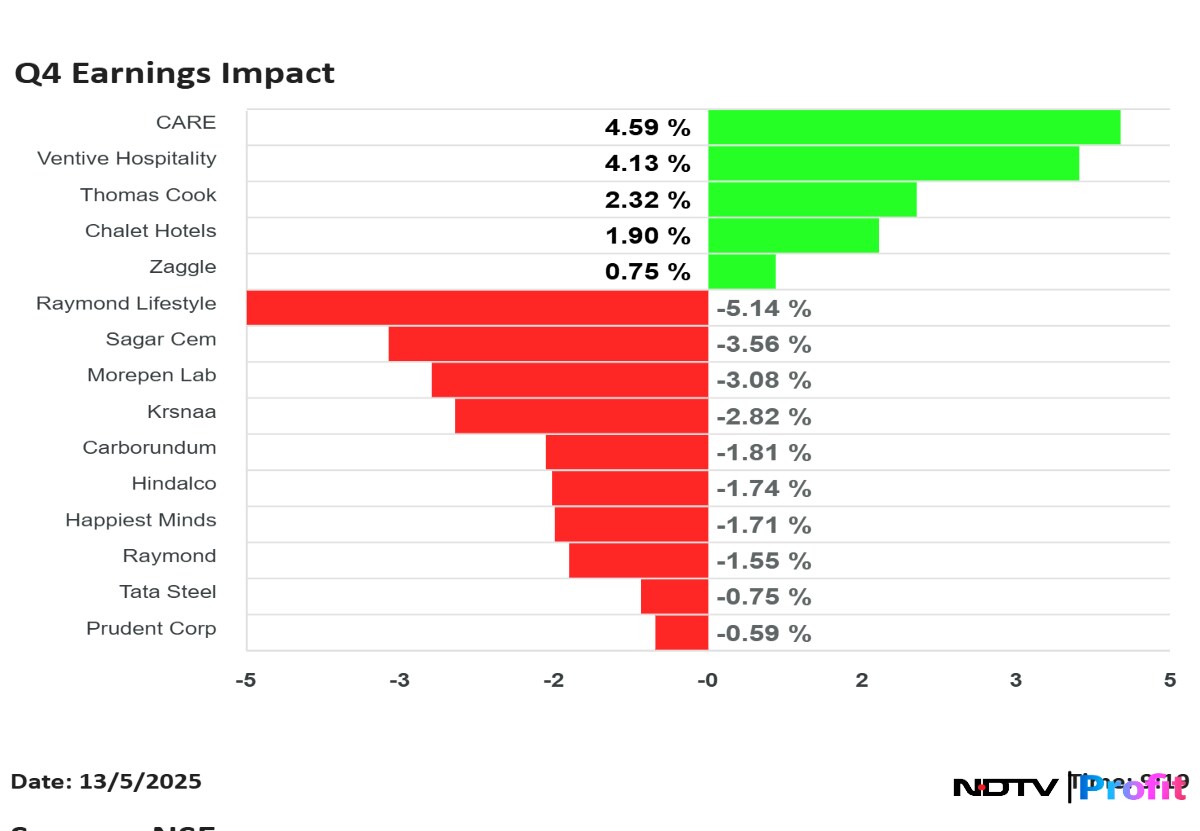

Ventinve Hospitality Ltd. shares rose the most, while Raymond Lifestyle Ltd. fell the most, among the companies that announced their results for quarter ended March.

Tata Steel Q4 Highlights (Consolidated, QoQ)

Share price fell 1.07% at Rs 150.

Revenue rises 4.8% to Rs 56,218 crore versus Rs 53,648.3 crore (Bloomberg estimate: Rs 57,295 crore).

Ebitda up 11.12% at Rs 6,560 crore versus Rs 5,903 crore (Estimate: Rs 6,616.1 crore).

Margin expands 66 basis points to 11.66% versus 11% (Estimate: 11.5%).

Net profit zooms 298% to Rs 1,301 crore versus Rs 326.64 crore (Estimate: Rs 1,160.4 crore).

Carborundum Universal Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 4.24% at Rs 955.70.

Revenue up 1.3% at Rs 1,217 crore versus Rs 1,201 crore.

Ebitda down 0.5% at Rs 1,000.8 crore versus Rs 1,005.6 crore.

Margin at 82.2% versus 83.7%.

Net profit down 78.4% at Rs 29.1 crore versus Rs 134.8 crore.

Zaggle Prepaid Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price rises 3.37% at Rs 379.

Revenue up 22.25% at Rs 412 crore versus Rs 337 crore.

Ebitda up 24.74% at Rs 36.3 crore versus Rs 29.1 crore.

Ebitda margin up 17 bps at 8.81% versus 8.63%.

Net profit up 57.86% at Rs 31.1 crore versus Rs 19.7 crore.

