(Bloomberg) -- Indian option traders appear to be relatively unconcerned that the upcoming general election will disrupt the market's steady climb higher, potentially leaving them vulnerable to an unexpected outcome.

While NSE Nifty 50 Index's monthly options expiring just after the election have risen slightly in value relative to shorter-term contracts as the world's largest democratic exercise approaches, their premium over April is 61% smaller than it was before the May 2019 vote, data compiled by Bloomberg showed.

“Markets in India are not pricing in any risk of negative political surprises,” said Vivek Dhawan, portfolio manager at Candriam Belgium NV. “I would say that the downside possible from surprise in election outcome is bigger than any upside if expectations are met.”

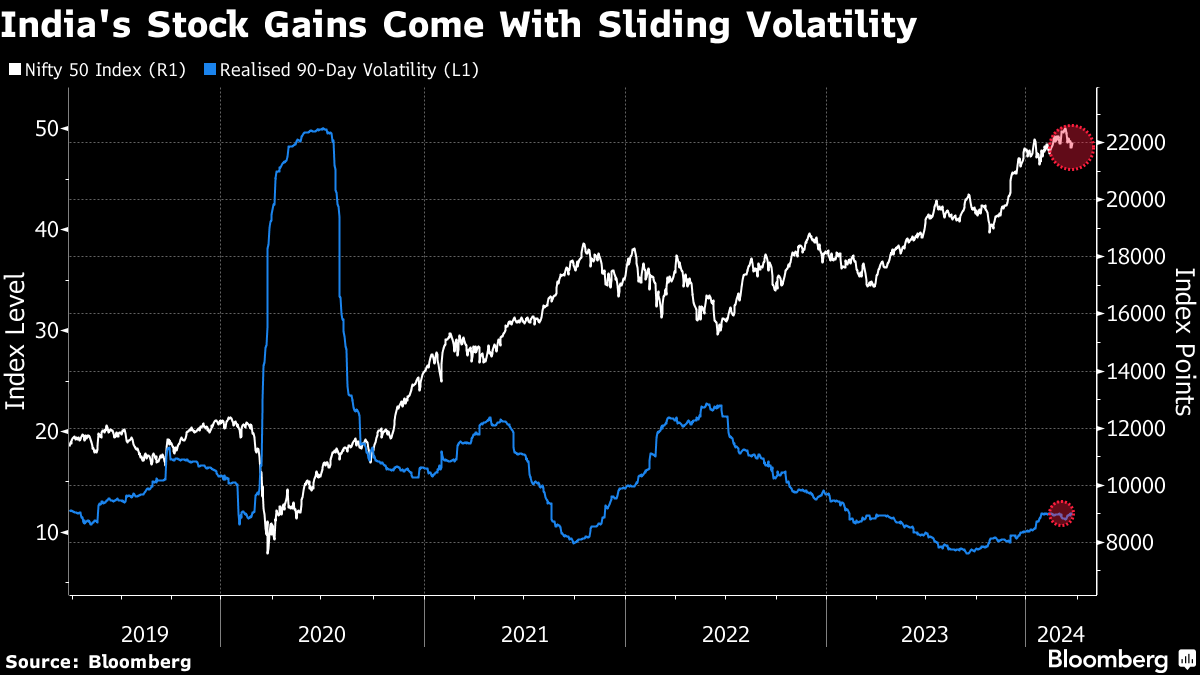

Indian stocks have risen for a record eight straight years, powered by robust corporate profits, increased participation by retail investors, and large foreign inflows. The gains have been marked by a notable drop in volatility that has only recently edged higher amid a selloff in small- and mid-cap shares following warnings from the securities regulator about overstretched valuations.

The ruling Bharatiya Janata Party's victory in key state polls in December has reduced political risk for India's $4.3 trillion equity market. The national election in which Prime Minister Narendra Modi will seek a third term in power will run over six weeks starting April 19, with votes to be counted on June 4.

Read more: JPMorgan Sees Foreigners Flocking to Indian Stocks After Polls

India's stock gauges jumped over 2% in the month after the end of polling in 2019 before giving up those gains and more in the subsequent months. Since then, the options market has grown over 100-fold amid a surge in trading by retail investors enticed by the potential for outsized returns.

Implied volatility for options expiring June 27 — the nearest contract after votes are counted on June 4 — is currently at a discount to September, signaling traders are paying more for protection against bigger swings in the market later in the year when the focus will shift to India's federal budget announcement and US presidential elections.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.