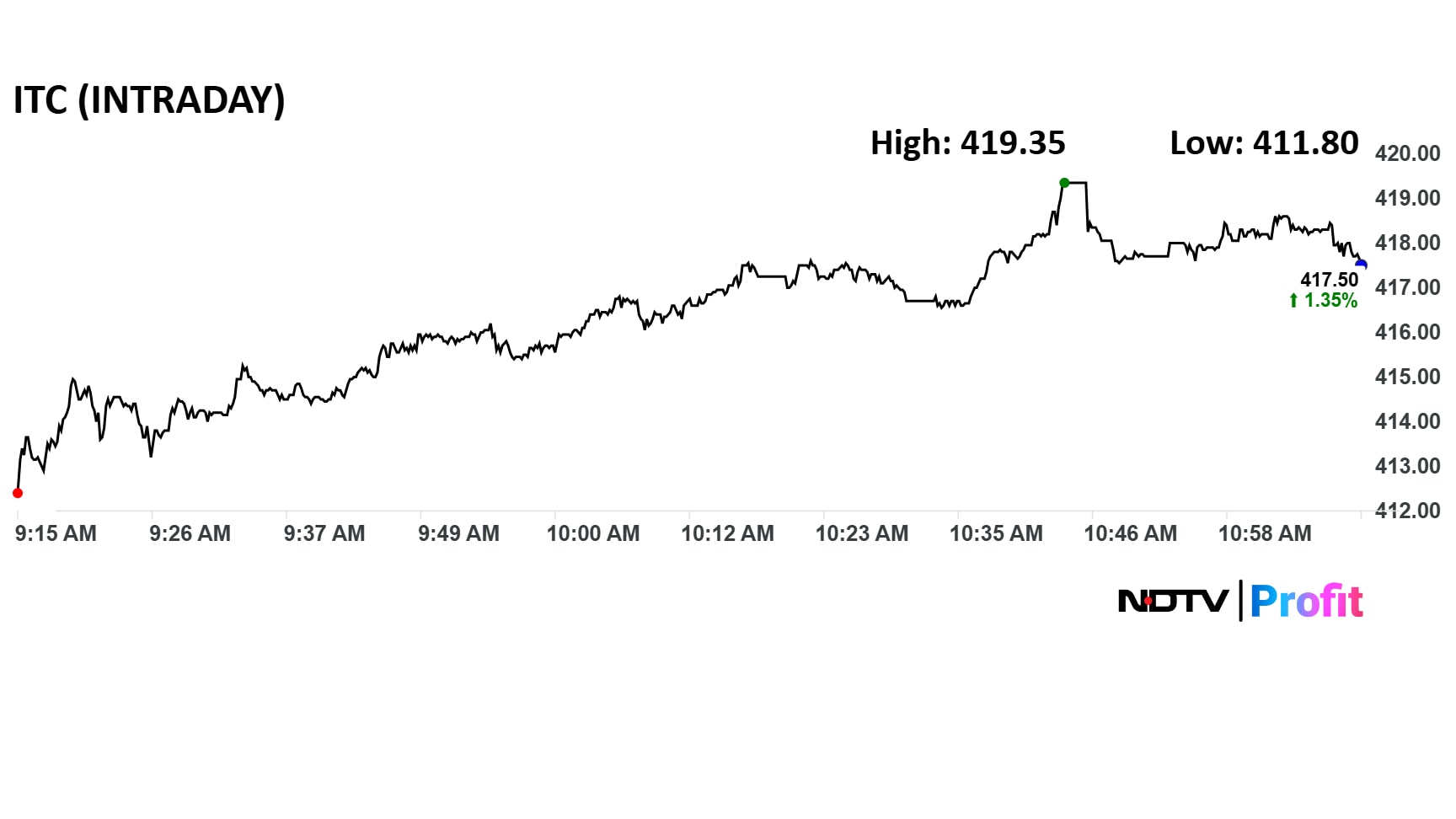

- ITC shares rose 1.8% ahead of Q1 FY26 results announcement today

- Revenue is expected to increase 14.5% to Rs 20,925 crore year-on-year

- Ebitda may grow 2% to Rs 6,417 crore, with margins declining to 35.1%

ITC Ltd.'s shares traded higher early in the session on Friday ahead of the first-quarter financial results due today. The stock gained 1.8% intraday and added most points to the benchmark Nifty 50 after Reliance Industries Ltd.

The Street expects the FMCG giant to report good revenue growth even as operating margins are likely to be under pressure.

ITC Q1 FY26 Estimates (Standalone, YoY)

Revenue may rise 14.5% to Rs 20,925 crore versus Rs 18,261 crore

Ebitda may rise 2% to Rs 6,417 crore versus Rs 6,295 crore.

Margin may be at 35.1% versus 37.3%.

Net profit may rise 3.4% to Rs 5,085 crore versus Rs 4,917 crore

ITC Q1 Preview

ITC's cigarette volumes and agri business are expected to drive topline growth.

Cigarette sales are likely to grow 7% with volume growth expected to be in the mid-single digits, as per Nirmal Bang Institutional Equities.

The margin drag is largely due to the FMCG and paper segments. FMCG volume growth may come in around 3-5%.

The Street will also be listening to management commentary related to recent acquisitions, such as Sresta Natural Bioproducts, to understand their integration and contribution to growth.

The extent of margin pressure across its various businesses, especially in the FMCG segment, with input cost inflation and pricing strategies, will be key determinants.

Analysts will scrutinise the impact of any price hikes, particularly in cigarettes and FMCG, to discern whether growth is volume or value-driven.

ITC's broader demand outlook and competitive intensity across its diverse portfolio will also be critical indicators of the company's overall resilience and future trajectory.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.