Paras Defence & Space Technologies' share price will be in focus during Thursday's session, ahead of its first-ever stock split, due on July 4. Notably, the smallcap defence company has delivered multibagger returns to investors in the last three-to-five year period.

Paras Defence shares jumped 4% on Wednesday after its subsidiary, Paras Anti-Drone Technologies Ltd., bagged a fresh international order worth Rs 22 crore from a leading European defence firm Cerbair, based in France. Paras Defence received a Letter of Intent from Cerbair to supply 30 units of CHIMERA 200 drone countermeasure systems.

Paras Defence Stock Split

The smallcap company set the record date as July 4, 2025 and will trade ex-split in the ratio 1:2, wherein one share of face value of Rs 10 will be split into two Rs 5 shares. The record date determines who will receive additional shares post-split, based on the split ratio.

Ahead of its first-ever stock split, Thursday marks the last day investors can buy the shares to qualify for the same. To be eligible for a stock split, investors must hold shares as of the record date announced by any particular company.

Given the T+1 settlement cycle, investors need to purchase the stock at least one trading day before the record date to be eligible. Buying shares on the record date itself will not qualify, as the ownership will not be reflected in time.

Therefore, investors who own the shares by July 3 will be able to reap benefits of the stock split. Shareholders who wish to be eligible for the stock split must own the shares before the specified ex-split date.

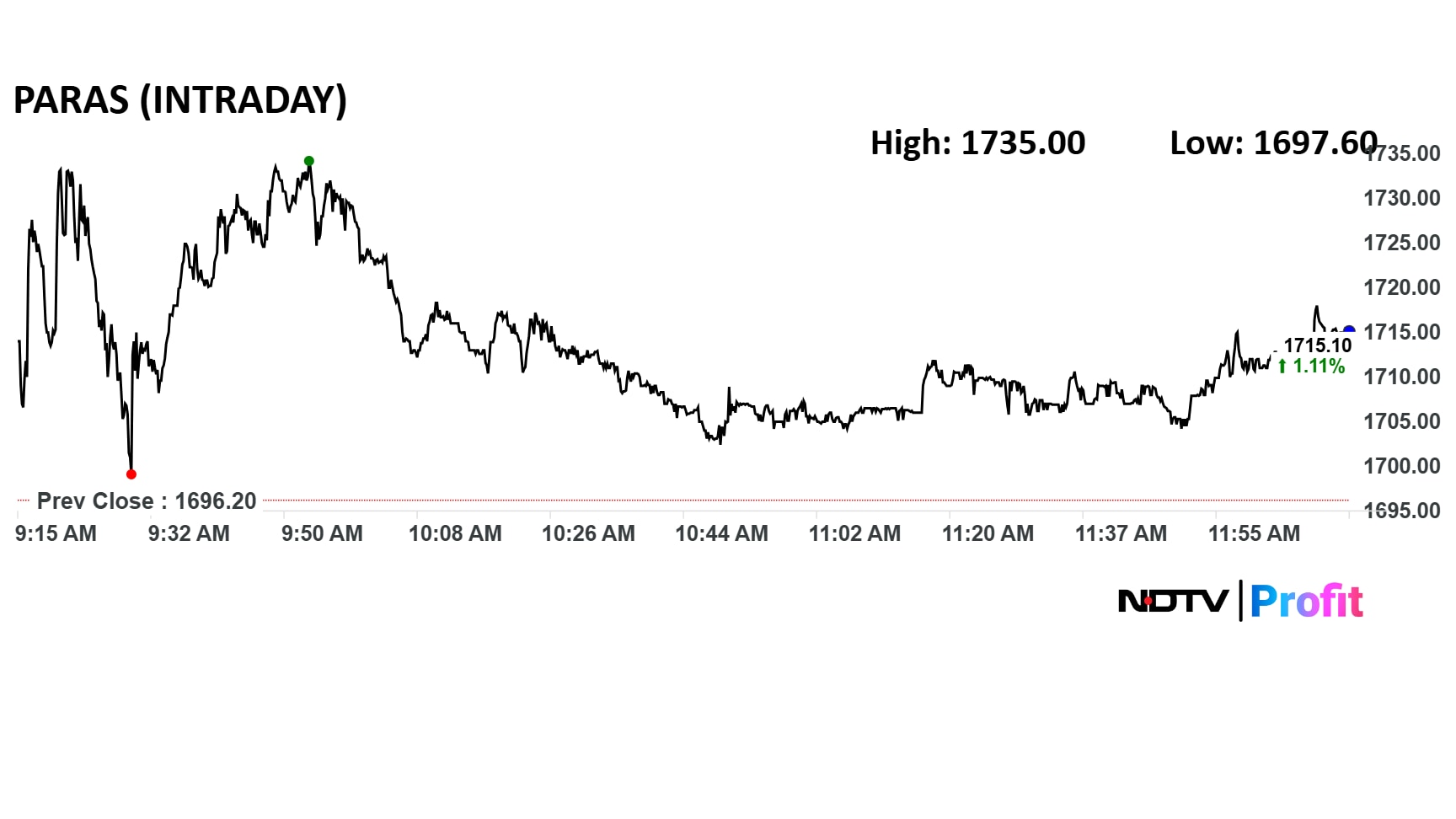

Paras Defence Share Price Movement

Paras Defence share price advanced 2.3% intraday to Rs 1,735 apiece.

Paras Defence share price advanced 2.3% intraday to Rs 1,735 apiece. The scrip was trading 1.1% higher by 12:15 p.m. The benchmark NSE Nifty 50 was up 0.2%.

The stock has risen 14% in the last 12 months and 70% on a year-to-date basis. Paras Defence has delivered multibagger 190% returns in the last three years and 247.55% in five years. The relative strength index was at 47.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.