Net profit aided by an increase in other incomes; other income increased by 3.5 times.

Raymond Lifestyle Q4 FY25 Results Highlights (Consolidated, YoY)

Share price fell 6.60% at Rs 938.25.

Revenue down 11.3% at Rs 1,494 crore versus Rs 1,684 crore.

Ebitda down 94.5% at Rs 13.6 crore versus Rs 246.2 crore.

Margin at 1% versus 14.6%.

Net loss of Rs 45 crore versus profit of Rs 236 crore.

Novelis Q4FY25 Results Highlights (Consolidated, QoQ)

Share price down 1.93% at Rs 639.35.

Revenue at $4,587 million versus $4,080 million.

Adjusted Ebitda at $473 million versus $367 million.

Adjusted Ebitda/tonne at $494 versus $406 million.

Volumes 957 KT versus 904 KT.

Krsnaa Diagnostics Q4FY25 Results Highlights (Consolidated, YoY)

Share price 4.03% lower at Rs 710.

Revenue up 12% to Rs 186 crore versus Rs 166.2 crore.

Ebitda up 21.3% to Rs 53 crore versus Rs 43.6 crore.

Margin at 28.4% versus 26.2%.

Net profit up 10% to Rs 20.6 crore versus Rs 18.7 crore.

To pay a final dividend of Rs 2.75 per share.

Sagar Cements Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 4.03% at Rs 211.01.

Revenue down 7% at Rs 658 crore versus Rs 709 crore

Ebitda down 46% at Rs 36.8 crore versus Rs 68 crore

Margin at 5.6% versus 9.6%

Net loss of Rs 73 crore versus profit of Rs 11.6 crore

Chalet Hotels Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rises 3.22% at Rs 897.95.

Revenue up 24.8% to Rs 521.97 crore versus Rs 418.26 crore.

Ebitda up 24% to Rs 339.46 crore versus Rs 272.84 crore.

Margin at 65.0% versus 65.2%.

Net profit up 50% to Rs 123.83 crore versus Rs 82.44 crore.

Morepen Labs Q4 FY25 Results Highlights (Consolidated, YoY)

Share price falls 4.04% at Rs 57.92.

Revenue up 10.1% to Rs 465.8 crore versus Rs 423 crore.

Ebitda down 12.6% to Rs 42.3 crore versus Rs 48.4 crore.

Margin at 9.1% versus 11.4%.

Net profit down 29.3% to Rs 20.3 crore versus Rs 28.7 crore.

Raymond Q4 FY25 Results Highlights (Consolidated, YoY)

Share price down 2.21% at Rs 1,538.

Revenue up 109.4% to Rs 557 crore versus Rs 266 crore.

Ebitda up 90% to Rs 55 crore versus Rs 29 crore.

Margin at 9.8% versus 10.9%.

Net profit down 42% to Rs 133 crore versus Rs 229 crore.

Prudent Corporate Advisory Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rose 4.44% at Rs 2,321.

Revenue up 18.1% to Rs 283 crore versus Rs 240 crore.

Ebitda up 13% to Rs 68.7 crore versus Rs 60.8 crore.

Margin at 24.3% versus 25.4%.

Net profit up 15.9% to Rs 51.7 crore versus Rs 44.6 crore.

Care Ratings Q4 FY25 Results Highlights (Consolidated, QoQ)

Share price up 6.22% at Rs 1,428.

Total income up 15.7% to Rs 125 crore versus Rs 108 crore.

Net profit up 53.6% to Rs 42.6 crore versus Rs 27.8 crore.

Ventive Hospitality Q4 FY25 Results Highlights (Consolidated, YoY)

Share price 7.86% higher at Rs 840.

Revenue up 461.9% to Rs 697.93 crore versus Rs 124.21 crore.

Ebitda up 363% to Rs 351.55 crore versus Rs 75.96 crore.

Margin at 50.4% versus 61.2%.

Net profit up 170.7% to Rs 127.87 crore versus Rs 47.22 crore.

Thomas Cook Q4 FY25 Results Highlights (Consolidated, YoY)

Share price rose 3.20% at Rs 149.50.

Revenue up 18.3% to Rs 1,969 crore versus Rs 1,664 crore.

Ebitda up 8% to Rs 98.2 crore versus Rs 91 crore.

Margin at 5% versus 5.5%.

Net profit up 13.96% to Rs 64.5 crore versus Rs 56.6 crore.

Happiest Minds Q4 Highlights (Consolidated, QoQ)

Share price down 2.58% at Rs 594.

Net profit down 32% at Rs 34 crore versus Rs 50 crore.

Revenue up 2.6% at Rs 544 crore versus Rs 530 crore.

EBIT down 15.9% at Rs 61.3 crore versus Rs 73 crore.

EBIT margin contracts to 11.2% versus 13.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.