Shares of Go Digit General Insurance Ltd. rose over 8% on Thursday, after its net profit nearly tripled to Rs 118 crore in the quarter ended December.

The insurer's total revenue in the third quarter rose over 7% to Rs 2,372 crore, in comparison to Rs 2,214 crore. Go Digit's gross written premium rose 10.2% to Rs 2,677 crore from the earlier Rs 2,428 crore.

The combined ratio at the end of the quarter stood at 108.1% in comparison to 110.3%, indicating that the operational performance improved in the quarter. However, the premium retention ratio was slightly lower at 83.8% in the October-December quarter in comparison to 87.9% last year.

The asset under management of the Fairfax-backed insurance company rose 20.1% to Rs 18,939 crore, compared to Rs 15,764 crore as of March 31, 2024.

In addition, on Thursday, Citi hiked the insurance company's target price to Rs 460 from Rs 450 per share earlier. The brokerage maintained a 'buy' rating amid improvement in the underwriting to net earned premium ratio. The net incurred claims ratio could surprise with an upside in the fourth quarter, it said.

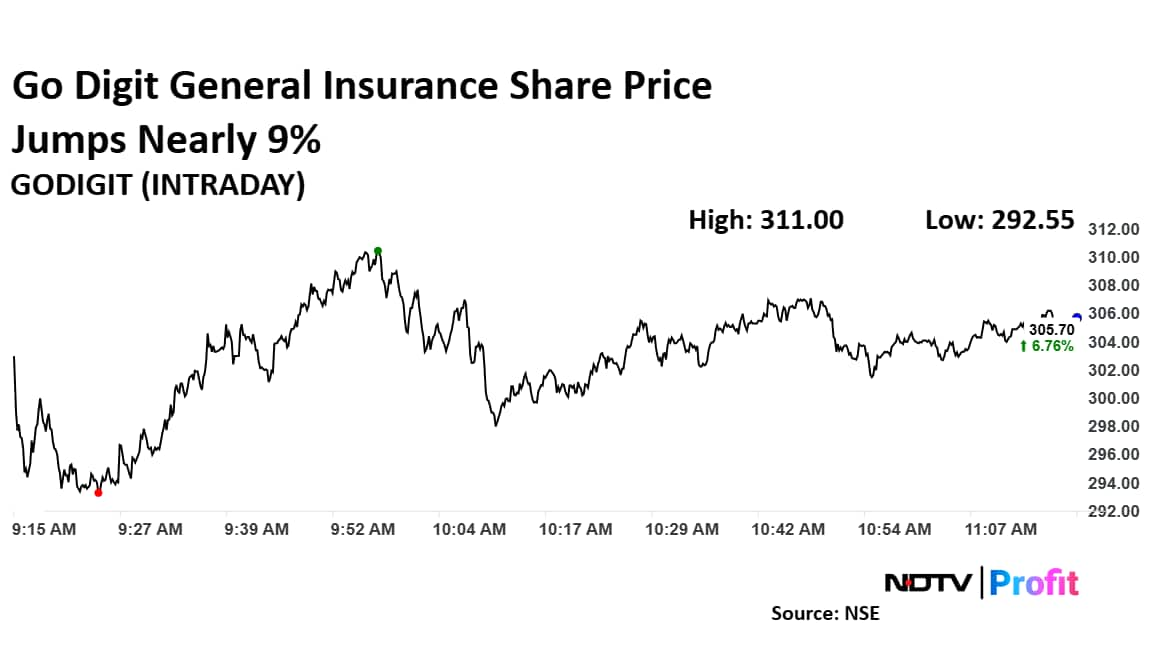

Go Digit General Insurance Share Price

The scrip rose as much as 8.61% to Rs 311 apiece, the highest level since Jan. 8. It pared gains to trade 6.51% higher at Rs 305 apiece, as of 11:17 a.m. This compares to a 0.26% advance in the NSE Nifty 50.

The stock has fallen 0.33% in the last 12 months. Total traded volume so far in the day stood at 9.7 times its 30-day average. The relative strength index was at 49.

Out of eight analysts tracking the company, six maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 24.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.