.web.webp?downsize=773:435)

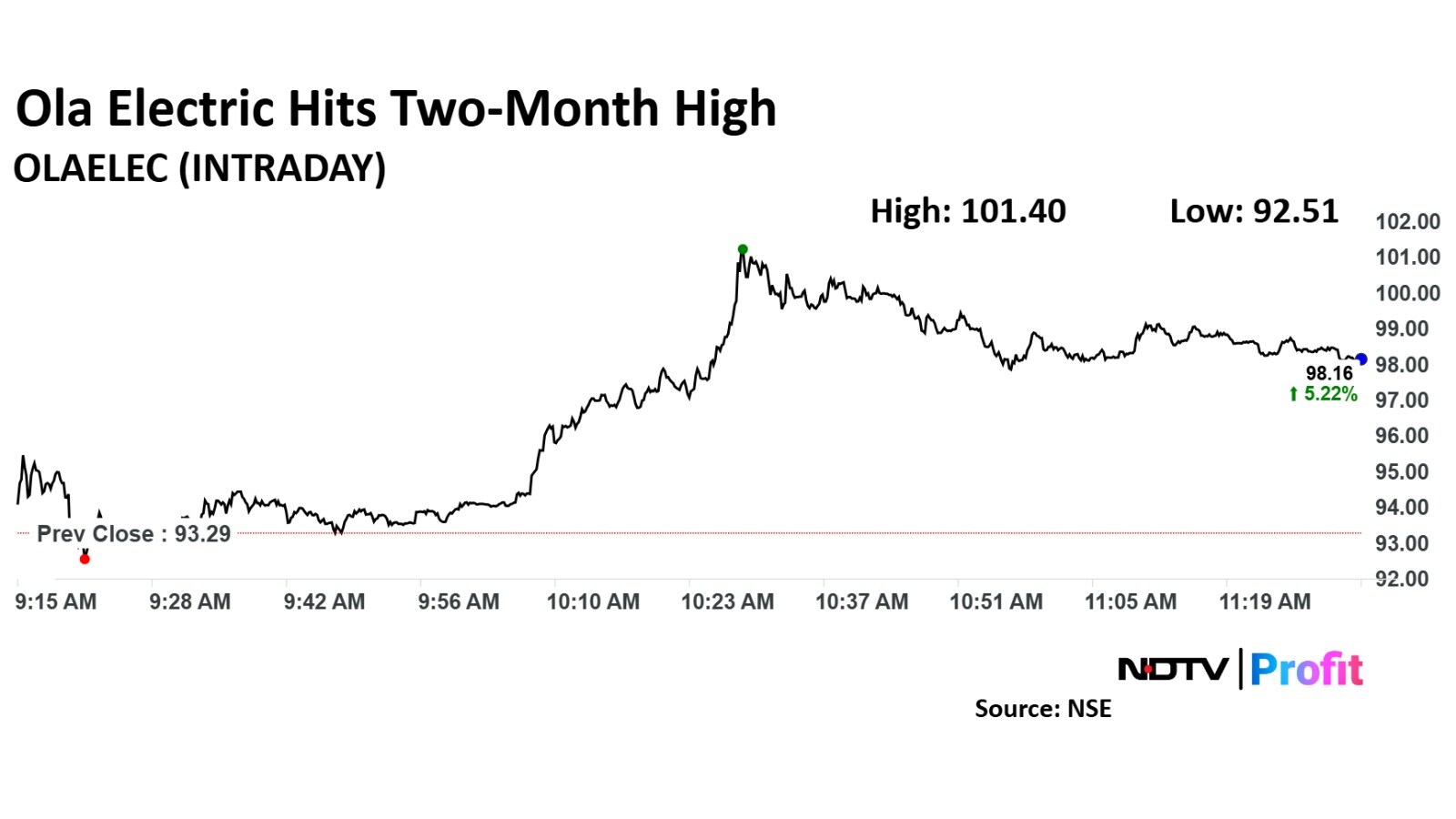

Ola Electric Mobility Ltd.'s shares rose for a second consecutive session to hit their highest in two months. The stock surged nearly 9% on Tuesday.

The stock saw an upswing on Monday as well after Ola CEO Bhavish Aggarwal shared his expansion plan on social media platform 'X'. Elaborating on the plan to grow their retail footprint, Aggarwal announced the opening of 4,000 stores across India this month.

Aggarwal wrote, "Taking the electric revolution to the next level this month. Going from 800 stores right now to 4,000 stores this month itself. Goal to be as close to our customers as possible. All stores opening together on December 20 across India. Probably the biggest single day store opening ever!"

Aggarwal also highlighted that all the new stores would have “service capacity too,” signaling the company's focus on improving after-sales service alongside its retail expansion.

This rapid expansion comes amid ongoing concerns regarding Ola Electric's service and product quality. The company has been facing significant backlash from customers, with over 10,000 complaints lodged with the National Consumer Helpline (NCH) between September 2023 and August 2024. Common grievances include delayed service, poor-quality components, and issues with batteries and vehicle parts.

Ola Electric share price rose as much as 8.69% to Rs 101.40 apiece. It pared gains to trade 4.68% higher at Rs 97.66 apiece, as of 11:57 a.m. This compares to a 0.6% advance in the NSE Nifty 50 index.

It has risen 7.6% since listing. Total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 68.

Out of seven analysts tracking the company, five maintain a 'buy' rating, and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.