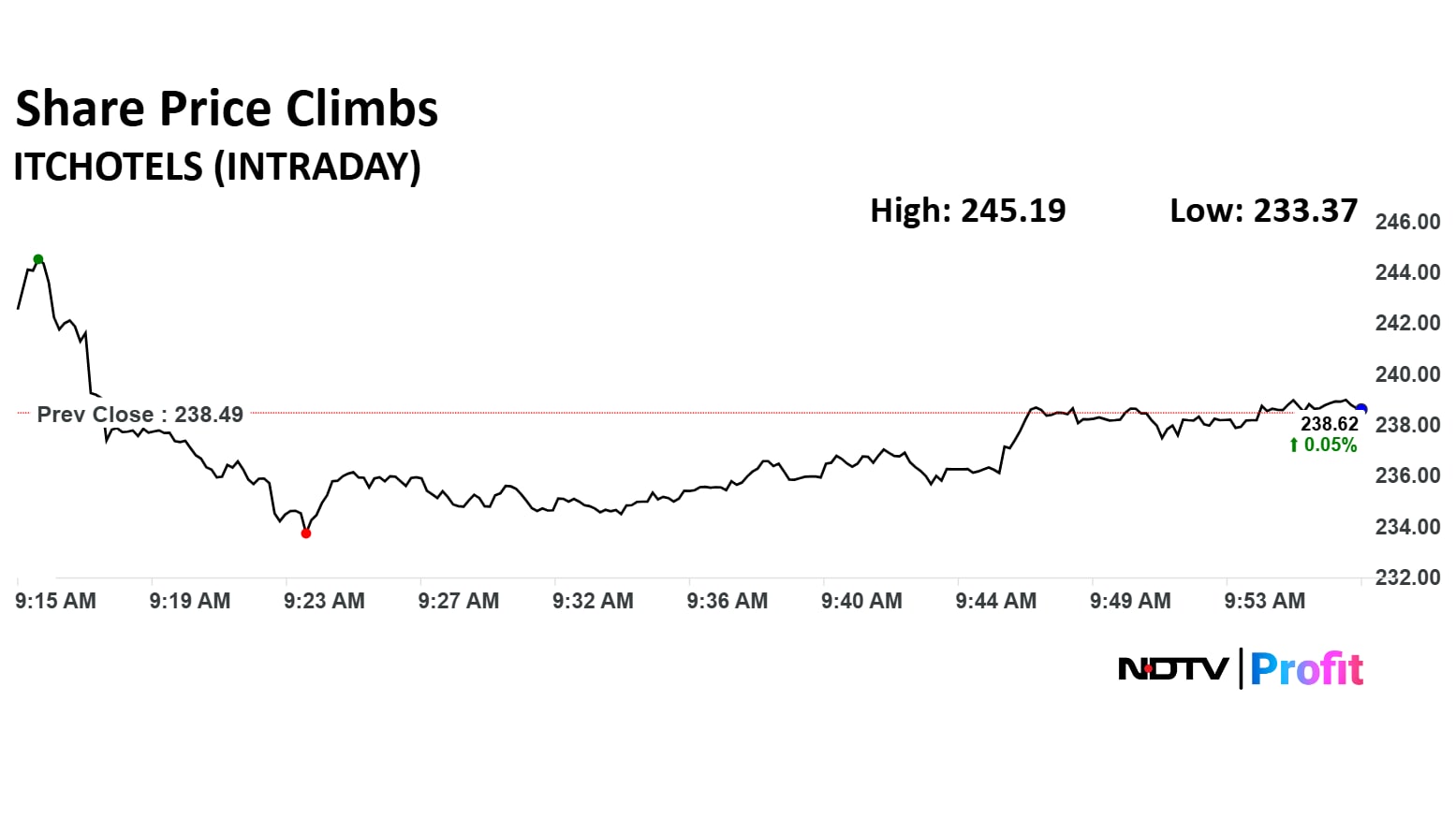

Shares of ITC Hotels surged as much as 2.81% in intraday trade on Thursday, extending gains after the company posted a robust set of Q1 FY26 earnings. The stock has caught the attention of investors and analysts alike, with brokerages issuing optimistic outlooks on the back of strong operational performance and strategic momentum.

The hospitality arm of ITC Ltd., which was recently demerged and listed independently, reported a 53.8% year-on-year jump in consolidated net profit to Rs 133 crore for the quarter ended June 30, 2025. Revenue from operations rose 15.5% to Rs 816 crore, compared to Rs 706 crore in the same period last year. Operating profit climbed 19% to Rs 245 crore, with Ebitda margins expanding to 30%, up from 29.2% a year ago.

Brokerages including Macquarie and Jefferies highlighted the company's strong RevPAR (Revenue Per Available Room) growth, improved occupancy rates, and the scaling of its Sri Lankan luxury property, ITC Ratnadipa, as key drivers of the outperformance.

Both firms reiterated their positive stance on the stock, citing ITC Hotels' strategic expansion and margin resilience as indicators of sustained growth potential.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.