(Bloomberg) -- Citigroup Inc. remains positive on the Indian rupee and expects it to build on its outperformance in the region this year.

The currency's strong fundamentals, a narrowing current account deficit, and growing expectations on inflows around India's inclusion into a global bond index are adding to its appeal, said Nathan Venkat Swami, head of foreign exchange trading in Asia Pacific.

The rupee is the only emerging Asian currency to have strengthened against the dollar this year as global investors buy Indian bonds ahead of the country's entry into JPMorgan Chase & Co.'s key gauge. Citi's views suggest its lure is unlikely to dim.

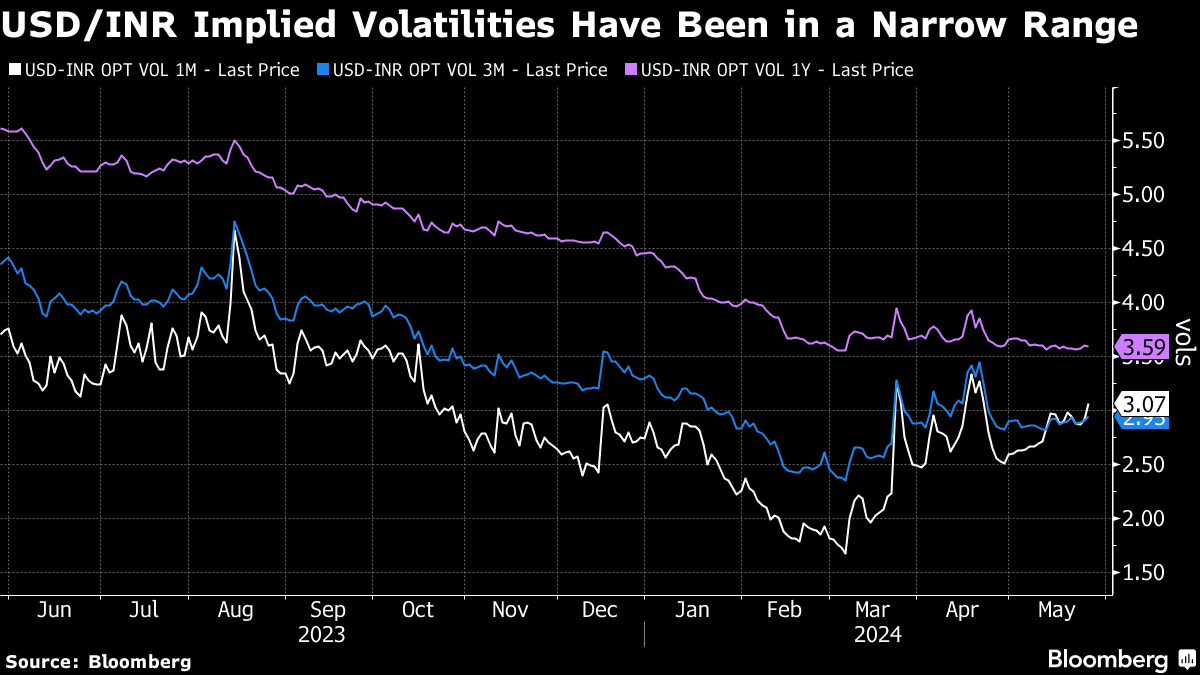

“Global investors have preferred the rupee within most Asian long-short relative value baskets because of its carry and volatility dynamics,” Swami said. “The currency has been very stable, with very narrow intraday movements and suppressed realized volatility in 2024.”

The one-week and one-month realized volatility for the dollar/rupee was tracking within the 1 to 1.25 vol range over the last few months, and the implied volatility curve was languishing at multiyear lows, Swami said.

The currency faces a key risk if national elections, where Prime Minister Narendra Modi is seeking a third term, throw up unexpected results.

There was some buying interest for at-the-money strikes in the one-month tenor which go beyond the election outcomes, but that was partly driven by the attractive break-evens given the low base volatility, Swami said.

The rupee is likely to be driven by a host of factors including global and US policy rates, and relative moves against Asian EM currencies in the near term, he added.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.