(6).jpeg?downsize=773:435)

Delhivery's share price fell over 6% on Tuesday, reversing the gains made a day ago.

Monday's rally came after the company announced its acquisition of rival firm Ecom Express Ltd. for Rs 1,407 crore. This acquisition, expected to be completed within six months, involves Delhivery acquiring at least 99.4% of Ecom Express' issued share capital.

The logistics solutions company plans to use the increased scale from this acquisition to invest in improving service quality through network expansion, technology investments, and research and development.

Delhivery also expects the acquisition to foster growth within the vendor ecosystem, providing existing vendors with greater confidence to invest in assets and research, ultimately benefiting the logistics industry.

The company, established in 2011 and headquartered in Gurgaon, offers a range of services, including express parcel delivery, freight, warehousing, and cross-border logistics.

Delhivery leverages technology and a vast network to provide logistics solutions across India. The firm's integrated logistics platform supports various sectors.

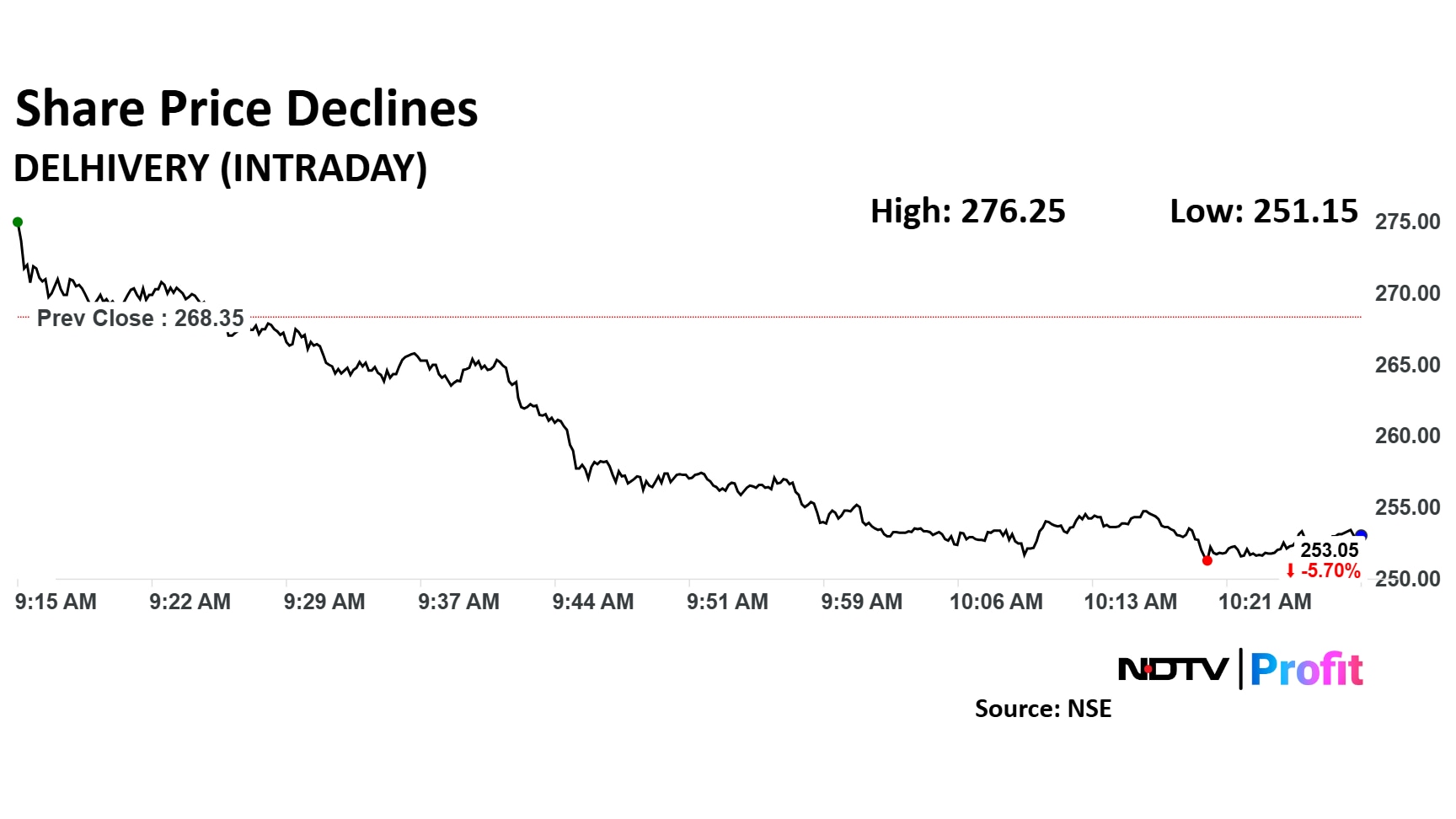

Delhivery Share Price

The scrip fell as much as 6.41% to Rs 251.15 apiece. It pared losses to trade 6.04% lower at Rs 252.15 apiece, as of 10:25 a.m. This compares to a 1.11% advance in the NSE Nifty 50.

It has fallen 44.58% in the last 12 months. Total traded volume so far in the day stood at 8.3 times its 30-day average. The relative strength index was at 43.

Out of 24 analysts tracking the company, 18 maintain a 'buy' rating and six recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 55.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.