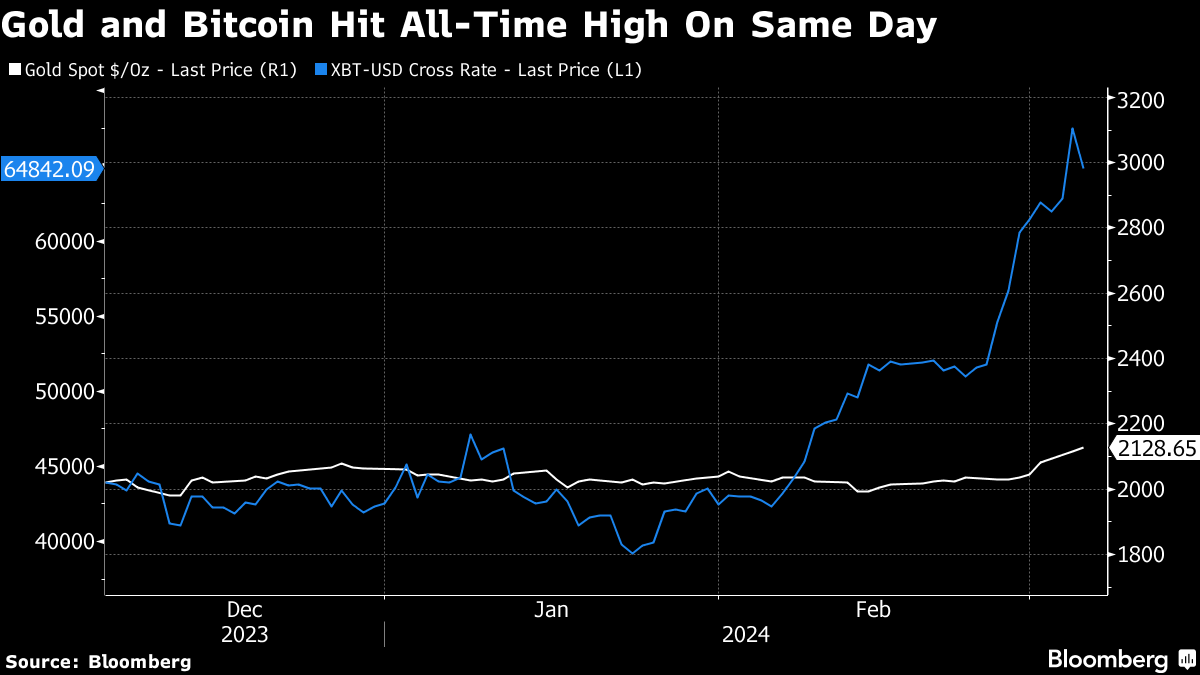

(Bloomberg) -- Exchange-traded fund investors appear to be more confident in “digital gold,” as Bitcoin is often referred to by advocates, than the actual precious metal as each one sets record high prices.

While both have been touted as stores of value and hedges against inflation, gold ETFs have seen about $4.6 billion of outflows this year, according to data compiled by Bloomberg Intelligence. The 10 US Bitcoin ETFs that began trading in January have had net inflows of around $8 billion, in the most successful launch ever of the investment products.

Investors often draw parallels between the cryptocurrency and hard assets like gold that offer no yield, especially during low-yield environments such as the Covid pandemic. Now gold appears lately to be driven more by a combination of expectations for monetary easing, geopolitical tensions and the risk of a pullback in equity markets.

“Growing investor confidence and strong performance of other asset classes continue to inspire a fear of missing out (FOMO) and have likely benefited from gold investors' exodus,” BI analysts Eric Balchunas and Andre Yapp wrote in a report Tuesday.

Bitcoin rose to a record for the first time in more than two years on Tuesday, yet the original cryptocurrency didn't stay at its new all-time high very long. After jumping to $69,191, Bitcoin has dropped by about 6% as some traders took some gains after this year's roughly 60% surge. Gold continues to hover close it its all-time high of $2,141.79, according to data compiled by Bloomberg.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.