Jupiter Wagons share price extended gains on Thursday to rise to its highest level in four months. Over the past two sessions, the stock has gained more than 18%.

Astha Jain, senior research analyst at Hem Securities on Nov. 26 had advised to remain invested in the stock. "We are positive on the railway space because we believe government capex will pick up in second half," Jain said.

"Jupiter is looking decent and potential upside can be seen," she said, as she recommends remaining invested till target of Rs 520-530 levels

A Systematix report last month had said that the company is strategically poised to leverage growth prospects within both the railway and electric mobility domains. "The company's robust order book, strategic acquisitions, and emphasis on innovation to drive future growth and value creation bode well," it added.

Investors are also expecting announcements benefitting the railway sector in the upcoming budget.

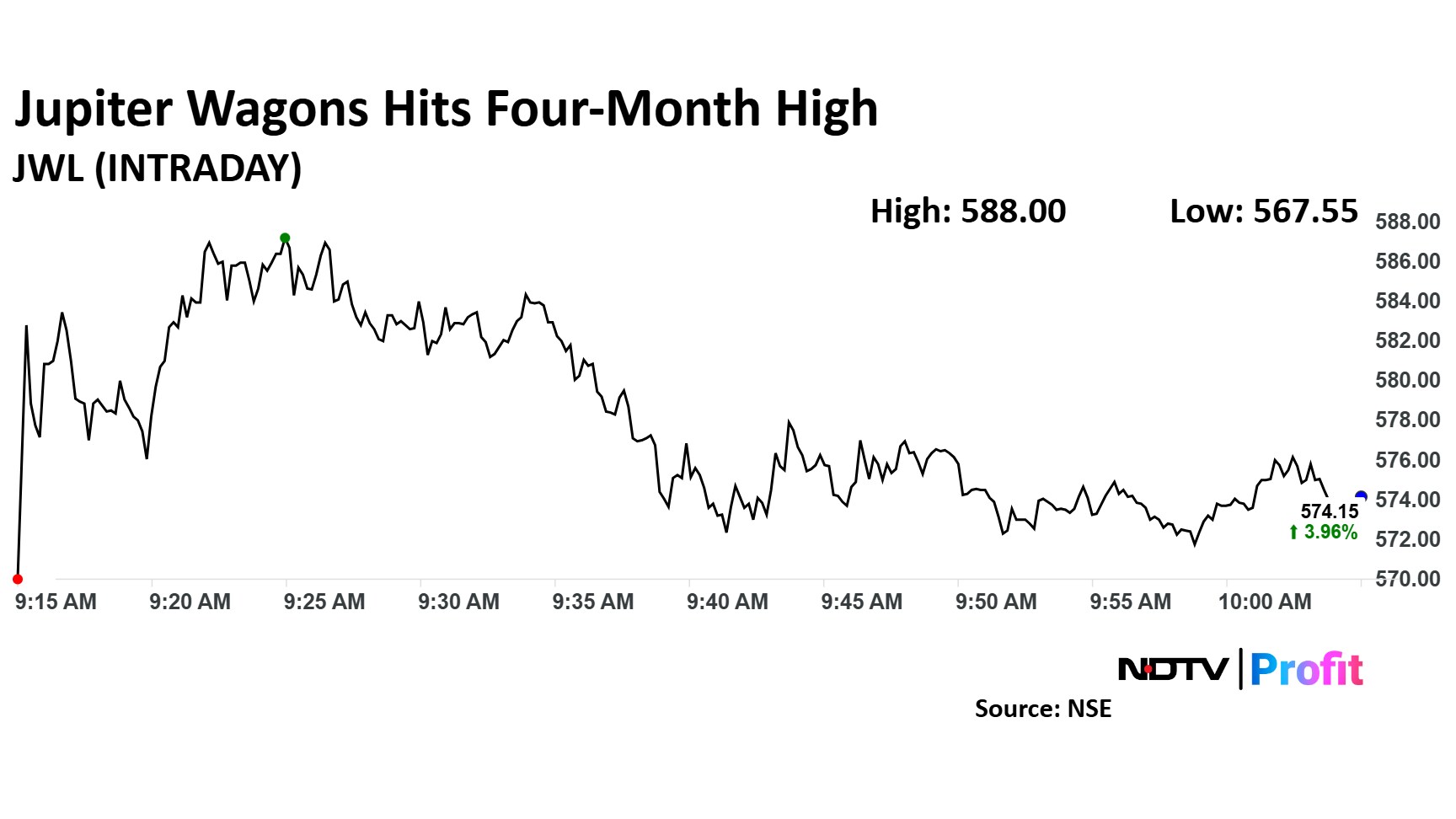

The scrip rose as much as 6.46% to Rs 588 apiece, the highest level since August 6. It pared gains to trade 3.2% higher at Rs 570 apiece, as of 10:24 a.m. This compares to a flat NSE Nifty 50 Index.

It has risen 79% on a year-to-date basis. Total traded volume so far in the day stood at 4.92 times its 30-day average. The relative strength index was at 72, indicating that the stock may be overbought.

Out of the five analysts tracking the company, three maintain a 'buy' rating, two recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.